Higher inflation expectations and the outlook for growth are still closely linked.

This may be a revelation in some circles (or ignored or even damned in others), but it’s been reality for several years now. [Let me explain why such is the case.] Words: 388

This may be a revelation in some circles (or ignored or even damned in others), but it’s been reality for several years now. [Let me explain why such is the case.] Words: 388

So says James Picerno (www.capitalspectator.com) in edited excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com has further edited below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Picerno goes on to say, in part:

The recent pop in the 10-year Treasury Note’s yield—up about 40 basis points this month to ~2.4%–has inspired cries that the end is near. One Wall Street analyst lamented that the recent pop in this rate was a sign of rising inflation expectations and that this was something to worry about…NOW! He also recognized that the market’s repricing of Treasuries for higher yields also reflected a brightening economic outlook but he couldn’t see that the two trends are, in fact, connected these days because the new abnormal continues to rule.

Home Delivery Available! If you enjoy this site and would like to have every article posted on www.munKNEE.com (approx. 3 per day of the most informative articles available) sent automatically to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

The main empirical fact is the high positive correlation between the stock market and the market’s inflation forecast (e.g., the yield spread on the 10-year nominal Treasury less its inflation-indexed counterpart).

Higher inflation isn’t always associated with good news for growth, of course. Critics rightly point out that Milton Friedman and Robert Lucas long ago warned us to be to wary of blindly accepting the Phillips curve as permanent gospel. There’s a price to pay for allowing inflation to rise too far,…especially under certain economic conditions but in the new abnormal, higher inflation is still useful. There will come a day when it’s detrimental, but not now.

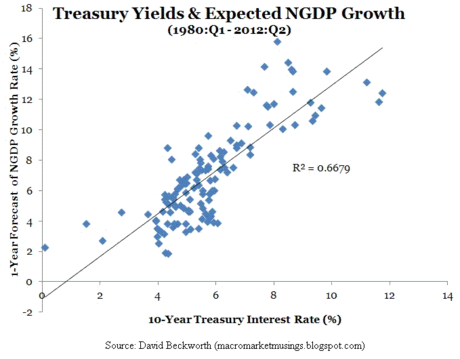

Meanwhile, higher nominal yields are telling us something about growth expectations. Economist David Beckworth crunches the numbers and shows us [in the graph below] the relationship over the last several decades, explaining:

“the expected growth rate of nominal GDP or aggregate demand is strongly related to the 10-year treasury yield. Thus, the recent rise in long-term yields can be interpreted as the bond market pricing in a rise in the expected growth of aggregate demand – and that is great news given the ongoing aggregate demand shortfall in the U.S. economy.”

*http://www.capitalspectator.com/archives/2012/03/expecting_growt.html#more

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

A previous article on the subject:

1. When Will Inflation Expectations & Stocks Stop Moving In Lockstep?

The stock market and inflation expectations remain joined at the hip. As the crowd anticipates higher inflation, the stock market rallies, and vice versa. This positive correlation between inflation and stock prices (a proxy for the economic outlook) won’t last forever and it’s anyone’s guess when [that will be but I have my views on it if you are so interested]. Words: 557

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money