What is developing in the markets is not the beginning of another leg down in gold, but a second chance to get positioned for what should be a very profitable intermediate degree rally over the next 2-3 months. [Let me explain further with a number of charts to support my position.] Words: 469

gold, but a second chance to get positioned for what should be a very profitable intermediate degree rally over the next 2-3 months. [Let me explain further with a number of charts to support my position.] Words: 469

So says Toby Connor (http://goldscents.blogspot.ca) in edited excerpts from his original article* entitled BIG MOVES COMING IN DECEMBER, JANUARY & FEBRUARY.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.

Connor goes on to say, in part:

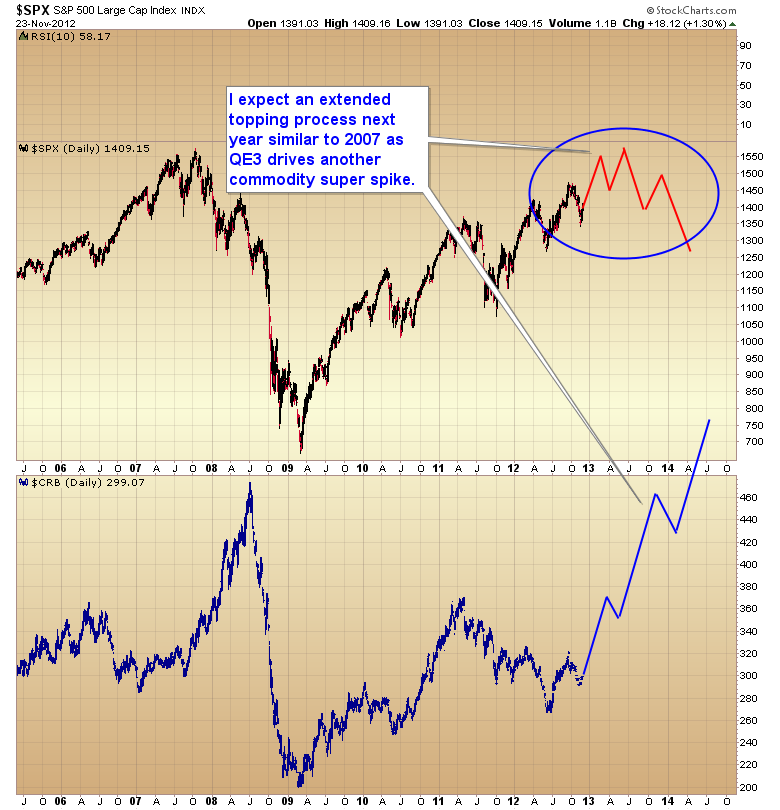

[While] I think the market will easily make new highs in the next two or three months, possibly even significant new highs… as QE3 starts to work its magic, I believe stocks and gold are now due for a short-term breather…[due to] the daily dollar cycle.Who in the world is currently reading this article along with you? Click here

[As of last] Friday the USD index was in the 24th day in the current daily cycle…[which] generally runs about 18-28 days trough to trough. At 24 days the cycle is well into the timing band for a bottom and bounce…[which] should force stocks into a short-term correction, or sideways consolidation, and gold into its next daily cycle low.However don’t be fooled by any short-term corrective move as stocks and gold have all clearly formed major intermediate bottoms. There are always corrective moves along the way, nothing goes straight up, but intermediate cycles don’t usually form a final top until sometime around week 12-15. As last week was only week 2 of a new intermediate cycle, we probably don’t need to look for a final top until sometime in February, or early March.

Coincidentally, that is when the dollar is due to form its yearly cycle low. A yearly cycle bottom is the most severe cyclical decline other than a three year cycle low (the next one of those isn’t due until mid-2014). I think we can safely assume that QE3 is going to complete the head and shoulders topping pattern for this particular three year cycle.

My Expectations

- The dollar should now head generally lower over the next year and a half with brief bear market rallies similar to what we just experienced.

- All asset prices higher should go higher into mid-2013 driven by an inflationary phase.

- Stocks will then begin to stagnate and begin an extended topping process as inflation starts to take its toll on the economy.

- Commodities should go into a super spike in mid-2014 (this is when I expect gold to reach its next C-wave top at roughly $4000).

I think we will experience the same phenomenon this time as QE3 eventually generates the same unexpected consequences and spikes commodity inflation.

Conclusion

Understand that what is developing is not the beginning of another leg down, but a second chance to get positioned for what should be a very profitable intermediate degree rally over the next 2-3 months.

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- It’s FREE

- It contains the “best of the best” financial, economic and investment articles to be found on the internet

- It’s presented in an “edited excerpts” format to provide brevity & clarity of content to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you and bring them to you each day!

- Sign up HERE and begin receiving your newsletter starting tomorrow

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Goldrunner: HUI Index Could Go As High As 1000 in 2013! Here’s Why

The prospects look great for Gold and Silver to move sharply higher into 2013 to mimic the moves made in the 2005/ 2006 period and especially in 1979. In both cases back then the PM Stock Indices made big runs along with Gold and Silver. As such, the current HUI looks good for a major bottom to now be in place and to mimic the PM Stock Surrogate chart from the late 70’s. This would see the HUI go as high as the 1000 area in 2013. Let me explain further. Words: 640

Our subscription service provides detailed technical analysis of where the price of gold, silver and precious metal stocks are going short term (in the next week or two), intermediate term (within the next 3-6 months) and long term (the ultimate top) in each stage of their respective bull runs. This service comes with detailed charting based on conventional technical analysis and our proprietary fractal analysis based on the ’70s. Below are some of our latest comments and rationale for expected price movements in gold without illustative charts which are only available to subscribers. Words: 1000

3. What, Me Worry? Not When You Look at These Monthly Gold & Silver Charts

We’ve been surprised at the recent action in the precious metals complex. During the recent correction the shares were showing quite a bit more strength than the metals. Then the shares took a dive below support yet the metals maintained their recent lows! How do we interpret this wild volatility in the relationship between the shares and the metals? Quite often we look at daily and weekly charts. Now is the time to take a look at the monthly charts which can help us get a better read on the larger trends at hand. Words: 636

4. U.S. Dollar Index to Plunge; Gold & Silver to Soar! Here’s Why

With President Obama being re-elected we can expect four more years of a Washington-centric controlled economy with a rolling program of borrow, print, spend and pretend; similar to the last four years….[What affect will such fiscal irresponsibility have on the U.S. dollar, gold and silver? Read on!] Words: 717

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money