…[Someone] recently informed me that an Invesco fund family study…[had concluded that] missing the “10 best days” of the market each year would result in wiping out virtually any gains over a longer-term horizon. Ugggggh…[This article refutes that conclusion in its emtirety!]

that] missing the “10 best days” of the market each year would result in wiping out virtually any gains over a longer-term horizon. Ugggggh…[This article refutes that conclusion in its emtirety!]

First of all, Wall Street firms from Fidelity to Invesco have a vested interest in making certain that you are always invested. That is why the Wall Street marketing machine pushed, “It’s time in the markets, not timing the markets.” Fund families make their money on commissions and internal expenses associated with you staying right where you are. They need assets under management; they cannot afford to let you sell. The same holds true for the financial media that generate revenue from advertising dollars from – yep, you guessed it – Wall Street financial companies.

Second, it is ridiculous to assume that when you choose to reduce some of your exposure to stocks that you’re only going to miss out on the wonderful bull market up days. If you’re out, you’re going to miss plenty of the unbelievably awful days as well. One is not capable of tragically missing out on all of the great days, nor is one capable of deftly avoiding all of the devastating down days.

It follows that a person may be better served by understanding the ramifications of:

- missing the “10 best days” and the “10 worst days” versus holding-n-hoping every position,

- missing the “25 best days” and the “25 worst days” versus holding everything you own,

- missing the “50 best” and 50 worst” or even,

- missing the “10 best quarters” and the “worst 10 quarters”

so let’s evaluate facts that Wall Street tries to keep from you with a look at the S&P 500 since 1970.

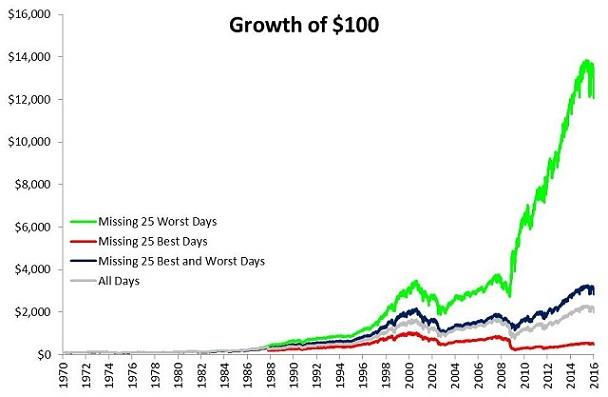

As stipulated before, nobody is going to perfectly miss only the 25 best days in each year of a market, anymore than he/she will miraculously miss the 25 worst days in the market. That said, one thing should still stand out in the chart below – something that Wall Street never mentions. As shown by the growth of the green line, missing the bad times is far more critical than missing out on those good times.

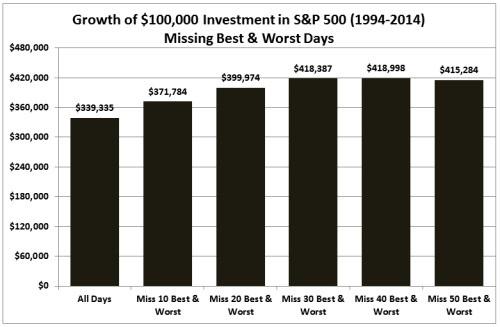

The same findings have been replicated over and over. The folks over at Stock Trader’s Almanac found that the effect of missing the “50 Worst Days” is substantially more powerful than missing the “50 Best Days.” (Not that you’d hear this from the “it’s time in the market” Wall Streeters.) Again, however, the more powerful message is the reality that missing BOTH the “50 Worst” and “50 Best” outperformed buy-n-hold between 1994 and 2014.

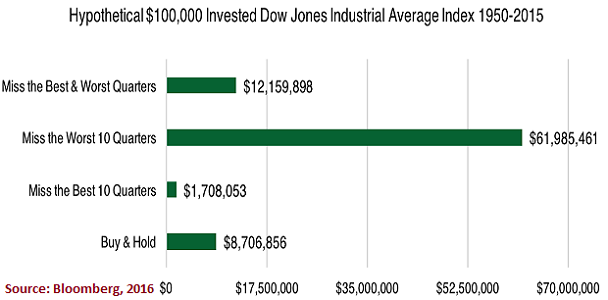

Still not convinced that buying-n-holding all market days could be problematic? Here is yet another look at 65-plus years of data on the Dow Jones Industrials Average. Once again, the media and Wall Street would want you to focus only on “buy-n-hold” at all times as it relates to missing the best three-month periods since 1950. And sure, if you managed to miss the 10 best quarters since 1950, you would have done far worse than had you simply stayed in the Dow through thin and thick. However, that is only HALF the story. Side-stepping the 10 worst quarters since 1950 had a far more powerful effect. Again, it would not have been able to do so, but it would not have been feasible to have only missed the 10 best quarters either. Most critically? Missing the best quarters and missing the worst quarters over 65 years dramatically outperformed buy-n-hold.

The take-home? Minimizing monstrous losses is far more critical to creating and maintaining long-term wealth than chasing returns via Wall Street’s tag-line, “time in the markets, not timing the markets.”

…When stocks are exceptionally overvalued on a fundamental basis, when the FTSE Multi-Asset Stock Hedge Index is hitting “higher highs,” when risk-off assets like Treasury bonds outperform stocks for 6 months, 12 months and 18 months, when stagnation threatens domestic and foreign economies, I reduce the percentage exposure to stocks. I also reduce the percentage exposure to any bonds that do not qualify as investment grade. Moreover, I make sure that the holdings themselves are low volatility securities with relatively strong balance sheets. My clients prefer some time out of the markets – and we are not talking about 100% in or 100% out.

…Some time out of the markets during the tech wreck (2000-2002) and the financial crisis (2007-2009) was beneficial to maintaining their standard of living going forward. Then, like now, some dry powder in the form of cash/cash equivalents helped reduce volatility. Then, like now, cash is how one can acquire desirable assets at lower prices down the road.

Disclosure: The above article was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

Related Articles from the munKNEE Vault:

1. Time the Market Using Market Strength & Volatility Indicators – Here’s How

Yes, you can time the market! Assessing the relative levels of greed and fear in the market at any given point in time is an effective way of doing so and this article outlines the 6 most popular momentum indicators and explains how, why and where they should be used.

3. Should You Buy, Hold or Sell? Time the Market By Watching Change In Market Trends! Here’s How

The trend is your friend and this article reviews the 7 most popular trend indicators to help you make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it.

4. Trying to Time the Market Is a Fool’s Errand – Here’s Proof

Pullbacks happen, and usually the market recovers, so trying to time the market is probably a fool’s errand – and a money loser.

5. Predicting What the Stock Market Will Do Is Impossible – Here’s More Proof

Predicting what the stock market will do in the next 12 months is tantamount to predicting coin flips. Here’s more proof that past stock market performance tells you nothing about future results — literally nothing.

6. A Stock’s Current P/E Is A Poor Indicator Of Future Performance

Just because stocks are expensive doesn’t mean investors should immediately cash out and prepare for imminent price declines. Why? Because elevated P/E levels are not that reliable in predicting potential market performance. Here’s the proof.

7. Hang In There! Panic Selling Is A Failing Strategy – Here’s Proof

Successful investors outperform by being patient and riding out the volatility. Losers panic and sell at what might appear to be the beginning of downturns. Losers make the mistake of thinking they can predict what will happen next and unsuccessfully time the market. Here’s proof that Panic Selling Is A Failing Strategy.

8. Shiller’s CAPE Is Crappy At Predicting 12-month Returns – Here’s Proof

Robert Shiller’s revered stock market valuation ratio, the so-called CAPE, is crappy at predicting 12-month returns. Here’s proof.

9. Go With the Flow: Buy & Sell Using a “Momentum” Approach – Here’s Why & How

Whether it is called “systematic trend-following”, “momentum trading” or “turtle trading”, it all comes down to entering trades on the basis of markets breaking out from previously established ranges and following some basic rules thereafter. It requires no special understanding of any given market – just a healthy respect for the price action – and can make you a lot of money in the process. Here are the details.

10. Should You “Buy & Hold” or “Time” the Market?

Warren Buffett likes to counsel individual investors to buy-and-hold (specifically, buy an equity index fund and hold it forever). This is a perfect example of “do as I say, not as I do,” as Buffett has successfully timed the market for decades and, [interestingly,] Buffett is now carrying his largest cash position ever in stark contrast to individual investors who now hold their smallest cash positions since the height of the internet bubble. Clearly, he’s timing once again and I’m sure a few of you are wondering just how he manages to do this so successfully. [Let me explain.]

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money