President Obama had a sit down with Fed Chair Janet Yellen last Monday which was the first one- on-one meeting they’ve had since October 2014 (right before Congressional elections). [Why? Because] the last Fed rate hike (the first in 9 years) did so much damage it took multiple Central Banks unveiling multiple new policies to undo it. In light of this, what are the odds Obama pushed Yellen to refrain from hiking rates and pushing an already weak economy into full-blown recession? Pretty darn high…[so what are the implications for future inflation and the price of commodities?]

on-one meeting they’ve had since October 2014 (right before Congressional elections). [Why? Because] the last Fed rate hike (the first in 9 years) did so much damage it took multiple Central Banks unveiling multiple new policies to undo it. In light of this, what are the odds Obama pushed Yellen to refrain from hiking rates and pushing an already weak economy into full-blown recession? Pretty darn high…[so what are the implications for future inflation and the price of commodities?]

This post is an enhanced version (i.e. not a duplicate) of the original by Graham Summers (GainsPainsCapital.com) as it has been edited ([ ]) and abridged (…) by  munKNEE.com

munKNEE.com to provide a faster and easier read. Enjoy!

to provide a faster and easier read. Enjoy!

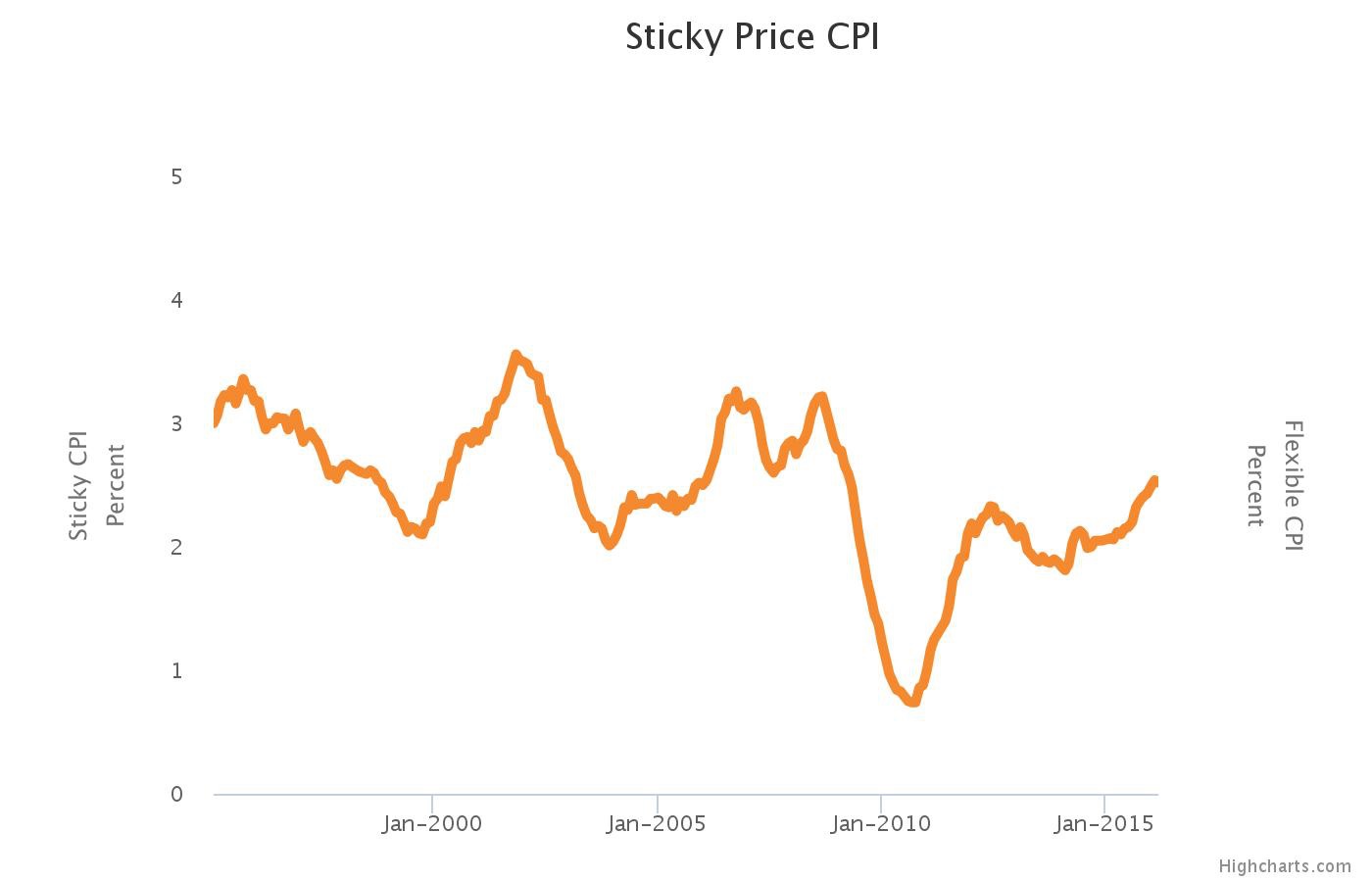

The precious metals markets know it too. Inflation is here – and the Fed isn’t going to try and stop it.

Conclusion

Gold and gold-related investments will be exploding higher in the coming weeks.

Want more such articles? “Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner of page).

Get engaged: Have your say regarding the above article in the Comment section at the bottom of the page.

Wanted! Contributors of original articles & links to other informative articles that deserve a wider read. Send to editor(at)munKNEE(dot)com.

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money