401(k)s, IRAs, and Social Security aren’t giving the average person enough to retire on anything close to a comfortable lifestyle as 80% of households have less than $100,000 in savings. That is not enough for even a minimal retirement.

If you spent most of your life paying as much as legally possible into the system, and you retire in 2019 at age 65, your monthly benefit will be $2,757, which is then indexed for inflation (at least under current law). It jumps to $3,770 if you delay retirement until age 70.

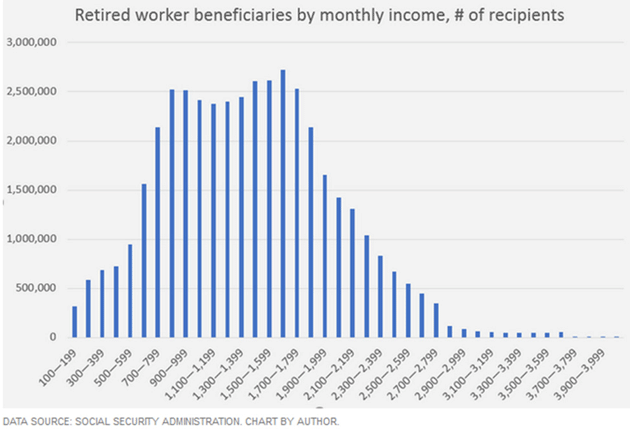

A solid majority of Social Security recipients, [however,] receive $2,000 a month or less, and many less than $1,000. The average benefit is $1,413, according to Social Security’s latest fact sheet. If that’s all you have, your retirement lifestyle is not going to include many cruises and golf tournaments. Of course, it shouldn’t be all you have.

- Social Security was never supposed to be a complete multi-decade retirement plan. It was designed to keep retired workers out of poverty at a time when lower life expectancies kept retirement much shorter for most—if they lived to 65 at all. Now we live longer, and we have higher expectations…

- Bottom line: Social Security probably won’t give you much security. You need more.

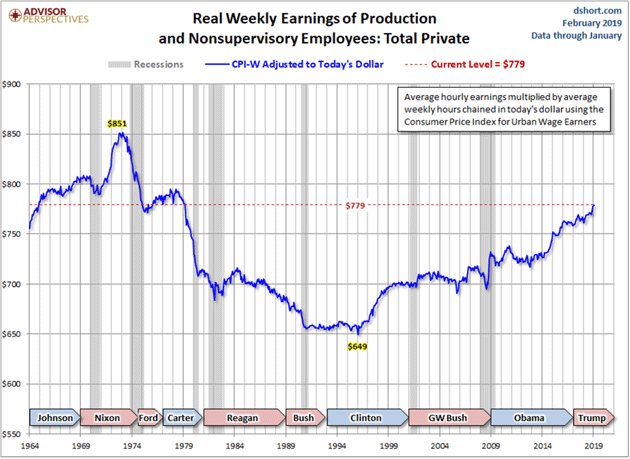

Ideally, people should avoid relying on Social Security and accumulate other savings as well. Many, perhaps most, do not. The reasons vary. I suppose some just spend their money unwisely and neglect to save anything but income data says many Americans can’t afford to both live a typical middle-class lifestyle and save enough to finance a 20+ year retirement. Here’s a Doug Short chart to illustrate.

In constant dollars and adjusting for hours worked, average weekly earnings for non-managers are now $779, and that’s an almost 40-year high. Millions of those now approaching retirement age spent their entire lives earning the equivalent of $40,000 a year, at most. Little surprise they don’t have six-figure retirement savings. The simple fact of the matter is, it takes enormous discipline to save even 6% for your 401(k) at that income level.

Insufficient Retirement Savings

In a country of 330+ million people, shockingly few have enough retirement savings to support the stereotypical “leisurely” golden years.

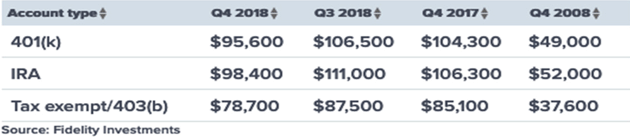

- In fact, the average balance in 401(k)s, 403(b)s, or IRAs fell to $95,600 at the end of last year from $104,300 at the end of the 3rd quarter. What sort of retirement can the average retiree look forward to with this minimal sum of money set aside? Is that all there is? Really? Is that really all there is? If so, we are in very real trouble.

The average IRA balance is not necessarily indicative of retirement savings generally, as many other vehicles exist, but it’s probably a good proxy and an average of around $100,000 won’t yield much of a supplement to the monthly Social Security benefits described above.

…401(k)s, IRAs, and Social Security aren’t giving the average person enough to retire on anything close to a comfortable lifestyle.

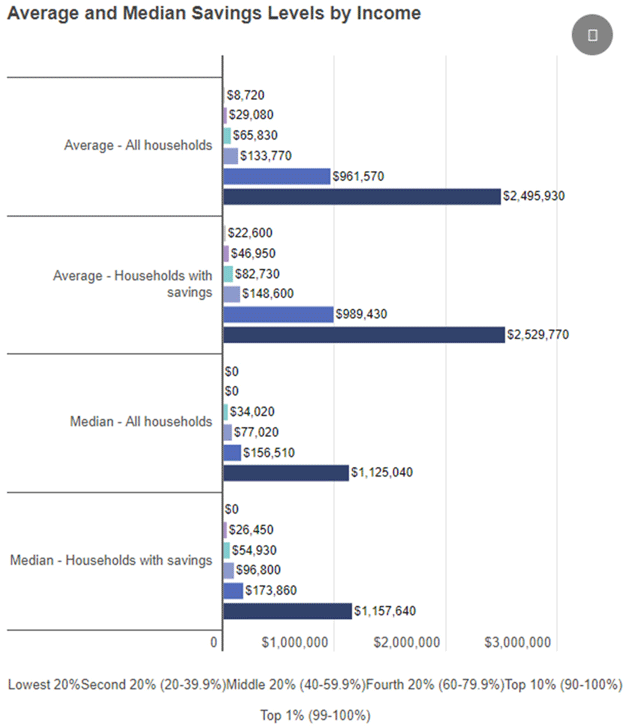

Average & Median Savings Levels by Income

- Average household savings for the bottom 40% are under $30,000.

- Median household savings for the bottom 40% are zero dollars.

Clearly the top percentiles and especially the top 1%, skew the average. Note the bottom lines in the chart below is not the top 20%, but the top 1% – and the top 1/10 of 1%? Don’t make me giggle.

Source: cnbc.com

The point is that the 80% of households have less than $100,000 in savings. That is not enough for even a minimal retirement.

- Let’s make the very aggressive assumption that you can take 5% a year from your savings plan.

- If you have $100,000, that’s $5,000 yearly or about $417 a month—on top of your Social Security – and what if you don’t have your house paid off or your car?

The Double Problem

…The Baby Boom generation that is now reaching retirement age has a double problem.

- First, many of its members didn’t save enough cash to support a comfortable retirement.

- Second, those many who did save enough could see it evaporate when we get into another bear market, which we certainly will at some point.

What can you do? [Here are ] some suggestions:

- First, whatever your age, save as much as you can. Stash it in your IRA, 401k, defined benefit plan, or whatever other tax-advantaged vehicles are available to you. Then save more outside them. If you look at your income and expenses and think “I just can’t do this,” think again. Start saving something, even if it’s $20 or $50 a month. Get in the habit and it will become easier…

- Second, invest in programs that give you at least a chance to dodge bear markets. Buy and hold works in theory, but not for most people because we are humans with emotions. We should recognize that and take steps to control it. As I continually say, we should invest in trading strategies and not buy-and-hold index funds in this environment and, of course, fixed income strategies like actual bonds, real estate, private credit, and so on.

- Third, forget about retiring at 65 unless you are in truly dismal health… Keep working a few more years, even if you have to find a new career that better fits your circumstances. This will let your capital accumulate longer and you’ll get a higher Social Security benefit by waiting until 70 to start collecting.

- Fourth, take care of your health. It will both reduce your medical expenses and keep you in shape so you can work and produce income longer. Further, staying physically active will keep you healthier. If that physical activity is involved in a job, that counts. There are studies that actually associate retirement with lower life and health spans. But gym time and a healthy diet are still important.

I can only imagine the panic of those less fortunate and prepared. Their problems are yours and mine, too, because an economy with so many low-income elderly people has less opportunity for everyone.

Editor’s Note: The above excerpts* from the original article have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money