There is an all out assault on the part of global central banks to destroy their currencies in an effort to allow their respective governments to continue the practice of running humongous deficits. In fact, the developed world's central bankers are faced with the choice of either massively monetizing Sovereign debt or to sit back and watch a deflationary depression crush global growth. Since they have so blatantly chosen to ignite inflation, it would be wise to own the correct hedges against your burning paper currencies.

Read More »Fed's Actions Are a Path to Ruin NOT Prosperity! Here's Why

Currency wars arise when a country steals growth from trading partners by cheapening its currency to promote exports. The new currency war began in 2010 when President Obama declared in his State of the Union address that it was the policy of the United States to double exports in five years. Since the U.S. would not become twice as productive in five years, the implication was the U.S. would severely cheapen its currency to achieve this goal. [Let me expand upon this.] Words: 666

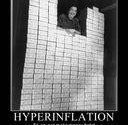

Read More »Hyperinflation in the U.S. is Possible But Unlikely – Here’s Why (+2K Views)

I respect many of the writers who believe that we will experience hyperinflation... but I think they are jumping the gun. Hyperinflation is something that is easy to say - and it certainly achieves the sensational headlines that so many financial writers seek - but it is much more difficult to achieve. At this point none of the economic or political factors required to set off hyperinflation are present. The question should not be whether or not it is possible, but whether or not it is probable in America today and in my opinion the probability of such happening is very low. [Let me explain why that is the case.] Words: 2695

Read More »Richard Russell: The Last Currency Standing Will Be Gold

Inflation is the central banks' method of avoiding the pain of austerity. Inflation is the current economic narcotic that is used by modern nations. It's the old ‘beggar thy neighbor’ system, and it will ultimately result either in all out hyperinflation and a collapse of the fiat currency system or a corrective deflationary crash. Either way, the last currency standing will be gold.

Read More »Here Are 2 Benefits of Devaluating the USD and How It Could Be Achieved

The primary obstacle to economic recovery is widespread insolvency among households and banks (meaning liabilities exceed assets). A consumer who is broke cannot spend, and a bank that is broke cannot lend. Devaluing the dollar would reduce the real value of the debt (increase the nominal value of the assets), rendering millions of households and most banks instantly solvent. [Let me explain.] Words: 590

Read More »How Inflationary and Deflationary Outcomes Might Affect Your Bullion and Mining Shares

Whilst we as staunch Austrians would prefer less liquidity provision and more allowance for markets to naturally self-correct and deleverage... we suspect that as markets try to self-correct, the authorities generally will be forced to print more and more [as] it is the easiest course for them to take and the typically all too human option...As such we look once more at how inflationary and deflationary outcomes might affect precious metal investors. Words: 1323

Read More »von Greyerz: Expanding Central Bank Balance Sheets Guarantee Massively Higher Inflation & Gold/Silver Prices – Here's Why

I am astonished to see how much money the central banks are printing and how their balance sheets are expanding. We have the absolute perfect recipe for hyperinflation and thus a massive increase in the price of gold and silver. So said Egon von Greyerz (www.goldswitzerland.com) in edited excerpts from an interview* with King World News. Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com …

Read More »Williams STILL Believes a Hyperinflationary Great Depression is Coming! Here’s Why (+3K Views)

The U.S. economic and systemic-solvency crises of the last five years continue to deteriorate yet they remain just the precursors to the coming Great Collapse: a hyperinflationary great depression. The unfolding circumstance will encompass a complete loss in the purchasing power of the U.S. dollar; a collapse in the normal stream of U.S. commercial and economic activity; a collapse in the U.S. financial system, as we know it; and a likely realignment of the U.S. political environment.

Read More »$10,000 Gold Debunked (+3K Views)

$10,000 (U.S.) gold [is] a gold bug’s dream come true [but] investors would be wise to have far have more modest expectations. [Let me explain why.] Words: 1000

Read More »True Money Supply Is Already Hyperinflationary! What’s Next? (+3K Views)

Economists are telling central banks to accelerate monetary growth even faster...to avoid a bank balance sheet implosion with all the deflationary consequences that implies. [As such,] the prospects for 2012, and thereafter, are for Total Money Supply to continue its hyperbolic trend - and when such a trend becomes established it becomes almost impossible to stop because the whole debt-based economy and the banking system would collapse. [Let me explain further.] Words: 550

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money