There are numerous…constructive fundamental, technical, and psychological variables that suggest gold is likely going substantially higher from here [and, as such,] this is likely an extremely good time to accumulate gold, gold miners, and other gold-related assets.

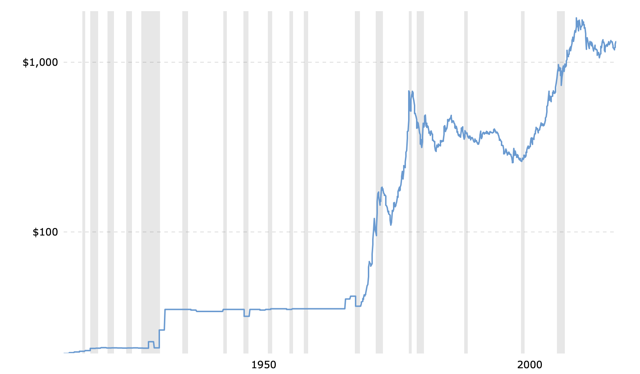

Since the 1970s, gold has been headed in only one direction, and that’s dramatically higher. In fact, gold has surged by about 3,760% since 1970, outpacing the DOW’s 3,190% move, and besting the S&P 500’s 2,980% return in that time frame.

Gold Price

Source: MacroTrends.com

Source: MacroTrends.com

…

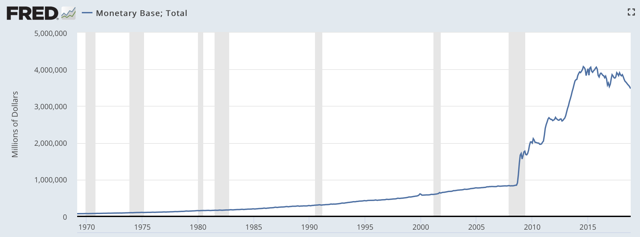

Monetary Base

…The U.S. continues to expand its monetary base, debt, treasury securities, and derivatives at an alarming pace….Just since 2000:

- The U.S.’s monetary base has increased by 451%…

- treasury securities have surged by 883%…

- derivatives have exploded by 605%…

- the U.S. national debt has grown by 293% [and the]

- U.S. GDP has increased by only 127% [while]

- gold has gained a modest 378% essentially in tandem with the U.S.’s monetary base over that time…

Source: stlouisfed.org

Source: stlouisfed.org

[From the above] we see that:

- GDP is not able to keep up with debt accumulation, and debt accumulation has surpassed GDP growth by a shocking margin over the past 20 years. This indicates that the U.S. will need ultra-low rates and further expansion of the monetary supply to dilute and service the enormous mounting debt…

- Since 2000 the monetary base has increased by 451% and gold has appreciated by 378% (and by 4,300% and 3,760% respectively since 1970) so we can clearly see…[that] the more the monetary supply of the world’s reserve currency (dollar) gets diluted the higher gold prices should go.

- the monetary base essentially quintupled in the years following the 2008 financial crisis due to all the QE and zero rate policies [and] now, with QT and higher rates, the monetary base has been contracting (down 16.5% from its peak in 2014) and this has had a somewhat negative effect on gold prices…

- with the Fed’s tightening path now near completion and with a possible recession on the horizon, it is extremely unlikely that the monetary supply will remain constrained for long…Therefore, the money supply will likely stop contracting, and will begin expanding once again relatively soon. This is extremely bullish for gold, and the Fed is already showing signs of capitulation…

- [even though[ the monetary base has shrunk by about 16.5% from its peak in 2014…[it] is still about 300% higher or quadruple what it was in 2008, while gold is only up by about 85% in the same time frame. This implies that gold could have a lot of catching up to do, and it also suggests that many market participants may be behind the curve on the Fed’s likely path going forward.

People often say that gold is a good hedge for fear in the market, a recession, and so on. However, it is not so much that gold is a good hedge against fear or a recession, as it is a great investment in times of monetary expansion. The Fed’s number one tool for dealing with a slowdown or a recession is to inflate the money supply by lowering rates and/or by introducing QE. That is why gold continuously goes higher, as its price has a direct correlation to the number of dollars circulating the planet.

Other Signs Supportive of Higher Gold Prices

Despite the nice 15% appreciation over the last 6 months, there are numerous indicators that suggest gold prices are just getting started here.

- The COT Report

- …Sentiment this bearish amongst speculators had not been observed at any time in the last 10 years. This suggests many market participants had become incredibly bearish on gold and are likely just now starting to recalibrate their positions. This period of unprecedented bearishness also likely marked a substantial low in the market.

- The Gold to Silver Ratio

- The gold-to-silver ratio is currently around 84…[which] is an incredibly elevated figure and implies that the gold market is still close to a rock bottom based on historical standards. Every time this ratio got to a level above 80 over the past 20 years it led to significant rallies in gold…

- Bond Rates

- Bond rates are still relatively low, which is good for gold as bonds represent a competing safe-haven asset class to gold. Low bond rates make gold more attractive, as investors get very little, or even negative real interest for storing their money in bonds. This provides a stronger case to own gold for many market participants who would typically invest money in bonds.

- The U.S. Dollar

- As the Fed ceases its path to higher interest rates the dollar’s rise will likely be stunted, and the buck will very likely begin to lose significant ground once QT is halted, and even more so once rates are brought down once again. Moreover, the dollar could cascade notably lower when future rounds of QE are implemented.

…Once more market participants begin to catch on that the Fed’s likeliest path forward is looser, not tighter, one of the best investment vehicles at this time will be gold, so expect a shift in sentiment to possibly spark extraordinary demand for gold and gold-related assets in future years.

Ultimately gold will likely continue to appreciate throughout 2019, should go substantially higher in 2020, and will very likely break out to new all-time highs over the next several years.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I saw gold miners and stopped reading. There is only one gold and that’s physical gold.