Martin Armstrong provides a remarkable explanation of what is going on right now with the U.S. dollar, bond yields and the current price of gold. It would be well worth your time to read and reflect on what he has to say.

with the U.S. dollar, bond yields and the current price of gold. It would be well worth your time to read and reflect on what he has to say.

So says Martin Armstrong (www.armstrongeconomics.com) in excerpts (822 words) of his most salient comments from his original extended article* of 2,078 words entitled Manipulating the World Economy Or Just Understanding How It Really Functions?, going on to say, in part:

The Flight-to-Quality is NOT Over – Yet!

Below is a monthly chart of the US 30-year Treasury bond and the pattern is very clear. The flight-to-quality is not yet over.

Gold is NOT Ready for Prime Time – Yet!

I have been warning gold was not ready yet for prime-time. Here we are on the edge of Europe being torn apart at the seams, socialists taking control of the battlements, inflation appearing likely, yet gold retreats. [Why? Because] Phase ONE of a Sovereign Debt Crisis is international capital flight-to-quality from one currency to the next.

The U.S. Dollar Rises Initially in a Sovereign Debt Crisis Then…

I have warned that the USA would be the last to go – not the first -….because it is the core economy being both the largest as well as the reserve currency. I have warned that this will not collapse into dust all at the same time. Each link will break one at a time cascading like dominoes. This is not my ‘opinion’ – it is ‘history’.

Note that during the chaotic period of the Sovereign Debt Crisis in 1931:

- the dollar rose to record highs as Europe crumbled into dust. This is the stage we must go through first and this is why the chart I began with is the US 30-year Treasury bonds showing that they are breaking out to the upside for the final rally as Europe stumbles to its knees.

- Only after they are done with everyone else will capital turn and look at the USA. When that second phase began in 1931, we see [in the chart below how] the dollar then crashed and burned….

Capital Attraction and the Flight-to-Quality

Capital Attraction and the Flight-to-Quality

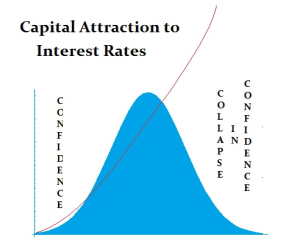

What the U.S. and German authorities fail to understand is we are dealing with a bell curve and not a linear progression. There has to be balance between austerity and stimulation. It is like heat and cold. Both extremes will kill you. We survive in the middle.

It is true that rising interest rates can attract capital. However, when capital flees, interest rates continue to rise due to the shortage of capital…[and it] goes to government debt because it is liquid and can absorb vast amounts.

The flight-to-quality is at the core of capital flow for it represents the first criteria in how capital moves between Public and Private assets [as clearly illustrated in the chart below].

The flight-to-quality… is unleashed whenever confidence in the private assets collapses. Investors panic, sell private assets, and rush to government bonds driving interest rates down sharply. During the 2007-2009 crises, interest rates in the USA virtually went to zero. In other words, people were willing to accept no interest just to park their cash in a safe place they saw as government assets when they feared even banks would not survive….

During a generational Private Wave, investment and speculation become common place. During a Public Wave, private assets are looked upon as risky and the safer bet is to invest and trust government.

Gold and the Fight-to-Quality

The nationalization of gold in April, 1933 became necessary because the wave that peaked in 1929 was a Private Wave and government was trying to seize power [and needed] to end the flight-to-quality. People were hoarding gold coin and certificates outside of banks because they did not trust the banks and they did not trust government bonds when so many government bonds had gone into default in 1931.

The official reasoning behind the nationalization of gold, however, was grounded in the collapse of confidence in both Public and Private assets creating hard times that had caused people to hoard gold. This trend further shrunk the available money supply reducing the velocity of money circulation decreasing economic growth….

Conclusion

Understanding what we are facing right now is critical to our survival. We must understand that forecasting a single market in isolation is asking for disaster. To comprehend the true global implication of how capital moves, we must embrace a global correlation approach…

*http://armstrongeconomics.com/693-2/2012-2/manipulating-the-world-economy-or-just-understanding-how-it-really-functions/ (To access the above article please copy the URL and paste it into your browser.)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money