Once every year gold and stocks form a major yearly cycle low while other commodities form a major cycle bottom every 2 1/2 to 3 years. Occasionally all three of these major cycles hit at the same time….That’s what’s happening right now and it should lead to a powerful rally over the next 2 years, culminating in 2014 when the dollar forms its next 3 year cycle low. Words: 622

commodities form a major cycle bottom every 2 1/2 to 3 years. Occasionally all three of these major cycles hit at the same time….That’s what’s happening right now and it should lead to a powerful rally over the next 2 years, culminating in 2014 when the dollar forms its next 3 year cycle low. Words: 622

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Connor goes on to say, in part:

The CRB Index and US Dollar Index

The implications are that once the CRB has completed this major cycle bottom we should see generally higher prices over the next year and a half to two years, presumably topping during a major currency crisis as the dollar drops into its next three year cycle low in the fall of 2014. [Read:

Gold

I think the recent rally in gold is signaling that gold has put in its yearly cycle bottom. Since gold did not break below the December low of $1523 I think we can assume that this is a B-wave bottom and should be followed by the consolidation phase of a new C-wave that should break out to new highs either later in the fall or next spring. [Read:

- Goldrunner: Fractal Gold Analysis Says Gold On Way to $3,500 Mid-year!

- Leeb: Gold Going to $3,000 Before the End of 2012!

- David Nichols: Expect to See $2,750 – $3,000 Gold By June 2013 – Here’s Why]

The next two years should generate an even more impressive advance than the 2009-2011 rally, possibly even generating the bubble phase of the bull market in late 2014 or early 2015 as the dollar crisis reaches a crescendo. [Connor is not alone in his assessment that the peak will be in that timeframe. Read:

S&P 500 Index

As gold usually leads the stock market by a few days, we should see the stock market put in its yearly cycle low sometime in the next several days but the outlook for stocks is not as bright as the commodity sector. While I do think continued currency debasement will probably drive the stock market to at least marginal new highs I also think an increasing inflationary environment is going to compress profit margins and constrict consumer spending. After a long topping process the stock market and economy will probably roll over and follow the dollar down into that 2014 bottom. [Read:

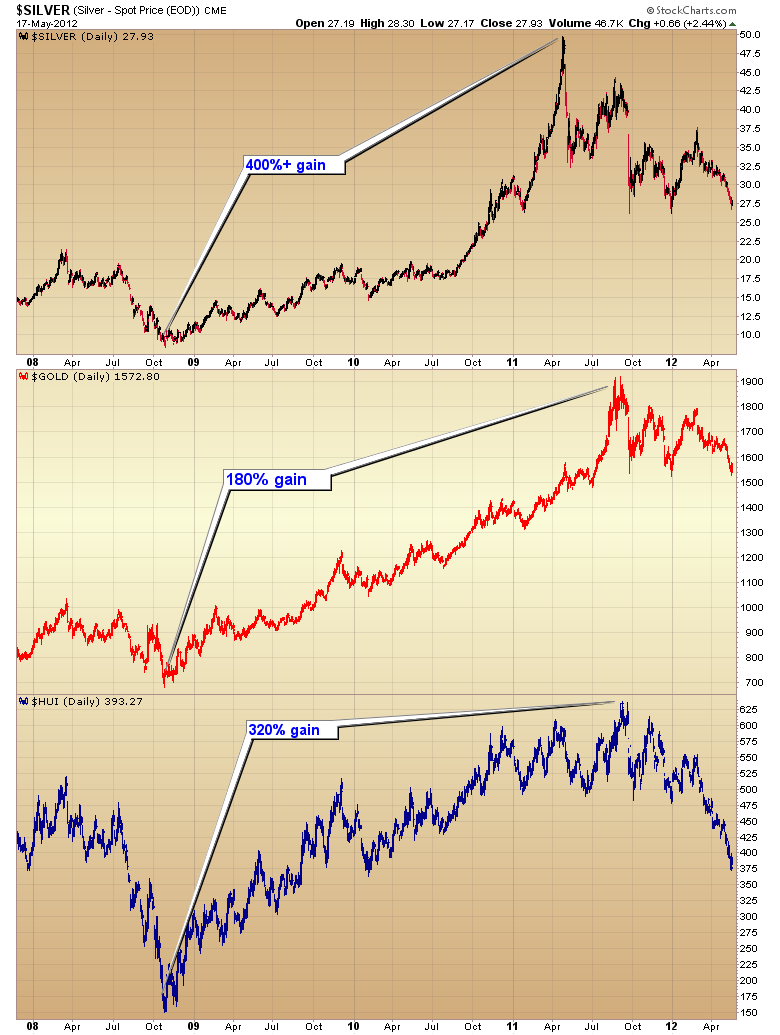

The last C-wave for silver was from 2009 – 2011 with a 400%+ gain at the parabola top in May of last year. [Read:

- GOLDRUNNER FRACTAL ANALYSIS: 2012 SILVER TO $70++

- Alf Field Sees Silver Reaching $158.34 Based on His $4,500 Gold Projection!]

Mining Stocks

Conclusion

I think we are at, or very close to, what is likely to be a once or twice a decade opportunity in the metals sector, especially the mining stocks.

*http://goldscents.blogspot.ca/2012/05/major-long-term-bottoms-forming-in-gold.html (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Update: 51 Analysts Now Maintain that Gold is Going to $5,500 – $6,500/ozt. in 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 51 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

2. Goldrunner: Fractal Gold Analysis Says Gold On Way to $3,500 Mid-year!

Our Fractal Model suggests the wave for Gold in US Dollars will sweep up into the $3500 to $3600 area into the mid-year time-frame. The leading edge of that time-frame begins in May and extends out for a few months. A potential for Gold to spike to a $3900 extended fib level exists. Like all parabolic moves in Gold, the late stages create the biggest price movements. Personally, I would be happy with a huge Gold run up to the $3200 level. Words: 1400

3. Alf Field: Correction in Gold is OVER and on Way to $4,500+!

There is a strong probability that the correction in the price of gold [down to $1,523] has been completed. The up move just starting should be…the longest and strongest portion of the bull market…at least a 200% gain… [to] a price over $4,500. The largest corrections on the way to this target, of which there should be two, should be in the 12% to 14% range. [Let me explain how I came to the above conclusions.] Words: 760

According to a recent Elliott Wave theory analysis gold is about to go parabolic reaching $3,495 in June 2013, $6,233 in April 2014, $10,899 in Sept. 2014, $18,712 in December 2014 and culminating in a parabolic peak price of $31,672 on January 16th, 2015! See the chart below. Words: 600

5. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

6. David Nichols: Expect to See $2,750 – $3,000 Gold By June 2013 – Here’s Why

The interim peaks in gold have been spaced 21 months apart over the past 6 years and have seen gains from 80.2% to 97.3%. As such, given the fact that the low of this last correction came in at $1,524 four months ago, we can expect gold to reach a new peak price of $2,750 to $3,000 in 17 months time (i.e. June/July 2013). [Let me explain in more detail.] Words: 976

7. Leeb: Gold Going to $3,000 Before the End of 2012!

The Fed is [going to] keep interest rates at zero until the end of 2014 [and that] is as aggressive as it gets and as bullish as it gets for gold. Inflation will be let out of the bag, maybe for the next three to four years. In this environment gold and silver are the best investments around…We are really talking about the next leg higher in this bull market…This is the leg I expect to take gold to $3,000 before the end of 2012.

8. Rebound Ratio Suggests New High for Gold By Mid-year

[While] some investors are frustrated,, and a few are worried that gold seems stuck in a rut [such a] stall in price has happened before…[but has] always eventually powered to a new high…[Let’s] examine the size and length of past corrections and how long it took gold to reach new highs afterward. Words: 740The Western world is going to need even more easing, more money. All of this is incredibly bullish for gold longer-term. I do think you have to navigate the end of the euro before the next massive move in gold, but that’s coming. It’s possible that gold may get hit initially as the euro fails, but you have to buy it if it does.

10. GOLDRUNNER FRACTAL ANALYSIS: 2012 SILVER TO $70++

Around this point in the fractal cycle in the late 70’s, Gold busted out of its channel to rise sharply higher, along with Silver. Silver’s channel top will lie up around $68 to $70 over the coming months which we believe will be reached in 2012. The next higher angled resistance bands for Silver run from $112 to $115, and then up at the $123 area. By the end of the Silver Bull, we expect to see Silver reach $500+. Words: 1765

11. James Turk: Silver Will Climb to $68-$70 in 2 to 3 Months

Silver will climb to $68-$70 in 2 to 3 months once resistance at $35 is taken out… In many ways silver is positioned today like it was back in the summer of 2010… Regarding gold, as goes oil, so goes gold…and the bottom line is that the wind is at the back of the bulls in both the gold and oil markets.

12. Alf Field Sees Silver Reaching $158.34 Based on His $4,500 Gold Projection!

This article was prompted by a question enquiring what the silver price might be if my gold forecast of $4,500 proved to be correct [see my article entitled “Alf Field: Correction in Gold is OVER and On Way to $4,500+!” and I have settled on] a target price of $158.34 for silver. [Let me explain how I came to that specific price.] Words: 850

13. Silver Will Go to $50 and Then Explode Dramatically Higher! Here’s Why

There is a massive amount of energy underlying the silver market, and when it is ready to unleash, we will see price/value increases that will stun even the most ardent silverbugs…The real power of this expected move is likely to be released only some time after the price of silver has surpassed the $50/ozt. level. [Let me explain.] Words: 685

14. History Says Silver Could Become the Next 10-Bagger Investment! Here’s Why

If you concur with the 159 analysts (see below) that maintain that physical gold is going to go parabolic in price in the next few years to $3,000, $5,000 or even $10,000 or more then you should seriously consider buying physical silver. Why? Because the historical gold:silver ratio is so way out of wack that silver should appreciate much more than gold as it goes parabolic in the years to come. Indeed, silver could easily reach $100 – $200 per troy ounce, maybe even $300 and conceivably in excess of $400 depending on how high gold goes. The aforementioned may be hard to believe but an analysis below of the historical price relationship between silver and gold suggests that such will most likely occur if gold does, indeed, go parabolic. Take a look. Words: 1423

15. Stephen Leeb: Silver’s Going to $60, $70, by the End of 2012 – Easy!

I think scarcity in oil is a dramatic tailwind for gold. Politicians will inflate. They don’t want oil to bring down the economy like it did in 2008. Remember, this inflation will take place with commodity prices already high. So this will create significant inflation. This means higher gold and silver. Gold at $3,000 by the end of the year, easy. Silver $60, $70, easy.

16. Now’s the Time to Take Advantage of Current Discount on Mining Shares – Here’s Why

Gold stocks are now trading as though peace, prosperity, balanced budgets, and the repudiation of fiat currencies were about to break out across the globe, sending the metal back to $1,000 per ounce in the very near future. Given the stagflation conditions in the developed world, however, and governments’ proclivity to use money printing in order to jump-start an economy, it may be wise to take advantage of the current discount being offered on mining shares.

17. Larry Edelson: “I’m Deeply Worried About the U.S. Dollar” – Here’s Why

The disaster in Europe should be pushing the U.S. dollar up more than it is but it’s not, and that has me deeply worried. [I’m] worried that the next leg of the dollar’s decline may be right around the corner; worried that the loss of the dollar’s reserve-currency status could occur more quickly than even I had expected and worried that the “X&@!” may soon hit the fan, across the entire globe. [Let me explain.] Words: 600

18. Charles Nenner: Dow to Peak in 2012 and Then Decline to 5,000!

Charles Nenner has been accurately predicting movements in the liquid markets for more than 25 years, and his most recent cycle analysis predicts that the current stock market rally is going to last through Q2 and then begin a major descent in 2013 – with the Dow eventually reaching 5,000! Read on to learn how Nenner’s unique system works and what he forecasts for commodities, currencies, bonds, interest rates and more. Words: 400

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money