If you don’t know much about investing, you may feel overwhelmed or bewildered by the choices…Enter annuities. The best of them are easy to understand, even by financial novices: “Give us your money, and we’ll give you this much money per month until you die.” That sounds simple – but simpler isn’t always better [so let’s review] whether they’re needed in a retirement plan or not.

…Annuities aren’t all alike, so let’s start with some definitions:

- Variable annuities:…Don’t mess with variable annuities. They’re too complicated, too expensive, and mainly a solution in search of a problem.

- Fixed immediate annuities are basically what they sound like. You usually make a single premium payment, and then the income starts monthly for the rest of your life. It may also pay out for the rest of your spouse’s life too, depending on its terms. If you want it simple, it doesn’t get much simpler. The certainty of knowing what you’ll be receiving each month should provide peace of mind.

- Deferred income annuities are very similar, but don’t start paying out for a while (that’s the deferred part). Because the issuer has time to invest your money before starting to pay you, your premium should be relatively small.

If an investor wants a guaranteed payout for a surviving spouse, or even if he or she wants to just invest a portion of their wealth into an annuity, we’d grudgingly say “OK.”…Our view, though, has long been that most people can handle income generation in retirement themselves, with the help of dividend-paying stocks such as Johnson & Johnson (JNJ), Exxon (XOM), and Procter & Gamble (PG).

Know What You’re Paying For

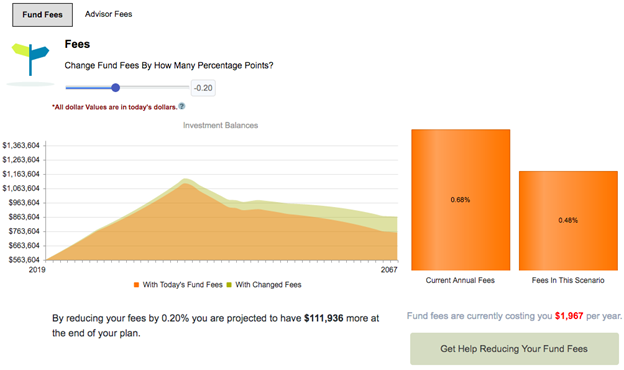

…A big part of a successful investment plan is to know what your investments cost. Fees and expenses can have a surprisingly large effect on total returns over time. That’s not just for annuities–that’s for everything. It’s easier to understand the effects when they’re presented graphically. In this example, which we ran through WealthTrace, dropping fees by just 20 basis points (that’s 0.20%) leads to an extra $112,000 at the end of the retirement plan.

…What’s needed to make a retirement plan successful remains the same. Investing is risk taking but people’s comfort with taking risks varies.

…What’s needed to make a retirement plan successful remains the same. Investing is risk taking but people’s comfort with taking risks varies.

- If an annuity ends up in a risk-averse investor’s arsenal – using money they might have otherwise just foolishly stashed away in a bank account – that’s OK, but

- if you’re relatively early in your investing years, and quite a ways from retirement, it’s probably going to be better to take bigger risks–and get higher returns–with the bulk of those assets [in something other than an annuity].

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money