…My case for gold is based on asset allocation, with stocks making up the  lion’s share of a growth portfolio with gold in a small minority position (maybe 5% to 10%) to balance a portfolio…

lion’s share of a growth portfolio with gold in a small minority position (maybe 5% to 10%) to balance a portfolio…

Below are my 5 reasons to consider gold now:

#1: The Federal Reserve May Not Raise Rates – and if they do, it may be “one and done.”

Gold has suffered in recent years based on the assumption that the Fed will raise rates – but they haven’t. Gold offers no interest income, so near-zero rates put gold on an “even playing field” with cash. However, if rates rise, that puts gold at a disadvantage. Gold has been trending downward based on this (so far) failed assumption…

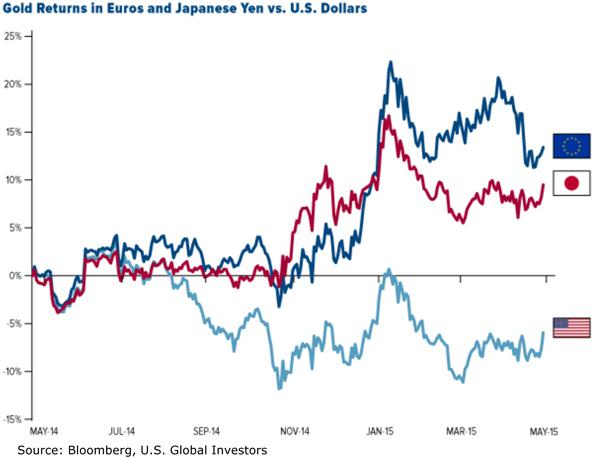

#2: The U.S. Dollar Has been Flat-lining. The U.S. Dollar Index rose rapidly (+25%), from 80 to 100, from mid-2014 to March 2015, but the Dollar Index has been flat to down over the last six months.

…Since most commodities are priced internationally in terms of U.S. dollars, the price of gold has been gently rising in recent months. Earlier this year, when the dollar was soaring, gold soared in euro terms. One way or another – weak dollar or strong dollar – gold will likely be rising in euros or dollars or both.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

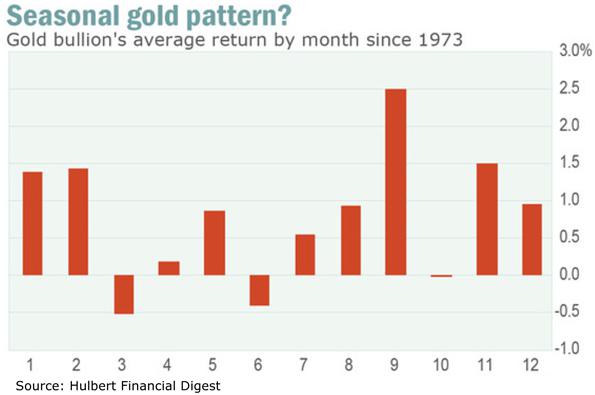

#3: Autumn is Gold’s Best Historical Season. Jewelry is still the largest single source of gold demand, and two large nations (India and China) account for about half of global gold demand. From the Indian holiday and wedding season in the fall to the Chinese New Year, gold jewelry sales tend to rise in those two economies. We could also see rising jewelry demand in the U.S. for Christmas and Valentine’s Day (note the jewelry ads on TV lately?).

Jewelry fabricators must stockpile raw gold in September for the holiday season, so September is gold’s best month historically – and November is the second best month.

Graphs are for illustrative and discussion purposes only…

#4: Central Banks are Stockpiling Gold: European and American central bankers own plenty of gold in their foreign exchange coffers – as a relic from the old gold standard years – but the developing world is catching up fast. Russia’s central bank added 31 metric tons of gold in August – its highest monthly total since March, and Reuters reported on October 16 that China increased its gold holdings by over 3% in the third quarter, buying over 50 metric tons, lifting their total holdings to 1,708.5 metric tons as of September 30.

To stem its financial crisis, China has been selling dollars, but China still has the largest foreign exchange horde in the world. Its gold holdings (fifth among nations, behind only the U.S., Germany, Italy, and France) represent only 1.7% of their total foreign exchange kitty so China has plenty of opportunity to buy more.

#5: “Paper gold” Traders are Looking at Gold Again. Gold-backed exchange traded funds (ETFs) have increased their gold position in recent months. The leading gold ETF, SPDR Gold Shares must buy gold to back up net new purchases and GLD has attracted net inflows of $950 million since August 1. The same trend is evident in the commodity market. Data from the CFTC (Commodity Futures Trading Commission) shows that speculators’ net-long position is now the highest it has been since mid-May.

In addition, third-quarter demand for Gold American Eagles at the U.S. Mint rose 181% over the second quarter. According to the Mint’s official Website statistics, the U.S. Mint sold 397,000 ounces, or 45% more than the 273,000 ounces they sold in the first half…

[The above article, written by Gary Alexander (navellier.com), originally appeared on SeekingAlpha.com (see HERE) and is presented above by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]Related Articles from the munKNEE Vault:

-

A Look At Gold’s Surprising Performance Over the Years

This article takes a look back at the history of gold’s performance as an investment over the years.

2. Smart Investors Will Seek Comfort In Gold – Here Are 7 Reasons Why

The Fed is beginning to wake up to the fact that there is no easy escape from its artificial zero interest rate policy. The Fed will not be able to move very far off of the zero-bound range before the yield curve inverts and the U.S., and indeed the entire global economy, melts down. This means real yields will become more negative, the U.S. dollar will lose more of its purchasing power and economic instability will intensify over time—the perfect fundamental backdrop for rising gold prices.

3. Is gold a good portfolio diversifier?

While the correlation between bonds and stocks tends to increase during economic turmoil, gold usually becomes negatively correlated with other asset classes in such times. This means that the diversification benefits of gold are maintained and may even increase in during severe crises. Let me explain further and provide some caveats.

4. Own Gold As An Insurance Policy On Your Investment Portfolio – Here’s Why

We are content to pay for house insurance for most of our lives yet very few of us have actually experienced a fire or a major disaster where we had to use the insurance. We are comfortable with paying the premiums every year in order to avoid a catastrophic loss. Well, owning gold is tantamount to owning an insurance policy on your investment portfolio.

5. What Is Gold’s Role In An Investment Portfolio – If Any?

There is a plethora of information available in all sorts of media that is negative about gold – gold is risky, volatile, a barbarous relic, and so on – but these arguments miss the point entirely, because they treat gold as an investment. To fully understand gold’s role in an investment portfolio, we need a new mindset—a gold mindset – [and HERE it is].

6. Protect Your Portfolio By Including 15% Gold Bullion – Here’s Why

Only about 2% of ‘investors’ actually have gold in their portfolios and those that have done so have insufficient quantities to offset the future impact of inflation and to maximize their portfolio returns. New research, however, has determined a specific percentage to accomplish such objectives.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money