100 days of facts! One new straight-up fact every day until the election from FaceTheFactsUSA.org to help Americans debunk myths, hold better conversations, get involved, and make choices as smarter citizens. Here is Fact #2 with supporting substantiation.

FaceTheFactsUSA.org to help Americans debunk myths, hold better conversations, get involved, and make choices as smarter citizens. Here is Fact #2 with supporting substantiation.

The following, by www.FaceTheFactsUSA.org, is brought to you courtesy of Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!). This paragraph must be included in any article re-posting to avoid copyright infringement.

Fact 2* Released: July 31, 2012 – Taxes (see Fact #1 here)

Stifling innovation – or paying a fair share?

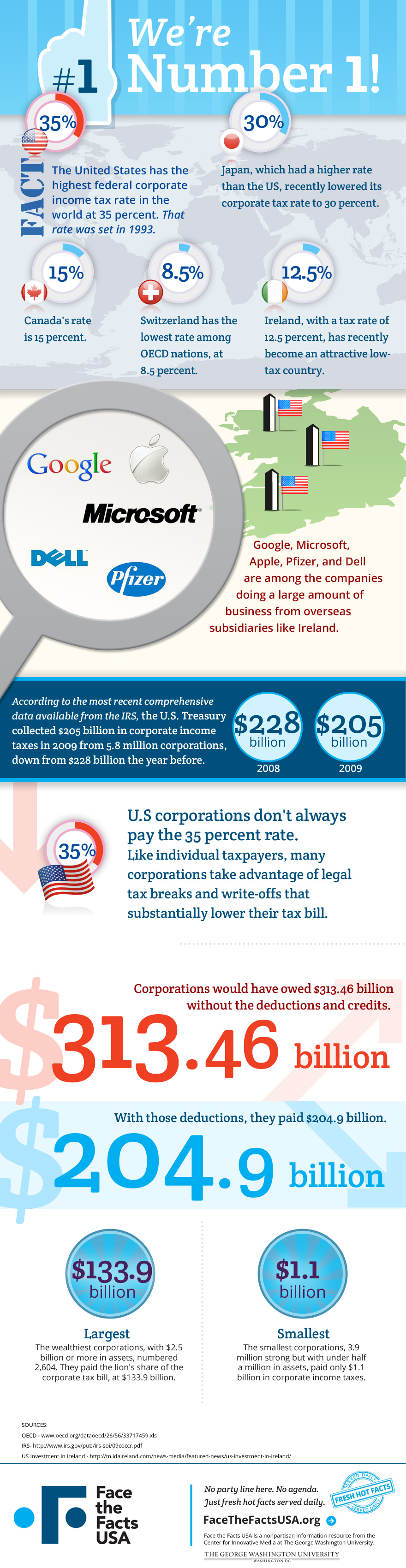

The United States has the world’s highest corporate income tax rate at up to 35%. Japan recently lowered its corporate tax rate to 30%, and some U.S. companies are moving operations to countries with lower rates such as Ireland, where the corporate tax rate is 12.5%. After various tax deductions and credits, the U.S. collected $205 billion in corporate income tax in 2009 from 5.8 million corporations, down from $228 billion the year before.

How do we know?

What do others say?

Here are stories and opinion relating to this fact. We didn’t base the fact on any of them; we simply find them interesting. Some argue a point of view. That’s them talking, not us….

- Third Way: “The case for corporate tax reform”

- Mercatus Center at George Mason University: “Why the US needs to restructure the corporate income tax”

- Virginia Law Review: “Corporations, Society, and the State: A Defense of the Corporate Tax”

- Tax Foundation: “The countdown is over; we’re No. 1”

- Huffington Post: “Apple, Google Amazon pay corporate income tax well below official rate”

- Christian Science Monitor: “US corporate tax rates must come down”

- Heritage Foundation: “Corporate tax reform should focus on rate reduction”

- New York Times: “How Apple sidesteps billions in taxes”

- Newsmax: “Corporate taxes crushing the economy”

- 60 Minutes video: “A look at the world’s new corporate tax havens”

*http://www.facethefactsusa.org/facts/ask-for-the-corporate-rate-or-not/

HAVE YOU SIGNED UP YET?

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com.

It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time.

SAVE TIME searching for today’s best articles. They are all here!

All articles are also available on TWITTER and FACEBOOK

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money