![]() The Federal Reserve is in quite a pickle. Mr. Market expects them to print

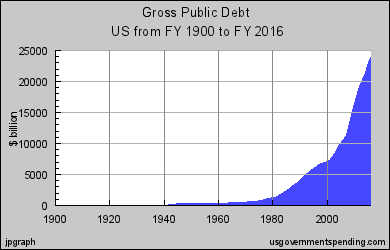

The Federal Reserve is in quite a pickle. Mr. Market expects them to print money to support the economy…but if the economy continues down this path, we may have a deflationary depression on our hands…Fed Chairman Ben Bernanke has said he will not allow this to happen under any circumstances. The Fed wants to keep interest rates low and create inflation so that it can pay off existing debt with cheaper dollars, avoiding insolvency. [The fact of the matter, however, is that] the Federal Reserve cannot stop printing money or the U.S. will experience the economic phenonmenon referred to as the Minsky Moment. [Let me explain just what the aforementioned all means.] Words: 1195

money to support the economy…but if the economy continues down this path, we may have a deflationary depression on our hands…Fed Chairman Ben Bernanke has said he will not allow this to happen under any circumstances. The Fed wants to keep interest rates low and create inflation so that it can pay off existing debt with cheaper dollars, avoiding insolvency. [The fact of the matter, however, is that] the Federal Reserve cannot stop printing money or the U.S. will experience the economic phenonmenon referred to as the Minsky Moment. [Let me explain just what the aforementioned all means.] Words: 1195

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Kientz goes on to say, in part:

What is a Minsky Moment?

A Minsky moment is the economic phenomenon that occurs when over-indebted investors are forced to sell good assets to pay back their loans, causing sharp declines in financial markets and jumps in demand for cash. In any credit cycle or business cycle it is the point when investors begin having cash flow problems due to the spiraling debt incurred in financing speculative investments. At this point no counterparty can be found to bid at the high asking prices previously quoted; consequently, a major sell-off begins leading to a sudden and precipitous collapse in market-clearing asset prices and a sharp drop in market liquidity.

The term was coined by Paul McCulley of PIMCO in 1998, to describe the 1998 Russian financial crisis and was named after economist Hyman Minsky. The Minsky moment comes after a long period of prosperity and increasing values of investments, which has encouraged increasing amounts of speculation using borrowed money. (Source: Wikipedia)

The Fed is in a Predicament

To avoid a deflationary depression, the Fed has more than tripled the money supply since 2008 in an attempt to spur price inflation, but this money is not moving around in the economy and has not bid up the price of goods as much as intended. Banks and corporations are hoarding much of it to bolster their balance sheets and keep liquidity in a contracting environment.

For both banks and corporations whose entire business model is built around perpetual growth, the current economic malaise has forced them to turn money into balance sheet assets to make up for declining economic activity, and thus revenues, in an attempt to remain solvent. Therefore, much of QE1 and QE2 printed money is not going to hit the street anytime soon. Therefore, the Fed has not been able to create all of the inflation that it wanted to pay off existing debts with cheaper dollars.

Take Note: If you like what this site has to offer go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE! An easy “unsubscribe” feature is provided should you decide to cancel at any time.

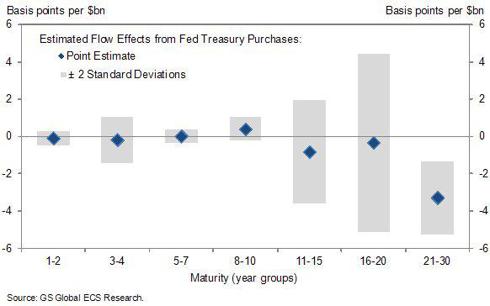

The second pillar in their program was to reduce interest rates on long dated treasuries by using Operation Twist. By doing this, it made rolling over existing debts with cheaper longer term debt more feasible, kicking the can down the road to fiscal insolvency and avoiding short term treasury market collapse. This has worked more or less in the short term, but Operation Twist has had a limited effect.

They recently announced an extension of the Operation Twist program will have a limited effect on the Treasury market and interest rates at their current levels, which are already low, but the Fed had no choice in extending the program….Fed purchases of treasuries have the most effect in lowering interest rates on longer term maturity issuance, and almost no effect on short term debt paper.

Regardless of the size of Fed purchases of treasuries, any stoppage in the flow of money into US debt would result in slowdown and negative growth in the economy.

Goldman Sachs notes that unless the Fed continually prints money, the impact from easing stops and turns almost immediately negative:

- Stock prices will decline, which will induce the treasury markets to experience doubts in the U.S. economy and

- raise interest rates on new paper. Rising interest rates disallows the continual credit expansion created by endless public government spending and thwarts the Fed’s second pillar of creating cheaper and cheaper long term debt issuance for the US Treasury.

- Obamacare and endless wars for oil would cease immediately, and the U.S. government wouldn’t be happy about that.

- Entitlement programs such as food stamps, Medicare, education, and social security would experience funding problems and eventually fail. Then, the American people would experience the real pain of economic contraction that has so far been alleviated by government handouts.

- The economic spiral would spike Treasury rates and

- Eventually the entire US debt system would collapse upon itself.

The Fed…will not announce QE3…until nearer the elections. The reasons for this are as follows:

- The Federal Reserve always supports the sitting President with its monetary policy. It will print to spur the markets when it counts most, and that is right as the election cycle nears the apex.

- The expectation of money printing resulting from a Fed QE announcement will immediately drive up the markets, and the actual money printing will leave an impression 6 months down the road.

- Therefore, expect the QE announcement to occur nearer the end of summer. Operation Twist was needed, therefore, to ‘tide’ the economy over until QE3 was announced.

Are we sure about QE3 at all this year? The answer is yes, for two reasons:

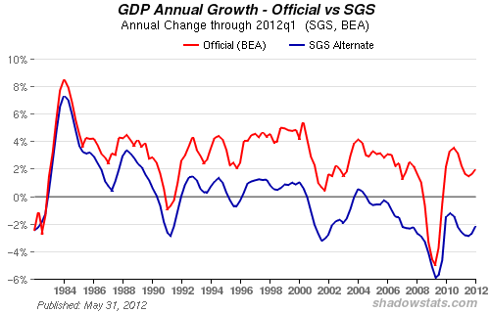

1. GDP is not growing at the rate the government needs it to justify their economic projections, and without growing GDP, companies will not spend their money, and banks will not lend their reserves. The Fed MUST have a growing economy to spur spending of previous QE dollars, and thus generate a more robust inflation rate. The Fed will target a ‘notional’ GDP and will print money until it gets that number.

Image courtesy of Shadowstats.com

2. The problems in ‘Euroland’ are causing a strengthening (relatively) of the U.S. dollar, which will decrease exports and lower GDP further. The Fed wants a weaker dollar to support better exports to stimulate U.S. GDP growth. Therefore, the Fed also MUST print more dollars to weaken it against the Euro and other currencies, making U.S. goods more attractive because the previous QE was not enough in the wake of current European fiscal and currency problems.

The theoretical bottoming of the EUR/USD that the Fed will allow is 1.21 level, or the 50% Fibonacci retracement. That could occur, at current movement rates, sometime around the U.S. election cycle.

Everything is lining up for a fall QE announcement. Stay tuned!

* http://seekingalpha.com/article/704881-minsky-moment-for-the-u-s-perpetual-dollar-printing-is-inevitable (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Article:

1. John Mauldin: The Debt Supercycle Will End in the Next 2-3 Years – and It’s Deflationary

We’re coming to the end of government’s ability to borrow money to fund current spending that’s beyond the growth of their economy….and I actually find that massively bullish because that government funding misallocates capital. It’s going to end in the next 2 or 3 years, Europe first, then Japan, then the US….

2. Jim Sinclair: ‘The End Is Not Near, It Is Here and Now’

Jim Sinclair is now warning… that ‘The end is not near, it is here and now’ in reference to the global financial system…[and] reiterating his long held view that there will be “QE to infinity” despite the denials of Bernanke and other central bankers. [He also has some interesting things to say about gold and alarming things to say about the euro. Read on.] Words: 305

3. U.S. “Deficit Disorder” Means Broken Promises + Even More QE! Here’s Why

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money