Despite all the negative press it sometimes gets…gold has historically been a wise investment because it has a negative correlation with the market…[and has] helped investors diversify their portfolios and improve their risk-adjusted returns.

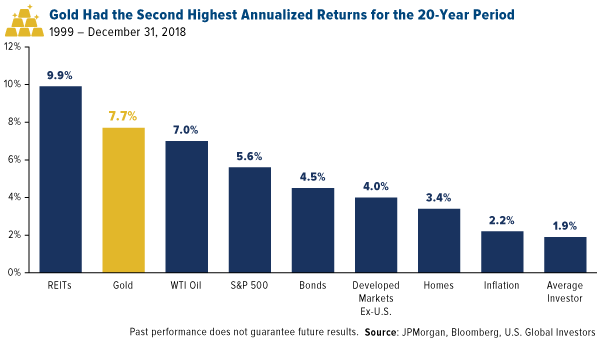

…For the 20-year period ended December 31, 2018, gold as an asset class had the second best annualized returns at 7.7%. Only REITs (real estate investment trusts) did better at nearly 10%.

The S&P 500, by comparison, returned only 5.6% on an annualized basis, but that’s after it underwent two huge pullbacks that greatly impacted performance. Bonds—which include Treasuries, government agency bonds, corporate bonds and more—came in next at 4.5%. Not bad, considering the asset class has lower overall volatility and risk than equities.

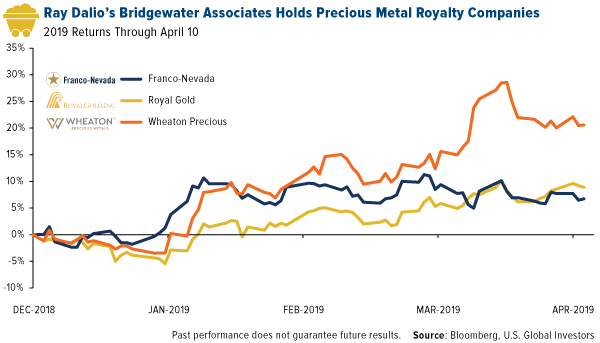

Ray Dalio, the billionaire founder of the world’s largest and most successful hedge fund firm, Bridgewater Associates, is a strong believer in the power of gold holding a significant positions in gold across all tiers in the industry. These positions include:

- physical gold (via SPDR Gold Shares and the iShares Gold Trust),

- senior gold miners (Barrick Gold, Newmont Mining, Goldcorp, etc.),

- junior gold miners (Yamana Gold, B2Gold, New Gold, etc.)

- and gold royalty and streaming companies (Franco-Nevada, Wheaton Precious Metals and Royal Gold). royalty companies…[Royalty companies, in fact,] crushed all other tiers in the gold mining industry, delivering an unbelievable 16% in compound annual growth from 2004 to 2018…

As always, I recommend the 10% Golden Rule (which you can learn about by clicking here). Shouldn’t you?

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money