This year’s recovery in precious metals prices – and the sudden spike in gold/silver mining stocks – convinced a lot of people that a new bull market had begun but last week’s brutal smack-down scared the hell out of many of the same folks. The latest commitment of traders (COT) report, however, implies that we should all relax. Things are playing out pretty much according to a script that’s been in place for decades – and which points to happy times by early next year. [Let me be more explicit.]

convinced a lot of people that a new bull market had begun but last week’s brutal smack-down scared the hell out of many of the same folks. The latest commitment of traders (COT) report, however, implies that we should all relax. Things are playing out pretty much according to a script that’s been in place for decades – and which points to happy times by early next year. [Let me be more explicit.]

The comments above and below are excerpts from an article by John Rubino (DollarCollapse.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

The Quick & Dirty COT Story

COT is a snapshot of what the big players in gold/silver futures contracts are up to. There are two main groups in this market:

- the commercials (mostly big banks and companies that buy metal to turn it into coins, jewelry and industrial products)

- and speculators who bet on price moves.

The former consistently fool the latter into guessing wrong at turning points. That is, the speculators are usually way long at the top and very short at the bottom so you can tell where prices are headed over next the six or so months by looking at what the speculators are betting on and assuming that if they’re excited, they’re wrong.

Gold Prices About to Fall

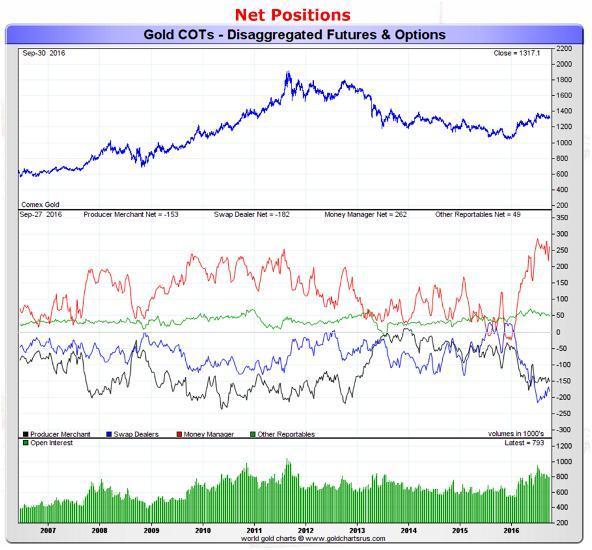

The following chart illustrates the above point. Ignore everything here except the red line, which represents the speculators…[and shows that] they’re very long and prices are about to fall...

This year the speculators have gone record long, which explains the fast recovery in metals prices and mining stocks: The speculators were piling in. This, of course, sets the stage for an eventual correction so what happened last week was to be expected (though it was several months overdue, illustrating the point that the COT report is great for direction but dangerously unreliable for timing).

When Might Gold Rebound?

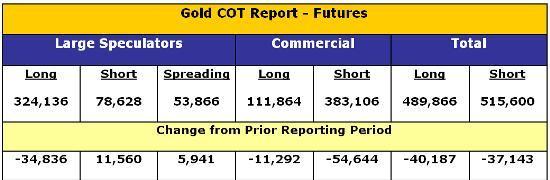

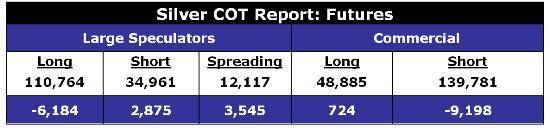

Now that we know why the beat-down is happening, let’s see what this indicator says about when (in very general terms) it might end. Here are the weekly COT reports for gold and silver through last Tuesday, courtesy of our good friends at GoldSeek:

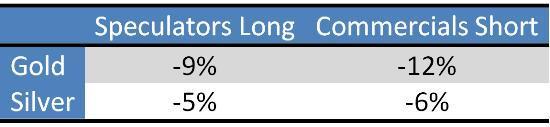

Note that the speculators are cutting their long positions while the commercials are scaling back their shorts. Here’s the same data expressed in percentages:

The key conclusions:

- Both groups are moving in the right direction to establish a precious metals bottom. That is, if they keep this up, eventually the commercials will be long and the speculators short, setting up a situation where the speculators will be forced to close their shorts by buying gold/silver, thus sending their prices up.

- The commercials are moving a little more aggressively than the speculators to close out their positions. Not sure what that means.

- Neither group had done all that much as of Tuesday the 4th, which implies that the bottom is not yet in sight.

- Based on the brutality of the final three trading days of last week, next week’s COT report will probably show a much bigger move in the right direction – that is, the speculators will be a lot less long – so on Friday the 14th (when Tuesday the 11th’s results are reported) we’ll have a better sense of how close that bottom is.

The carnage in bullion and mining shares represents a great buying opportunity because eventually these paper games will stop working. The fundamental environment of:

- negative interest rates,

- massive government deficits,

- steady increases in private sector debt and

- incipient banking/credit crises everywhere you look

is phenomenally good for real assets like gold and silver so, who knows, this might be the last chance to get in before the phase change.

Follow the munKNEE – Your Key to Making Money!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money