The U.S. already has more government debt per capita than the PIIGS (Portugal, Italy, Ireland, Greece and Spain) do and it just keeps getting worse and worse thanks to both political parties. We are on the road to national financial oblivion yet most Americans don’t seem to care. They don’t realize that we have enjoyed the greatest prosperity we will ever see…and that when the debt bubble bursts there is going to be an immense amount of pain. That is a very painful truth, but it is better to come to grips with it now than be blindsided by it later. [Let me explain.] Words: 1130

Italy, Ireland, Greece and Spain) do and it just keeps getting worse and worse thanks to both political parties. We are on the road to national financial oblivion yet most Americans don’t seem to care. They don’t realize that we have enjoyed the greatest prosperity we will ever see…and that when the debt bubble bursts there is going to be an immense amount of pain. That is a very painful truth, but it is better to come to grips with it now than be blindsided by it later. [Let me explain.] Words: 1130

So says Michael Snyder (http://theeconomiccollapseblog.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Synder goes on to say, in part:

All debt bubbles eventually burst and, right now, we are living in the greatest debt bubble inthe history of the world. Over the past 30 years, household debt, corporate debt and government debt have all grown much faster than our GDP has – but no nation on earth has ever been able to expand debt much faster than national output indefinitely. The clock is ticking on this debt bubble and when it collapses we will say “bye bye” to our vastly inflated standard of living and we will discover that we have destroyed the economy for all future generations of Americans.

It is amazing that the United States has been able to pile up as much debt as it has. Over the years, many authors have predicted that U.S. government finances would collapse long before the U.S. national debt ever got to this level so the mountain of debt that we have accumulated is quite an “achievement” if you want to look at it that way. [Let’s take a look at all aspects of it.]

Take Note: If you like what this site has to offer go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE! An easy “unsubscribe” feature is provided should you decide to cancel at any time.

1. Household Debt

Sometimes a picture is worth a thousand words. When most Americans think of the “debt problem” in this country, they think of the debt of the federal government but that is not the only debt bubble that we are facing.

Thirty years ago, household debt in the United States was approaching the 2 trillion dollar mark. Today, it is sitting at about 13 trillion dollars [as shown in the graph below].

- We pay for our homes with debt, and mortgage debt as a percentage of GDP has more than tripled since 1955.

- We pay for our cars with debt, and at this point about 70 percent of all auto purchases in the United States involve an auto loan.

- We pay for higher education with debt, and the total amount of student loan debt in America recently surpassed the one trillion dollar mark.

- Wherever we go we pay with plastic.

Amazingly, consumer debt in America has risen by a whopping 1700% since 1971 and, if you can believe it, 46% of all Americans carry a credit card balance from month to month. We are absolutely addicted to debt and we do not know how to stop.

2. State And Local Government Debt

Our state and local governments are also addicted to debt. 30 years ago, state and local government debt was approaching the 400 million dollar mark. Today, state and local government debt is hovering around the 3 trillion dollar mark [as illustrated in the graph below].

In the United States today, we don’t just have one “government debt problem” – the truth is that we have hundreds of them. All over the country, state and local governments are facing bankruptcy because of too much debt. The city of Stockton, California, for example, is right on the verge of declaring bankruptcy.

3. Federal Government Debt

Of course the biggest offender of all is the federal government. 30 years ago, Ronald Reagan was running around proclaiming what a nightmare it was that the U.S. national debt was reaching the one trillion dollar mark. Well, [as the graph below shows,] we are about to blast through the 16 trillion dollar mark with no end in sight.

Running up debt at a much faster rate than our GDP is rising is a recipe for national financial suicide. Our politicians continue to steal about 150 million dollars an hour from future generations and everybody just acts like this is perfectly normal.

Debt From Sea To Shining Sea

Now let’s add up all the debt in the country. When you total up all household debt, business debt and government debt, it comes to more than 300% of our GDP [as shown in the graph below]. In fact, if current trends continue we will hit 400% of GDP before too long.

As you can see from the chart, there was a little “hiccup” during the last recession, but now the debt bubble is growing again. The question is: “How high can it go before the entire system collapses?”

Total credit market debt owed is roughly 10 times larger than it was about 30 years ago….and if we do that again in the next 30 years, our total debt will be more than 500 trillion dollars in the 2040s. Unfortunately, that’s the way that debt spirals work. They either have to keep expanding or they collapse – so will the U.S. debt spiral continue to expand or will we soon see a collapse?

It’s a Worldwide Event!

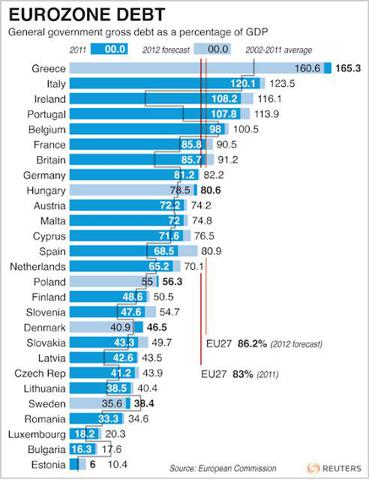

Sadly, this exact same thing is happening all over the world. The government debt-to-GDP ratio in Japan (the third largest economy in the world) blew past the 200% mark quite a while ago, and almost every country in the EU is absolutely drowning in debt [as can be seen in the table below added by the editor of munKNEE.com].

The world has never faced anything quite like this. There is way, way too much debt in the world, but the only way we can continue to enjoy this level of prosperity under the current system is to pile up a lot more debt.

The western world is like a debt addict in a deep state of denial. Some debt addicts end up with dozens of credit card accounts. They will keep opening more accounts as long as someone will let them. Most debt addicts actually believe that they will be able to get out of the hole at some point, but most never do.

The American Reality (Check)

Most Americans still believe that:

- we are experiencing “temporary” economic problems that will eventually go away and that

- even greater prosperity is still ahead.

Sadly, what the mainstream media and the two major political parties are telling them is a bunch of lies. We have enjoyed the greatest prosperity that we will ever see in the United States, and when the debt bubble bursts there is going to be an immense amount of pain. That is a very painful truth, but it is better to come to grips with it now than be blindsided by it later.

*http://theeconomiccollapseblog.com/archives/too-much-debt-our-biggest-economic-problem (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Eventual Rise in Interest Rates Will Be Downfall of U.S. – Here’s Why

Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign. The question is: when is sooner or later? The purpose of this article is to examine that question. Words: 2600

2. Oh My GAWD! This Infographic on US Debt Is Frightening

LOOK! Everyone needs to see this. United States owes a lot of money. As of 2012, US debt is larger than the size of the economy. The debt ceiling is currently set at $16.394 Trillion, estimated to be hit around Sep 14, 2012. In the infographic below that enormous amount is illustrated in $100 bills. It’s frightening! Words: 605

The derivative market has blown a galactic bubble…and since there is literally no economist in the world who knows exactly how the derivative money flows or how the system works,…we really don’t know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times. [If, and when, it happens it] will be catastrophic for the world financial system. If you ever wanted a tool to help yourself or others visualize the staggering magnitude of US debt and derivatives, the infographic below is a good one to share. It visualizes who those 9 too-big-fail banks are, what their derivative exposures are, and what scandals they’ve been lately involved in. Words: 1915

4. John Mauldin: The Debt Supercycle Will End in the Next 2-3 Years – and It’s Deflationary

We’re coming to the end of government’s ability to borrow money to fund current spending that’s beyond the growth of their economy….and I actually find that massively bullish because that government funding misallocates capital. It’s going to end in the next 2 or 3 years, Europe first, then Japan, then the US….

5. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

6. Jim Sinclair: ‘The End Is Not Near, It Is Here and Now’

Jim Sinclair is now warning… that ‘The end is not near, it is here and now’ in reference to the global financial system…[and] reiterating his long held view that there will be “QE to infinity” despite the denials of Bernanke and other central bankers. [He also has some interesting things to say about gold and alarming things to say about the euro. Read on.] Words: 305

7. Fitzwilson: Governments/Economies/Societies Converging On a Common Dead End of Historic Proportions

“The financial markets continue to show extreme volatility as the various institutions and governments deal with the end of their respective roads….Governments, economies and societies are converging on a common dead end, and it is a dead end of historic proportions….There will come a moment when this dysfunctional system can be sustained no longer. It is not inevitable. There is still time for rational behavior and solutions, but that time is short.”

8. Embry: Global Financial Crisis II is Coming – and It Will Be Even Worse! Here’s Why

“Either you take the debt clean-out right away, and that means a very hard deflationary depression, or you do what I suspect they will try to do and that is keep pumping money into the system to keep the whole banking (system), derivatives and economies afloat [and] that will lead to some sort of monetary distress that could end in hyperinflation. I think that’s the worst outcome, but there is no good outcome.”

9. Government Can’t Prevent the Next Financial Diaster – Here’s Why

Even as I write these words, the world’s largest economy — the E.U. — is coming unglued at the seams, the world’s second largest — the U.S. — is careening headlong toward a fiscal cliff that promises to gut its GDP, nearly all of Asia — including Japan, China and India — is slowing…and yet most investors still don’t get the message. [Let me go on to explain just what that message is.] Words: 1357

10. Martin Weiss: You Are Being Forewarned – Again – About an Imminent Financial Megashock!

[You are being forwarned – again – that Europe and the U.S. are now on a collision course with a second Lehman-type megashock….A snowball of events – bank runs spreading across Europe – are bringing us a few steps closer. What [can we expect] next? Let me explain. Words: 179511. The Zombification of the Financial System: Debt is NOT a Free Lunch, Debt is NOT Wealth!

Why are both debtors and creditors willing to build a status quo of massive unprecedented debt? [After all, the delusions of] creditors that debt is wealth and should never be liquidated, and of debtors that debt is an easy or free lunch have been smashed by the juggernaut of history many times before…[and] I think they will soon be smashed again. [Let me explain.] Words: 1150

12. U.S Likely to Hit the Financial Wall by 2017! Here’s Why

The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money