This quarter’s mid-period has a negative focus [and we are] now seeing the result – a growing belief that the stock market run is over. [If that is, indeed, the case then it is most important to know exactly how to take advantage of the buying opportunities that are about to come about. Here’s what you need to know to do just that.] Words: 925

So says John Tobey (www.investmentdirections.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com , has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Tobey goes on to say:

How Buying Opportunities Come About:

In slumping periods like now, a slide back to a nearby support level occurs. This support level can be any, or all, of the following:

- A price that has acted as a floor: The clear picture gives investors confidence in the price barrier.

- A price that represents a percent decline (e.g., 10%) from the latest high price…

- A moving average price: A popularly followed average – e.g., 100 days – often acts as a barrier.

In a typical market the nearby barrier holds but, occasionally, the price falls below it and this action triggers two competing forces:

- Selling by those who believe the breakdown means further price drops and

- Buying by bargain hunters.

It’s this occasional breakdown that could provide us an opportunity.

How Indices Show the Developing Situation:

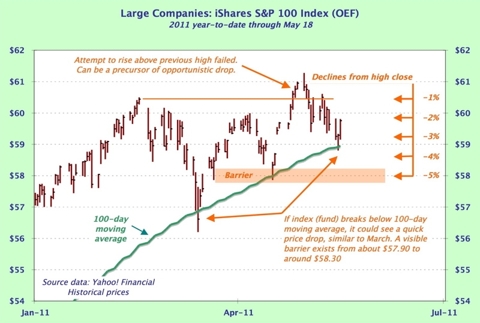

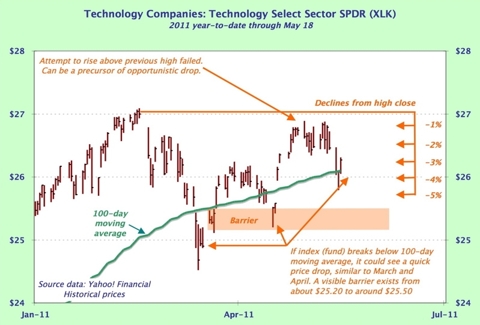

Below are two views of market action using the index ETFs for a) Major U.S. companies: iShares S&P 100 Index (OEF) and b)Technology companies: Technology Select Sector SPDR (XLK)

Importantly, most stock indices have similar pictures currently. Therefore, many (most?) stocks could offer buying opportunities if the short-term drop occurs.

How to Take Advantage if Opportunity Arises:

[Current] valuations are attractive and outlooks are positive [and, in addition,] we are coming into the summer season when economic activity can increase – meaning there is the possibility of positive economic, financial and corporate developments – and a breakdown at this stage can generate heavy buying quickly. [As such,], we must be prepared to act quickly [and] a good way… to [do so] is to:1. Place “limit buy orders” at pre-determined prices making the orders GTC (good-till-canceled) to ensure the order is in place – and to prevent a weakening of will power. Brokers often refer to GTC orders as “good-till-close” because they see many investors cancel their orders because of the bad news and commentaries that accompany price drops. However, we need that anxious activity in order to get those desirable prices.

2. mark your orders DNR (do not reduce) otherwise the buy price will be adjusted down by the amount of any dividend paid. While total return needs to include dividend payments, trading tends to focus on unadjusted prices. (One caveat: Nasdaq stocks, because there are many market makers, can actually trade below your limit price without your order being filled, so leave a price margin to allow for this occurrence.)

How to Determine a Buy Price:

We all hate the idea of buying too high or, perhaps worse, of missing out by having too low a price. Here are the rules I follow:

1. Examine stock charts, looking especially at barriers, percent declines and moving averages as outlined above.

2. Place orders at “odd” numbers, higher than even ones (e.g., at $25.33, not at $25.00 or even $25.30). Many investors use the even numbers, meaning there is competition for any shares sold there. Moreover, many times a stock’s price doesn’t quite reach that even number.

How to Act When Sparks are Flying, the Stock is Dying and You are Buying:

[When] sparks are flying [and your preferred] stock is dying… is what keeps many investors from making opportunistic purchases. The drops can be so quick it seems that an even better bargain is just around the corner but just as quickly the stock can bounce back leaving the procrastinator behind – hoping for lightning to strike again. [The lessons to be learned are that:]- It’s better to be satisfied with an attractively priced position than to fear missing out on the low price and come away empty-handed.

- If the stock doesn’t turn back up then the loss will be less than buying before the drop plus, it will not drop to zero. When a stock is truly reversing direction, it typically settles in at ever-lower levels, giving plenty of opportunity to exit. (An exception is the reversal of a blow-off phase, such as the one silver [went] through [lately].)

- If your order is not filled and the stock gallops ahead [then] forget about it. That’s investing – and there will be more opportunities down the road.

Sign up for FREE weekly “Top 100 Stock Index, Asset Ratio & Economic Indicator Trends”

Conclusion

With increased investor/commentator concerns being voiced, stocks might make a short-lived drop we could be on the verge of seeing a good buying opportunity. [As I said above, a good way to capture the opportunity is to:

- place “limit buy” orders at pre-determined prices

- price the orders using odd dollar and cents amounts

- make the orders GTC (good-till-canceled) and

- mark the orders DNR (do-not-reduce)

…and now you know exactly how to take advantage of whatever buying opportunities come about.]

*http://investmentdirections.com/2011/05/21/stock-market-buying-opportunity-could-be-coming/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

Stock Market

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money