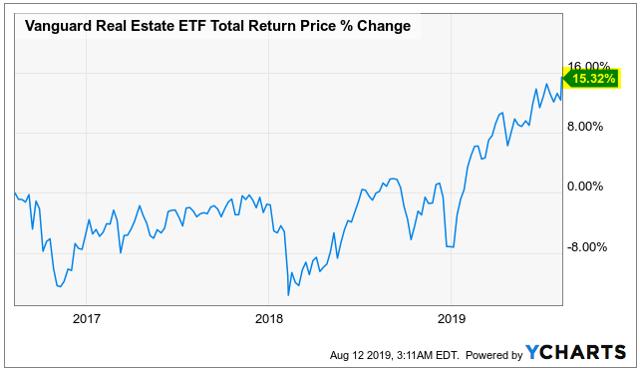

…In 3 years, the REIT market barely moved, and then finally, in early 2019, the momentum returned and REITs are hot again! #munKNEE/Money!

…Below we present 5 reasons why we believe that REITs are set for more out-performance in the coming years:

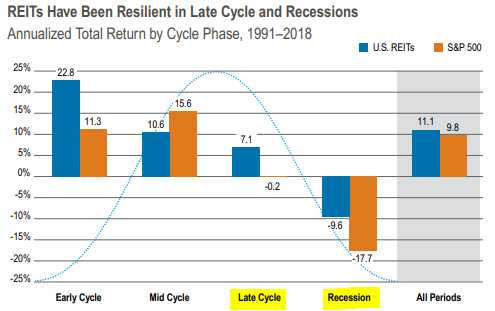

#1: Defense in Late Cycle & Recessions

REITs have historically produced much greater returns in a late cycle economy (outperforming the S&P 500 by more than 7% annually since 1991) when interest rates are peaking, and global growth is slowing down. Moreover, they have also provided greater downside protection during recessions and recovered faster during the early cycle.

This is not really surprising. REITs generate highly resilient cash flow that barely changes during recessions. They also pay higher dividends which tend to act a shock-absorbers.

As global growth slows down and interest rates are cut, REITs become highly desirable as yield-starved investors crowd the sector for higher income in a low growth environment. This is exactly what is happening right now.

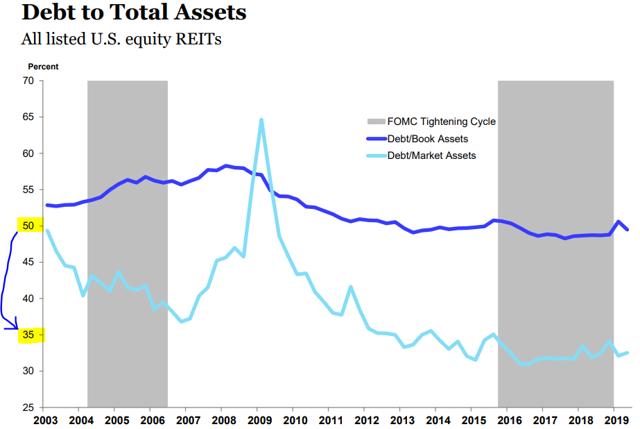

#2: Rock-Solid Balance Sheets

REITs balance sheet are stronger than ever in 2019. The average debt-to-assets is at just ~35%, which compares very favorably to most private equity real estate investors who often use up to 70% debt to finance deals.

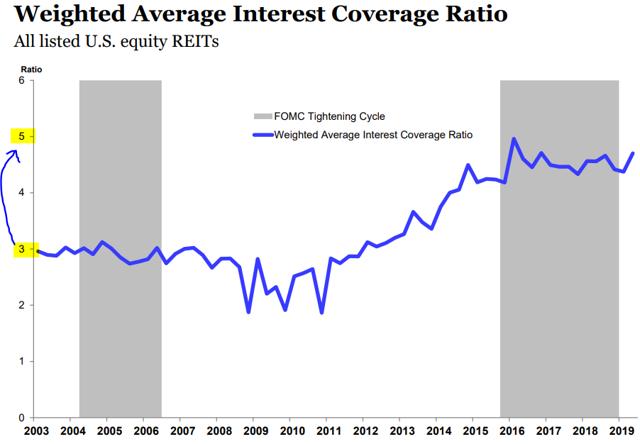

Interest coverage ratios are also at all-time highs:

Finally, most of this debt is fixed rate and the average debt maturity is at over six years and well-staggered.

These are all very significant improvements that will make REITs even more resilient to recessions in the future. Balance sheets have never been this strong for REITs. The same cannot be said about most other equity sectors.

#3: Resilient Fundamentals

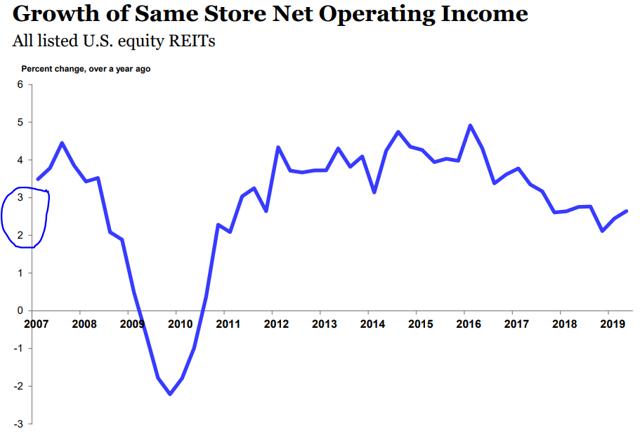

Current operating performance for the REIT industry is right in its ‘sweet spot’: over the last four quarters, same-property NOI growth averaged 3.2 percent, consistent with the industry’s long-term norm.

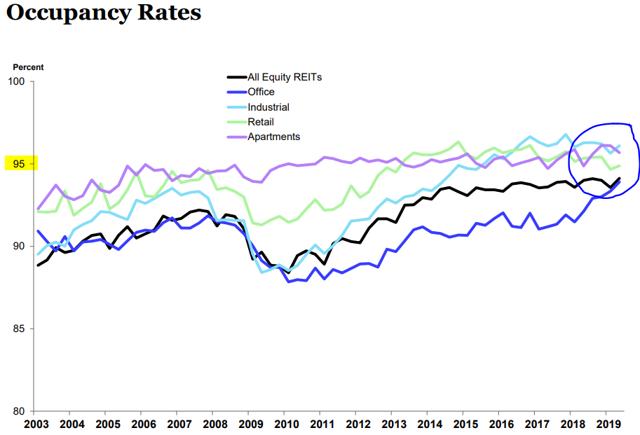

NOI growth is right around 2-3% for most property sectors – a very healthy level. Occupancy rates are also today at historically high levels- which suggest that (1) there is no oversupply and (2) landlords may enforce further rent increases.

Complementing these rent hikes, REITs today have exceptionally good access to capital (strong balance sheets) and low payout ratios of around 70% on average (based on cash flow). Therefore, they are able to expand portfolios with new acquisitions.

When you combine 2-3% NOI growth with some leverage and external growth, REITs can realistically reach >5% annual FFO growth.

#4: Margin of Safety

The REIT market has been on a very strong run since the start of the year. As a result of this strong performance, many investors are led to believe that REITs are now overpriced and posed for poor returns. In reality, [however,] this large surge in share prices is coming after 3-years of disappointing returns with only ~5% annual returns.

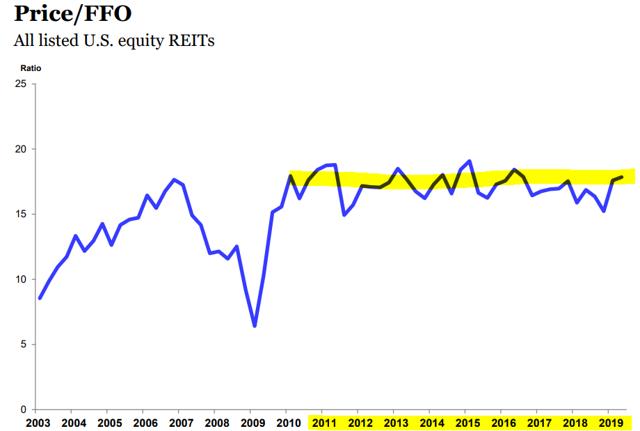

Therefore, REIT valuations have actually fallen behind when you compare to broader equity market indexes. The S&P500 trades currently at 22x earnings – a 30% premium to its historic average. REITs trade at roughly 16x FFO – close to its historic mean.

…Undervalued opportunities remain abundant in the small-cap segment of the REIT market – as we explain below:

#5: Niches of Opportunities

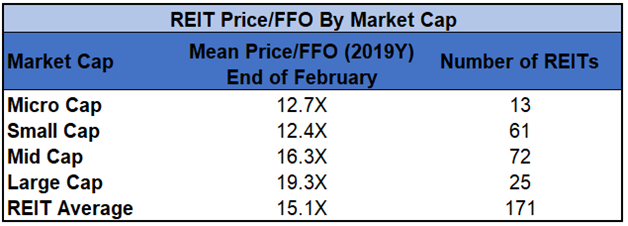

Many market pundits look at popular market-favorite large-cap REITs such as Realty Income (O), Prologis (PLD) and quickly conclude that REITs are overpriced. The reality is very different when you look into smaller and lesser-known REITs.

The difference in small-cap vs. large-cap REIT valuations has rarely been as large as today.

- Large caps trade at close to 20x FFO

- While smaller REITs trade at only 12x FFO

- That is a nearly 40% discount!

We believe that this creates an opportunity for the more entrepreneurial investors who are willing to do some digging because there’s no valid reason to justify such a large valuation differential.

Many REITs have become overvalued, but there still exists some small niches where value is abundant. Now is the time to be very selective and recognize that “not all REITs are created equal.”…

- Do we know whether REITs will be higher six months from now? No.

- Do we believe that a portfolio of undervalued REITs is very attractive in a late cycle economy?[Yes!]…

Today, REITs enjoy the strongest balance sheets ever in their entire history, healthy fundamentals, and trade at earnings multiple discounts to broader stocks. Therefore, we would expect REITs to outperform stocks in today’s late cycle economy, and even more so as the cycle finally turns.

Thank you for reading! If you liked this article, please scroll up and click “Follow” next to my name to receive future updates.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money