This article is presented by www.munKNEE.com The article goes on to say, in part:

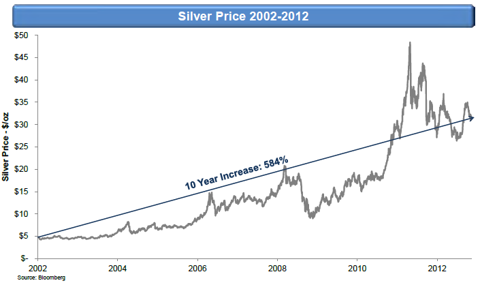

Silver prices have corrected meaningfully after peaking out at near USD50 levels. A correction of over 20% is generally considered bearish and can weaken investors’ interest in the metal [but] I believe that silver can produce another decade of over 500% returns [just like it did] in the last 10 years.

(click to enlarge)

The Current Macro-economic Scenario’s Impact on Silver

The global economy (especially the developed markets) is in a phase of prolonged sluggish economic growth. GDP growth has been volatile since 2007, and recession seems very likely for the U.S. without government support. Further, the eurozone is already in a recession. This scenario necessitates continued expansionary monetary policies by Central bankers globally, and is positive for hard assets like gold and silver.

Industrial Demand for Silver to be a Major Driver for Silver Prices

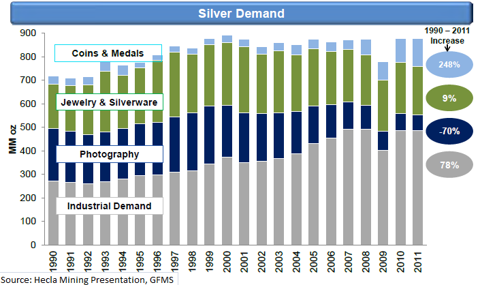

[As the graph shows below,] the demand for silver coins and medals has increased by 248% during the period 1990 to 2011…[and] industrial demand for silver has surged by 78%….I am of the opinion that Industrial demand will be the second biggest driver for silver prices after the hard asset factor. I can also say with some conviction that industrial demand for silver will grow at a greater pace than witnessed in the last two decades.

(click to enlarge)

There are certain important properties that make silver a favored industrial metal.

Silver has the highest electrical conductivity of all the metals. Silver is 80% more conductive than aluminum, 50% more conductive than gold and 6% more conductive than copper. This makes silver critically important in the miniaturization of circuits as electronic items become increasingly compact.

Silver has superior thermal conductivity and higher reflectivity (94%) in the visible light. These factors are leading to silver being increasingly used in a wide array of industries globally.

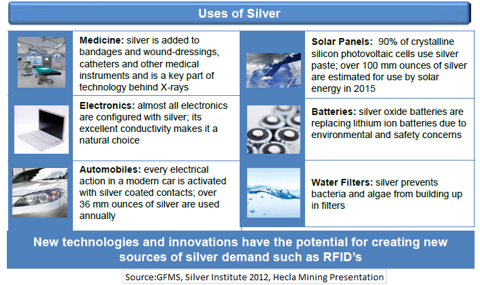

The diagram below gives a summary of the industrial application of silver and the potential new areas where silver can be utilized.

(click to enlarge)

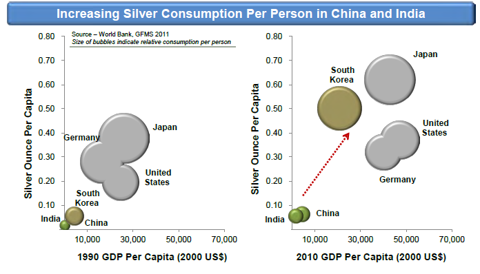

I mentioned earlier that I expect the industrial demand for silver to grow at a more robust pace than before. The primary reason for this rationale is the low per capita consumption of silver in emerging markets as compared to developed markets. Even if the per capita demand for silver in China and India (home to over 2.5 billion people) comes anywhere near the per capita consumption of developed markets, the amount of silver that needs to be mined will be very significant.

(click to enlarge)

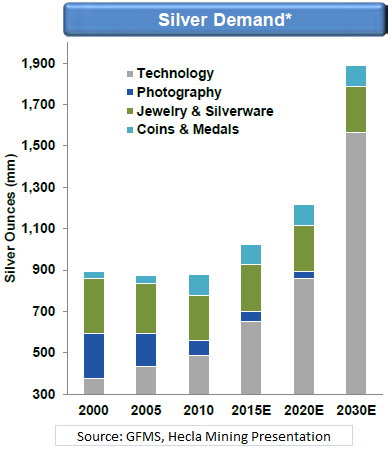

The huge impending growth in Asia, Africa and emerging Europe, coupled with the population factor, will be the key demand driver for silver in the long-term. The chart below gives the expected demand for silver excluding investment and ETF demand. With the above discussed industrial drivers, demand is expected to surge over the next two decades.

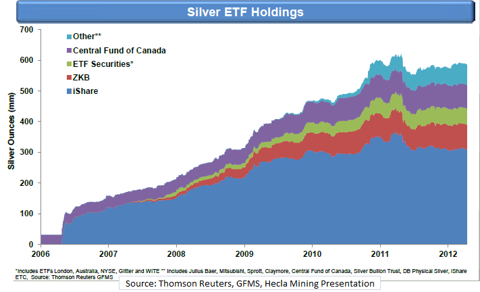

At the same time, the silver ETF holdings have surged since 2007 to record highs.

(click to enlarge)

This surge in silver ETF holdings has been largely due to the financial crisis, which continues to plague the developed economies. Going forward, the silver demand will continue to increase as investors and individuals buy silver more as a currency, which is a store of value than for any other purpose.

Lack of Supply of Silver to be a Major Driver for Silver Prices

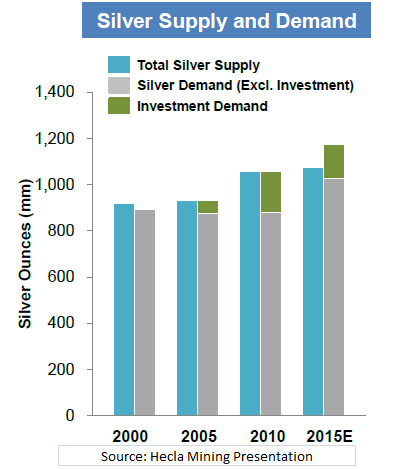

Coming to the supply side factors, there could be a demand-supply mismatch with growing demand for silver from Asia in 2015. The current silver demand of 1.06 billion oz is expected to rise to 1.18 billion oz by 2015. With no major silver mining project in the pipeline, surge in investment demand coupled with industrial demand has the potential to outpace the expected supply. If this scenario pans out, [the price of] silver will trend meaningfully higher over the next few years.

Conclusion

Considering all these fundamental factors, it makes sense to consider exposure to silver at current levels and add to the position on any correction. The metal is certainly poised for another decade of the bull market and has the potential to outperform many asset classes.

In line with this expectation, I would consider exposure to physical silver as a first choice of investment. Also, investors can consider the following stocks and ETFs for exposure to silver.

iShares Silver Trust ETF (SLV) – The Trust holds silver bullion and is designed to provide investors with a simple method to gain exposure to the price of silver. The ETF has a relatively low expense ratio of 0.5%.Rio Tinto plc (RIO) – Rio Tinto is a leading international mining group with a diversified geographical presence and a diverse product offering. Most of Rio’s assets are in Australia and North America, but it also operates in Europe, South America, Asia and Africa. Gold and silver are produced primarily as by products of Rio Tinto’s copper operations. Investors can consider exposure to this 2.5% dividend yielding stock as it is one of the best commodity plays.Hecla Mining (HL) – Established in 1891 in northern Idaho’s Silver Valley, Hecla Mining is the largest and one of the lowest cash cost, primary silver producer in the U.S., with exploration properties and operating mines in four world-class silver mining districts in the U.S. and Mexico….This stock…can be considered for medium to long-term. I must mention here that the risk associated with this stock is high. However, I do believe that the company has decent fundamentals to give robust returns over the next few years.

Sign up HERE Your Daily Intelligence Report

FREE The “best of the best” financial, economic and investment articles to be found on the internet An “edited excerpts” format to provide brevity & clarity to ensure a fast & easy read Don’t waste time searching for articles worth reading. We do it for you! Sign up HERE You can also “follow the munKNEE” twitter & Facebook

*http://seekingalpha.com/article/1086891-silver-another-decade-of-500-returns-is-possible

Related Articles:

1. Availability Of, and Demand For, Silver vs. Gold Suggests MUCH Higher Future Prices for Silver

<img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> The current availability ratio of physical silver to gold for investment purposes is approximately 3:1. So, why is it that investors are allocating their dollars to silver at a much higher ratio? What is it that these “smart” investors understand? Let’s have a look at the numbers and see if it’s time for investors to do as a wise man once said and “follow the money.” Words: 1052; Tables: 1

2. Silver: 5 Forces That Should Help Polish Off the Tarnish & Propel It Higher

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> The price of silver has been corroding for much of the past year but a variety of signals in recent months suggest that it may not be long before silver begins to shine once again. [This article identifies 5 such signals and/or reasons why that may well be the case.] Words: 643; Charts: 2

3. Why You Should Now Invest in Silver vs. Gold

<img title=”gold-silver2″ src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” alt=”gold-silver2″ width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” /> <img title=”gold-silver2″ src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” alt=”gold-silver2″ width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” data-lazy-type=”image” /> <img title=”gold-silver2″ src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” alt=”gold-silver2″ width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” /> <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” alt=”gold-silver2″ title=”gold-silver2″ /> The price of silver is going to go much, much higher – much higher – over the next decade [relative to gold according to Jim Rogers and I concur. Below are 5 solid reasons why I believe that is the case.] Words: 767

4. Gold:Silver Ratio Suggests MUCH Higher Price of Silver in Next Few Years

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”6 <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> The majority of analysts are now of the opinion that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold, silver could escalate dramatically in price over the next few years. How much? This article takes a look at historical gold:silver ratios and what attaining certain relationships would mean for the price of silver should specific price levels for gold be realized. Words: 691

5. Goldrunner: Silver to Rocket to $60 – $68 and Then Much Higher

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”6 <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> Personally, based on the fundamentals at hand and the fact that Gold doubled its log channel around this point in the cycle; I expect Silver to bust up out of its log channel in 2013. Initially, I look for Silver to reach the $60 to $68 level, first and hold open the possibility for Silver to do much more on the upside as the 70’s Silver Chart reflects.

6. Alf Field Sees Silver Reaching $158.34 Based on His $4,500 Gold Projection!

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” />

7. Silver’s Price Could Outpace That of Gold – Here’s Why

<img title=”gold-silver” src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” /> <img title=”gold-silver” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”gold-silver” src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” title=”gold-silver” /> The value of silver has skyrocketed in recent decades –leading many investing experts to believe that silver’s price could outpace gold for the first time in history. This infographic covers silver’s meteoric increase and the factors that have led to silver’s exploding value…[and] takes a nod to the future to see where silver’s price may be headed based on the most up to date demand data.

8. I’m A Crazy Silver Bug…Why Aren’t You?!!

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Si <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> It’s true that there are “NO SURE THINGS” in life…but an investment in SILVER comes DARN CLOSE! Yes, you’ll have to ride the tidal wave of price manipulation but when the waves die down you will fully appreciate the power and value of SILVER. Let me explain.

9. Gold: What Does a “Troy” Ounce or “18/24 Karat” Gold Really Mean?

<img title=”gold” src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” /> <img title=”gold” src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img width=”77″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2009/10/gold.jpg” alt=”gold” title=”gold” /> You have no doubt read countless articles on the price of gold costing “x dollars per ounce” and possibly own a gold ring or some other piece of gold jewellery but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? Let me explain. Words: 637

10. Moolman: Long-Term Chart Suggests Silver Will Comfortably Pass $150 By End of 2013

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Si <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> Thanks to this similarity in events, as well as the similarity in sequence, of the price movement of silver from the beginning of 1966 to the beginning of 1980 with the end of 1999 to the end 2013, my analysis suggests that silver will comfortably pass $150 by that date. Let me explain my rationale. Words: 338

11. Silver Will Go to $50 and Then Explode Dramatically Higher! Here’s Why

<img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” /> <img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ /><noscript><img title=”Silver Bars” src=”https://www.munknee.com/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ /> There is a massive amount of energy underlying the silver market, and when it is ready to unleash, we will see price/value increases that will stun even the most ardent silverbugs…The real power of this expected move is likely to be released only some time after the price of silver has surpassed the $50/ozt. level. [Let me explain.] Words: 685

12. The Dollar is Toast! The Future is Silver

<img title=”sunshine-silver-slide-e1268276971175″ src=”https://www.munknee.com/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/11/sunshine-silver-slide-e1268276971175-90×65.jpg” alt=”sunshine-silver-slide-e1268276971175″ width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/11/sunshine-silver-slide-e1268276971175-90×65.jpg” /><noscript><img title=”sunshine-silver-slide-e1268276971175″ src=”https://www.munknee.com/wp-content/uploads/2011/11/sunshine-silver-slide-e1268276971175-90×65.jpg” alt=”sunshine-silver-slide-e1268276971175″ width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://www.munknee.com/wp-content/uploads/2011/11/sunshine-silver-slide-e1268276971175-90×65.jpg” /> <img title=”sunshine-silver-slide-e1268276971175″ src=”https://www.munknee.com/wp-content/uploads/2011/11/sunshine-silver-slide-e1268276971175-90×65.jpg” alt=”sunshine-silver-slide-e1268276971175″ width=”90″ height=”65″ /> Psychologists tell us that there are five stages of grief over loss of whatever kind, usually death, or breaking up with a loved one, which are: denial, anger, bargaining, depression, acceptance. I’ve applied these to the loss of the dollar, as I see most people today are still stuck in denial, and here’s how to deal with that. Words: 1100

discusses the reasons for believing that silver can produce another decade of over 500% returns. Words: 954; Charts: 7

discusses the reasons for believing that silver can produce another decade of over 500% returns. Words: 954; Charts: 7

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

For what it is worth, I too think Silver will outperform Gold in the next decade, hopefully we will both be alive and well in December 2019 to toast our forward thinking and good fortune…

Until then… Happy New Year