…Gold miners are likely in the early stages of a prolonged bull market cycle that will likely enable GDX to go substantially higher over the next several years. [Here’s why.]

About GDX

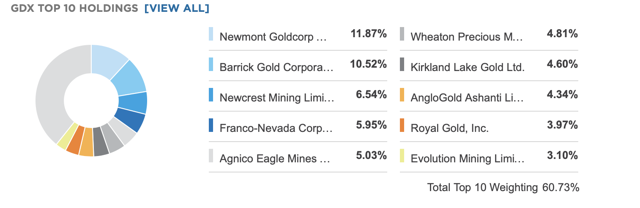

GDX aims to imitate the price and yield performance of the NYSE Arca Gold Miners Index which is intended to track the overall performance of companies involved in the gold mining industry. The ETF has total net assets of roughly $10.5 billion, and has 44 holdings…

Here is a snapshot of GDX’s top ten holdings that account for over 60% of the ETF’s weight.

Image Source

Image Source

Why Prices Will Go Higher

- Gold and silver prices should continue to appreciate as the Fed embarks on its latest easing cycle.

- As gold and silver increase in value, so should the companies responsible for deriving these underlying assets.

- Gold miners are likely to become increasingly profitable as many miners’ all in sustaining costs (AISC) are between $765 and $850 [vs. its current price of approx. $1,400ozt and is]…

- Gold is probably headed higher from here [so] this…should enable gold miners to produce substantially higher profits than previously anticipated.

- Additionally, consensus analysts’ revenues and EPS estimates for this year and for 2020 are likely very light, as they are based on lower gold prices (likely $1,200-1,350) and, thus, gold miners have a high probability to surprise much higher earnings wise.

- Higher-than-expected revenues, and EPS should enable multiples to expand, drive demand for gold, gold stocks and should contribute to higher GDX and gold miner prices in general…

- The Fed is on a path towards another easing cycle which is extremely bullish for gold, GDX and gold-related stocks in general, many of which are incorporated into GDX.

- We can also expect to see a lower dollar and lower interest rates, both very bullish factors for gold.

- A lower buck makes gold cheaper in other currencies, and lower rates take the incentive out of owning long-term bonds.

- The gold to silver ratio is above 92 now, its highest level in several decades…

- Every time this ratio has come close to current levels we’ve seen major rallies in gold, silver, GDX, and gold miners in general.

- We see gold appreciating more rapidly than silver in recent months and years [and] this is typical for an opening stage in a gold/silver bull market.

- Usually, gold outperforms in the initial stages, and silver normally begins to outperform gold in the mid-to-late stages of a bull cycle…

- Now that gold is clearly above $1,400 there is not much technical resistance until $1,500 and higher.

- The bullish technical setup coupled with the Fed’s easing cycle should enable gold prices to go much higher during this bull market cycle.

- This phenomenon should reflect extremely positively on GDX and gold mining shares in general.

- With gold above $1,400, $1,500, or possibly higher in future years, revenues, profit margins, and net income in gold miners should increase substantially.

- This should provide the necessary catalyst for significantly higher stock prices.

- The market is likely behind on gold miners and their profitability potential due to higher gold prices.

- As such, the probability is for gold to remain elevated and possibly move substantially higher from here.

Bottom Line

I remain very bullish on this sector, and the recent rally is likely just the beginning of a multi-year move higher in the gold mining space. I plan to increase GDX and gold miner-related holdings at the start of Q3, as I see a great deal of upside going forward in this sector.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money