How much is the market really concerned about a slowing global economy? That question has in the past been posed to Dr. Copper, the red metal afforded the honorific for its supposed Ph.D. in predicting global economic health. However, the title now has been stripped, according to Bank of America’s commodity research team.

So says Jamie Chisholm who goes on to say:

“As a cyclical asset, copper demand has always been closely correlated with global GDP growth, but that sensitivity has been declining,” says the Bank of America team. “This reduced beta to GDP has already provided support to copper prices at around $8,500/t ($3.86/lb) in recent quarters and limited downside price pressures on the red metal in the midst of an industrial recession, a rare occurrence,” they add.

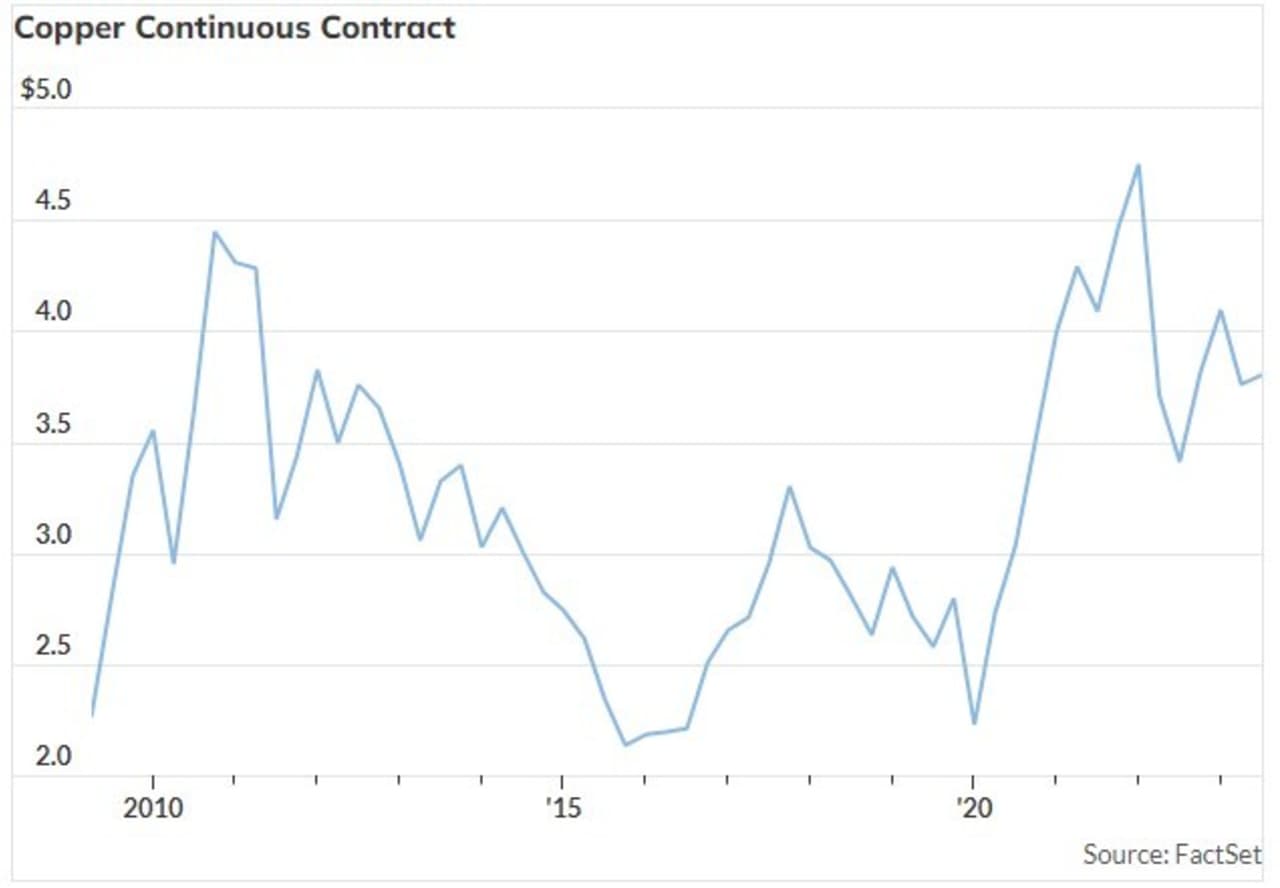

As the chart above show, copper’s price is above its average of the last 15 years despite current concerns about a slowing Chinese economy impacting broader global demand. This decline in copper’s beta, or volatility, in relation to the global economy is due to a confluence of factors, says Bank of America.

- Global economic growth has been weaker in the past decade relative to the run-up to the crisis of 2007/8 and this has impacted stocking cycles.

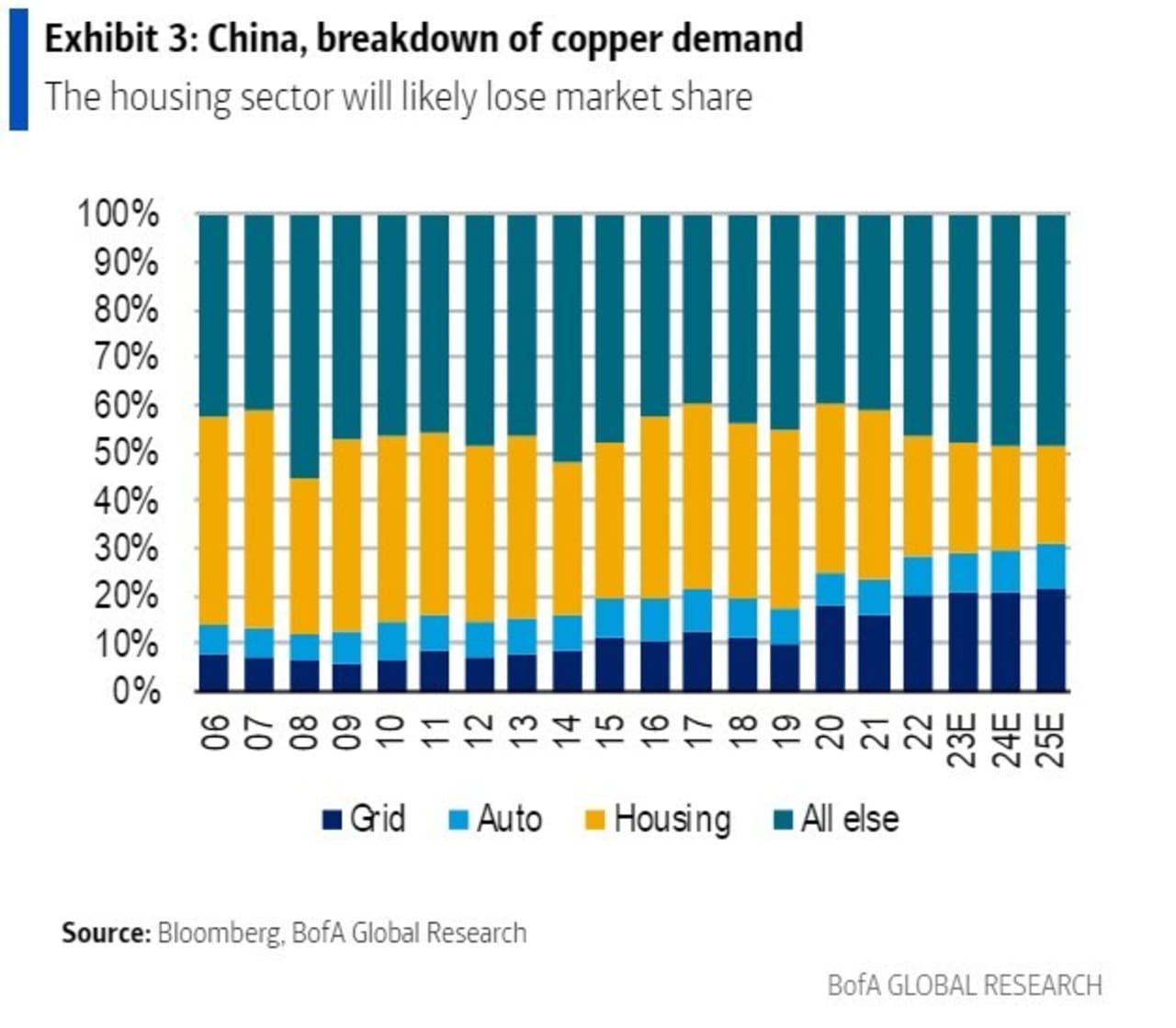

- Furthermore, Beijing has shifted an emphasis on mainly construction led growth to what Bank of America terms “higher-quality, healthier expansion”, where the property sector’s demand for copper has eased and a desire to decarbonize the economy sees copper demand picked up by the auto and energy transmission sectors and it is this shift towards structural growth that is most significant. “As the global economy is accelerating the move towards net zero, and developed markets are also ramping up their efforts to tackle climate change, there is a high likelihood that copper demand will remain less cyclical. Going forward, Dr. Green may be a better name for the red metal than Dr. Copper!,” says Bank of America.

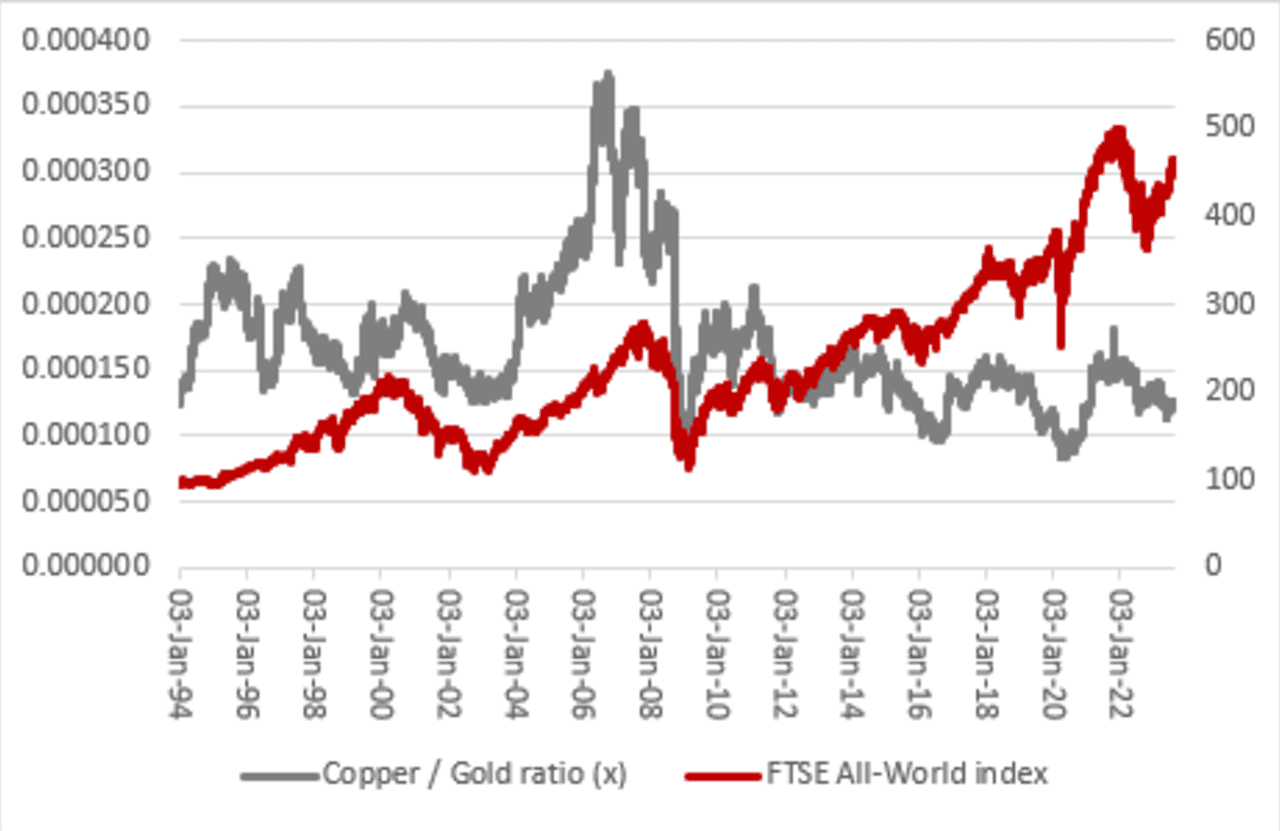

Does all this mean we can’t attach the same importance to the copper/gold ratio, a gauge that tends to decline as various worries boost the gold price but suppress copper’s? Jeffrey Gundlach, the chief executive of DoubleLine Capital and the so-called bond king, is known for placing great importance on the ratio for copper to gold as a way of benchmarking Treasury prices. Equity bulls may hope so, given that Russ Mould, AJ Bell investment director, is wary of the signal the ratio is broadcasting, should the traditional correlations apply.

“The copper/gold ratio is still 50% above its January 1980 all-time low, so more progress from gold could signal trouble ahead. Someone is going to be wrong and if the equity markets have it right then copper should start to outperform gold pretty smartly, even if it is not doing so right now,” says Mould.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money