Investors of all stripes must now be aware both of the bull market in gold/silver and the bear market in the U.S. dollar. Despite all of the rhetoric, however, it seems that little is actually understood about how these two phenomena are actually connected. Ultimately, this connection (or lack thereof) has serious implications for both markets. [Let’s examine the situation more closely.] Words: 778

So says Adam Kritzer (www.forexblog.org) in an article* which Lorimer Wilson, editor of www.munKNEE.com, has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Kritzer goes on to say:

Many gold investors insist they are buying gold as a proxy for shorting the dollar. Commentary on gold prices is full of apocalyptic warnings about the current financial system and criticism of fiat currencies, which are backed by nothing except good faith. They argue that buying gold is the best (or even the only) hedge against the eventual collapse of the dollar. Unfortunately, I don’t think this argument holds up to close scrutiny [for several reasons].

- gold and silver (I am including silver in this analysis not because of any deep relationship to gold, but only because of the association ascribed by other commentators and an observable market correlation) prices have risen much faster over the last year (and decade, for that matter) than even the strongest currencies. Furthermore, gold is rising faster than the dollar is falling. In terms of the Swiss franc — which is to forex markets as gold is to commodities markets — gold has risen more than 17% since the start of 2010.

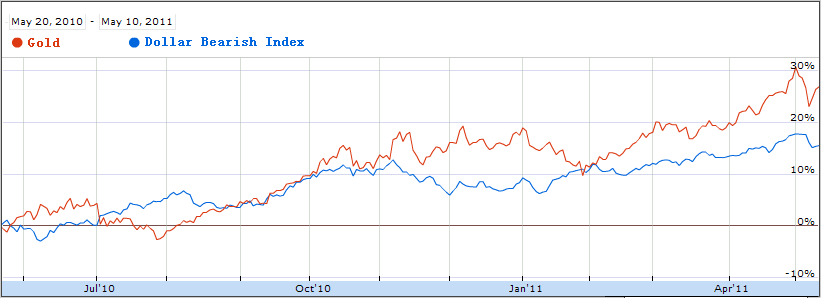

- the putative correlation between gold and forex markets asserts itself sparingly (as you can see from the chart below, which plots gold against an index that shows dollar bearishness), and in difficult-to-understand ways. For example, gold stalled during the financial crisis while the price of silver suffered a veritable collapse. Does it make sense that when financial anxiety was highest, interest in gold and silver ebbed? The recent rally in the dollar followed the recent correction in gold and silver — not the other way around. If anything, this shows that gold investors are taking their cues from the broader commodity markets and not from forex markets.

- the macroeconomic case for gold is flimsy. While I don’t think it’s fair to attack gold on political grounds, I still think it’s reasonable to try to ascertain what forces are supposedly being hedged against. If it is inflation that gold buyers are worried about, why aren’t all investors equally concerned? Based on futures markets — whose credibility is just as solid as gold markets — inflation expectations are around 2-4% across the G7. If instead it is sovereign debt default that gold investors are concerned about, again, I have to ask why other markets don’t share their concerns. Credit default swap rates are higher for Japanese and European debt than for US Treasury securities, but the yen and euro remain positively buoyant against the dollar. Again, how do gold investors explain this contradiction? To me, it seems obvious that gold and silver are rising for reasons that have very little to do with fundamentals. Monetary expansion has driven a wave of money into financial markets, and a significant portion of this has no doubt found its way into gold, silver, and other metals. In fact, it seems that last week’s correction was driven partly by higher margin requirements for speculators.

- Finally, their cause is being helped by low interest rates, since the opportunity cost of holding gold (which doesn’t pay interest) in lieu of dollars (which does) is currently close to zero. When interest rates rise, it will certainly be interesting to see if there is any impact on gold.

Conclusion

I [may] not have a strong understanding of gold and silver markets – for all I know, their rise is genuinely rooted in supply/demand, as it should be – but my only wish is that investors will stop pretending that it has anything to do with the dollar.

*http://www.forexblog.org/2011/05/what-the-forex-markets-tell-us-about-gold-silver.html

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS Feed or our FREE Weekly Newsletter.

Gold

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money