The supply of silver went down in 2015 due to lower scrap supply and I believe silver production from mines will not rise significantly in 2016 so supply will be subdued going forward. Demand however will keep going up. [IMO if you start] stacking silver you’ll be rich in exactly 5 years.

from mines will not rise significantly in 2016 so supply will be subdued going forward. Demand however will keep going up. [IMO if you start] stacking silver you’ll be rich in exactly 5 years.

I’m betting a lot on silver at this moment, not just because the gold to silver ratio is at multi-decade highs, but also because of the supply and demand figures.

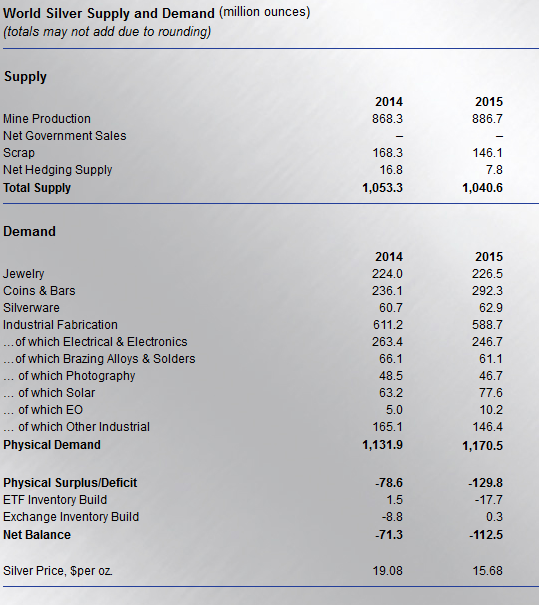

The silver institute just released the latest 2015 numbers. 2015 saw an increasing deficit at 112.5 million ounces.

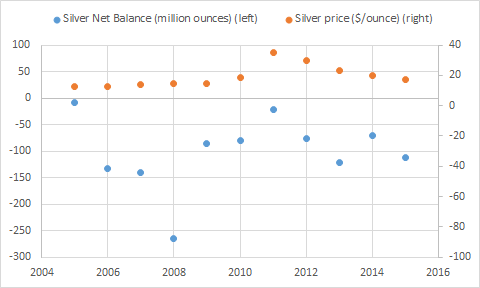

…[Below is a chart of] what it looks like historically. When deficits increase (blue chart goes down), then the silver price will start spiking a few years later.

As you can see, the supply went down in 2015 due to lower scrap supply and I believe silver production from mines will not rise significantly in 2016 so supply will be subdued going forward. Demand, however, will keep going up… [The deficit in silver in 2015 was 112.5 million troy ounces and,] going forward, we expect that deficits in silver will only become worse: 200 million ounces by next year; then 250 million ounces by 2018; then 300 million ounces by 2019. By 2020, there is no silver left at these low prices.

Conclusion

…Keep on stacking silver and in exactly 5 years, you will be rich. I recommend buying silver miners like Endeavour Silver. They just released earnings and they are very profitable at this moment.

Disclosure: The original article, by Albert Sung, was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Yet another reason to own Silver is that with China, India and Russia now buying up lots of physical Gold, Silver is in a great position to be the replacement for physical Gold for the rest of the World!

Plus acquiring Silver does not have the baggage of Gold, which means people are not as likely to remember that you have any which makes it “safer” to own and far easier to barter with than Gold, especially for small amounts of goods.

Parts of the above were posted at http://tinyurl.com/gmed9m3