Strong S&P 500 Earnings + Weak Stock Values = Opportunity

With all the negative talk that we are consistently fed, the truth is, that corporate America is strong. The fundamentals underpinning most of our great companies warrant higher valuations than they are currently receiving. With interest rates at all-time lows, and therefore, the price of bonds at all-time highs, they are less competitive to stocks than normal. Consequently, I believe that equity valuations should be higher than normal, not lower. Therefore, I feel that now is a great time for investors to be building equity portfolios whether the market is at the total bottom or not. [Let me be more specific as to why I think that is the case.] Words: 1493

So says Chuck Carnevale (www.fastgraphs.com/_blog/) in an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Carnevale goes on to report, in part:

Earnings Are Strong

Dirk Van Dijk, a Director of Research at Zacks Investment Research, recently published an article titled: Earnings Strong, Economy Not. The following excerpts tell the S&P 500 earnings story:

The Earnings Picture

Second quarter earnings season is effectively over, with 497 or 99.4% of the S&P 500 reports in. With the exception of a handful of financials, most notably Bank of America (NYSE:BAC) which had a $12 billion negative swing in net income from last year, this is another great earnings season.

The year over year growth rate for the S&P 500 is 11.9%, way off the 17.1% pace those same 497 firms posted in the first quarter. However, it you exclude the Financial sector, growth is 19.4%, actually up slightly from the 19.1% pace of the first quarter. At the beginning of earnings season, growth of 9.7% was expected, 12.2% ex-Financials.

Attention will now start to shift to the expected growth in the third quarter. Things are expected to slow a bit, with 12.30% growth expected overall, and 11.9% if the financials are excluded. While that is down fairly significantly from the second quarter, especially ex-financials, it is right in line with what the expectations for the second quarter were before companies started to report.

Top-line results were also very strong, with 10.45% year over year growth for the 497, actually up from the 8.77% growth they posted in the first quarter. The top-line results are even more impressive if the Financials are excluded, rising to 10.71% from the 9.49% pace of the first quarter.

Top-line surprises have been almost as good as than the bottom-line surprises, with a median surprise of 1.76% and a 2.46 surprise ratio. The revenue growth in the first half is remarkable, given only 0.4% GDP growth in the first quarter and just 1.0% in the second, with low overall inflation. High commodity prices helped revenues among the Energy and Materials sectors, and higher growth abroad and currency translation effects from a weak dollar have also helped.

Looking ahead to the third quarter, year-over-year growth of 6.16% is expected for the full S&P 500, and 6.38% growth if Financials are excluded. At the very start of reporting season, revenue growth of 9.62% total growth was expected, and 8.94% excluding the Financials.

Stock Prices are Weak

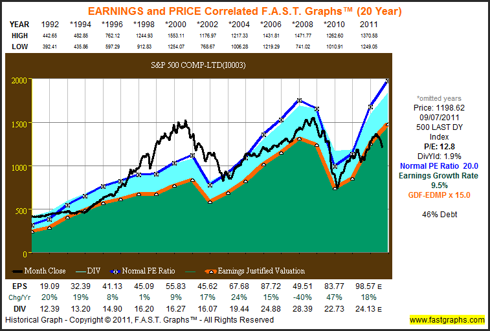

The following F.A.S.T. Graphs™ covers the earnings and price relationship of the S&P 500 since calendar year 1992. All of the earnings numbers come directly from Standard & Poor’s Corp. (Note that only every other year’s data is typed on the graph due to space constraints, however, each year’s data points are plotted on the graph). The orange line represents earnings multiplied by the S&P 500’s 150-year historical normal PE ratio of 15. The blue line represents the S&P 500’s last 20 year’s normal PE ratio of 20. The black line represents monthly closing stock prices. The green shaded area graphs earnings, and the light blue shaded area shows dividends paid out of earnings.

Who in the world is currently reading this article along with you? Click here to find out

There’s an important lesson on statistical analysis that I believe this graph offers. Although it is statistically correct that the normal PE ratio for the S&P 500 over the last 20 years has been 20, the graph shows that this number is somewhat misleading. In truth, there have only been a few times over the last 20 years where the S&P 500 was valued precisely at 20 times earnings. Clearly, as the graph vividly illustrates, stock values have often been dramatically above 20 times earnings, and often dramatically below 20 times earnings over this time frame.

Consequently, I offer that this graph provides a much more relevant and comprehensive view of the S&P 500’s relative valuation over the last 20 years than the statistic does. Of course, the same can be said of the 150-year historically normal PE ratio of 15. On the other hand, it’s interesting to note from the graphic below that this is the only time in the last 20 years that the S&P 500 has been valued significantly below the normal 15 PE ratio. To me this indicates that the S&P 500 is currently on sale.

click to enlarge images

The following graph plots the S&P 500’s price to sales ratio since calendar year 1992. The current price to sales is low relative to historical standards. Once again, to me this indicates attractive current valuation.

Conclusions

If the S&P 500 achieves the earnings goal of $98.57 as estimated by the above graphs, its year-end 2011 earnings justified fair value would be 1478.45, which is approximately 23% higher than it currently sits. To be clear, this is a mathematical calculation based on the current and near-term earnings power of the S&P 500 companies. Also, based on current earnings estimates, the earnings yield for the S&P 500 is 8.4%, which is approximately 4 times higher than the yield on the 10-year T-note. Therefore, this is not a forecast that it will get there, only a calculation indicating that it should.

The following excerpt from Dirk Van Dijk’s article cited above corroborates this view:

In an environment where the 10 year T-note is yielding 1.99%, a PE of 14.5 x based on 2010 and 12.5 x based on 2011 earnings looks attractive.

*http://www.fastgraphs.com/_blog/Research_Articles/post/Strong_SP500_Earnings_plus_Weak_Stock_Values_equals_Opportunity/

Related Articles:

1. How the Dow 30 Stocks Compare According to Their Margins of Safety

Benjamin Graham, known as the father of value investment, is famous for his simple, yet powerful, valuation method as first explained in his 1973 book, Intelligent Investor, and later updated in his book entitled Renaissance of Value. His “Graham Number” approach has been adapted and applied to all 30 stocks listed on the Dow Jones Industrial Index to determine which of the stocks have above average safety factors – of which only 10 do. Below is an explaination of the approach, the formula and the results for all 30 stocks. Words: 1220

2. Which Stocks Trade at a Discount to the “Graham Number”?

Benjamin Graham, the “godfather of value investing” created an equation to calculate the maximum fair value for a stock, referred to as the Graham Number and any stock trading at a significant discount to this number would appear undervalued. [Here are the names of 18 such stocks.] Words: 1707

3. Buy:Sell Ratio Suggests Weakness in Equities is Due to Fear – NOT Fundamentals

While it would seem that moms and pops and the average punter out there are running out of the equity market and into the “safety” of US Treasuries, corporate insiders are doing the exact opposite. This is yet another bullish contrarian sign. From the start of 2004 at least, this is the biggest buying spree that corporate insiders have engaged in. [Allow me to show you the specifics.] Words: 345

4. Now’s the Time to Buy Quality Dividend Stocks – Consider These 11

The decrease in stock prices over the past weeks has many investors scared that the market is forecasting a dip in the economy. This panic has started to create an environment where enterprising dividend investors could start adding to their positions at cheaper prices. In fact, if stocks keep going lower this would create tremendous opportunities for enterprising dividend investors to scoop up some of the best dividend stocks in the world at fire sale prices. In this article I will explain why the market dip has created a perfect opportunity for dividend investors and specify 11 stocks worth considering. Words: 819

5. Don’t Fight the Fed: Buy Some of These 20 Blue Chip Stocks Instead!

The herd continues to stampede into U.S. Treasury debt of every possible maturity to, theoretically, avoid risk. Yields on AA+ 10-yr bonds can be locked in to yield 2.11% per year and you get your principal back in 10 years. [As we see it, though] the only justification for [such a meagre] return on invested capital must be tied to the belief that a return is better than nothing given the prospects of a future depression. We believe, however, that fighting the Fed and investing like a depression is coming is not the right way to position your portfolio. [Below are 20 suggestions on how to generate in excess of 2.11% returns plus strong appreciation potential with modest risk.] Words: 657

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money