Could U.S. Treasuries be the best performing asset class of the next one-two  years? It’s quite possible. I am sure this article is bound to stir up controversy, but I’d like to spend some time analyzing several drivers that could buoy bond prices in the coming months. Words: 1053

years? It’s quite possible. I am sure this article is bound to stir up controversy, but I’d like to spend some time analyzing several drivers that could buoy bond prices in the coming months. Words: 1053

So says the Macro Economist (http://macromusings.com/) in edited excerpts from an article* posted on Seeking Alpha under the title Making A Case For U.S. Treasuries .

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

1. Sub-par Global Growth

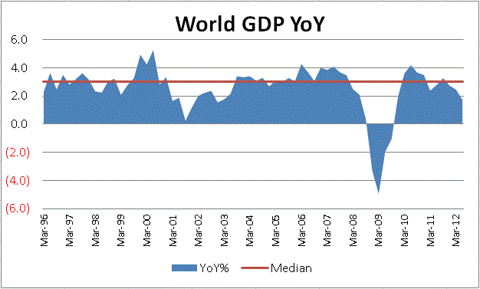

Global GDP has now been below trend since the fourth quarter of 2011. Real growth should be around 3% per year. Sustained periods above this threshold have generally been good for global growth proxies like commodities and emerging markets, while sustained periods below have seen an outperformance in defensive sectors and a bid to bonds.

Source: World Bank

2. Commodities turning down again

Indeed, the current cycle appears no different with the commodities peak clearly coinciding with the faltering global growth that began in 2011.

The downturn in commodities is signaling another downshifting of global growth which puts a floor on bond prices.

3. Equity markets no longer provide an alternative

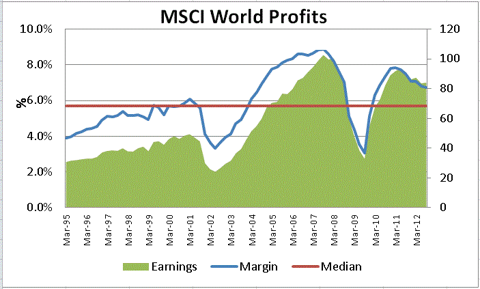

While global growth and commodities peaked in 2011, equities have been a source of strength. Global earnings have been in a slow, downward trajectory since 2011. As one would expect, earnings declines have been most pronounced in the EAFE, whereas the U.S. has been a bastion of strength.

The different earnings trajectories of the various global regions has been reflected in the relative share price movements, with the U.S. outperformance particularly pronounced over the past 18 months.

Thus far, the global earnings slowdown can be described as a soft-landing, but this was also the case in 2008 when global growth was stronger than the U.S. Today, we see a role reversal, as it now appears the U.S. earnings cycle is turning. U.S. Treasuries are one of the few alternatives against slow growth and earnings declines.

Who in the world is currently reading this article along with you? Click here

4. The U.S. macro-economy is tipping over

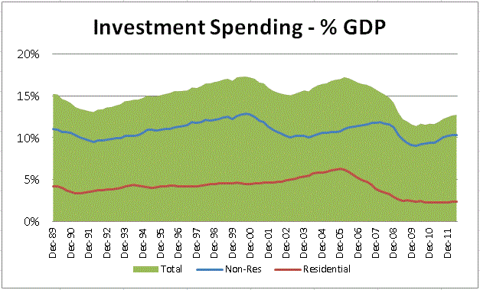

In some ways, the U.S. economy has supported the rest of the world. The U.S. still accounts for 50% of the capitalization of the MSCI World index and U.S. GDP is around 25% of the global total. Our economic growth and U.S. companies’ profitability since 2009 has been a positive driver for global risk assets but it appears the U.S. economy could be succumbing to the global malaise, compounded possibly by internal fears over the consequences of future austerity aka “The Fiscal Cliff.” This shows up first and foremost in capital investment, which appears to be hitting an inflection point.

Capital investment decisions by CFOs are long-horizon decisions. Clearly, U.S. executives see something amiss. Once inflection points occur, they last for a couple of years, and can be vicious as we saw in 2007-2008, or virtuous as we have seen in the past three years.

A turn in U.S. capital investment, and the knock-on effects, will have further negative ramifications for global risky assets and likely provide a floor on bond prices.

The sliver of good news is that given the upturn in housing (albeit from depressed levels), it’s possible the U.S. can avoid recession even if the rest of the world slips into it. The odds of a major growth scare in 2013 have now increased and markets generally tend to be anticipatory, with the first leg of a bear market usually occurring very fast and approaching losses of 20%. This can only be good for bonds.

Don’t Delay!

– Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com

– It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time

– Join the informed! 100,000+ articles are read every month at munKNEE.com

– All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read

– Get newly posted articles delivered automatically to your inbox

– Sign up here

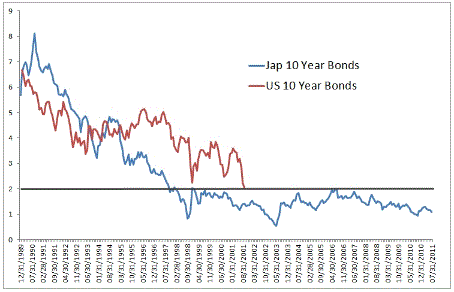

Also, if you’re wondering where the 30-year JGB stands, I’ll do one better and show you the 40-year bond, which as recently as 2010 hit 1.6% and currently stands just above 2%.

Source: Bloomberg

We are reticent over having any stock allocation at this point, given the nosebleed valuations we see in the defensive sectors. For instance, as investors have chased high yield investments, they have pushed the S&P500 Utiliities index to its highest price:sales and profit margin ratio since our data set began in 1993.

We’ve thrown in the towel on the effectiveness of any further QE in elongating the business cycle, and for our traditional defensives versus cyclicals trade to work (on the basis of valuation and crowdedness), and have moved into a fully defensive posture shunning anything that is remotely related to positive global growth. While we like to trade tactically, this is a fundamental view, and represents the bias from which we expect to be trading for some time.

Conclusion

Our preferred fixed income investment is TLT. Contrary to the view of sell-side strategists, we think TLT is positively asymmetric at this point. Central Bankers have been able to cause a lot of volatility in the equity markets since 2011, hence making shorting high beta assets a dangerous game, but they cannot change the business cycle and the smart money appears to have strong hands in bonds.

Throughout these massive interventions to create inflation, TLT has been incredibly resilient, telling us that deleveraging forces are stronger than any Wizards behind the Curtain. That’s the hallmark of a true bull market.

[Before taking any action based on the article above please read this follow-up article on Seeking Alpha for a different point of view on TLT.]

*http://seekingalpha.com/article/956851-making-a-case-for-u-s-treasuries

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Marc Faber Bearish On ALL Asset Classes (Including Gold)!

I consider Dr. Marc Faber [to be] one of the best and well read economists in the world….[A] historical analysis of Dr. Faber’s views…[shows] that he has been spot on most of the time, not exactly always on the timing, but surely on the trend of asset classes and the economy and, currently, he is bearish on almost ALL asset classes, including gold, [and I agree. Below are my reasons for being bearish in the near term.] Words: 880

2. What is the Best Way to Inflation-Proof Your Portfolio? Here are the Options and Recommendations

With investors concerned about inflation it begs the following questions: “What is the best way to attempt to inflation-proof ones’ portfolios? Buy TIPS? Short Treasury bonds? Stocks? Real Estate? Commodities? Gold? Currencies?…[In this article we review each option and come to a conclusion as to how best to hedge the risk of inflation.] Words: 1672

The U.S. is one of the worst debt ‘offenders’ in the world [and, as such, unless] dramatic spending cuts and tax increases [are undertaken within the next 5 years,] America’s debt/GDP ratio will continue to rise, the Fed will print money to pay for the deficiency, inflation will follow, the dollar will inevitably decline, bonds will be burned to a crisp, and only gold and real assets will thrive. [Here’s why.] Words: 674

4. Dr. Nu Yu’s View of Stock Markets, Gold/Silver, Crude Oil, USD & US Treasury Bond

Last week the gold index broke to the upside from the 12-week trading range between 1550 and 1630. It is a bullish sign for gold. Now gold is going to test the upper boundary of the 12-month Descending Triangle pattern. If prices are able to further break through the upper boundary of the triangle, gold could become intermediate-term bullish.

I believe that in the autumn of 2012 we are going to see…a series of negative events – failing economies, higher unemployment, more QE, and extraordinary levels of social unrest. When QE is announced, I see a temporary rally in stocks but at some point stocks will collapse. I’m not talking about mining stocks, but common stocks outside of the mining sector.

6. Negative Interest Rates Becoming More Prevalent – Here’s Why You Should Be Concerned

The once unthinkable might become policy: negative nominal interest rates. Investors should care as they may be increasingly punished for not taking risks yet masochistic investors believe they may be the prudent ones given the risks lurking in the markets. What are investors to do, and what are the implications for the U.S. dollar and currencies? Words: 779

7. These Bonds Yield 7 – 9%: Are They Worth the Risk?

Buying bonds that insure against the extremely unlikely possibility of a specific catastrophic financial event can prove to be a very profitable investment and an ideal portfolio diversification move. I’m talking about cat bonds. Here is probably the first article you have ever read on the subject. Enjoy! Words: 821

8. Foreigners Beware: U.S. Treasury Maturity Dates are Alarming

While many investors want to believe that U.S. treasuries are a safe haven, I will use this article to debunk that myth with plain hard evidence…[to support my contention that] holding U.S. bonds is the worst investment going forward. Words: 500

Martin Armstrong provides a remarkable explanation of what is going on right now with the U.S. dollar, bond yields and the current price of gold. It would be well worth your time to read and reflect on what he has to say. Words: 822

10. The Lessons Learned from 2008 Will Maximize Returns and Protect Your Assets This Time Round

My 3 favorite barometers for gauging investor sentiment in order to predict market outlook…are SPY as a proxy for U.S. stock markets…GLD as a proxy for commodities and TLT as a proxy for U.S. bonds, and when these 3 markets make big moves, it´s time to pay attention to what they´re saying. [Let’s review] how these 3 markets reacted during the crisis of 2009-2009 and then compare them to current market conditions. [Doing so] can give you an edge to be better positioned for the rest of this year. Words: 972

11. Bonds Are NOT a Safe Place to Be – Here’s Why

For those who think bonds are a safe place to be, you might want to reconsider. In addition to rising sovereign risk (yes, for the U.S. as well as other countries), there is interest rate risk….[should you not] hold it to maturity. If interest rates rise, then the value of your bond falls (Bonds can produce capital gains/losses, just like stocks.) and the possibility of interest rates rising is pretty good. Words: 530

12. With Options So Limited Where Should We Invest?

The fear factor among investors is high with investors unsure just where to put their money. Let’s review the options and come to a conclusion as to where best to invest our cash at this point in time. Words: 402

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money