In a 1998 speech at Harvard, legendary investor Warren Buffett…[said,] “Gold has no utility.” He’s correct in that gold doesn’t produce earnings, or pay dividends, BUT there are some very good reasons gold should be an essential part of every investor’s portfolio.

“Gold has no utility.” He’s correct in that gold doesn’t produce earnings, or pay dividends, BUT there are some very good reasons gold should be an essential part of every investor’s portfolio.

The comments above & below are edited ([ ]) and abridged (…) excerpts from the original article written by Stephen McBride (HardAssetsAlliance.com)

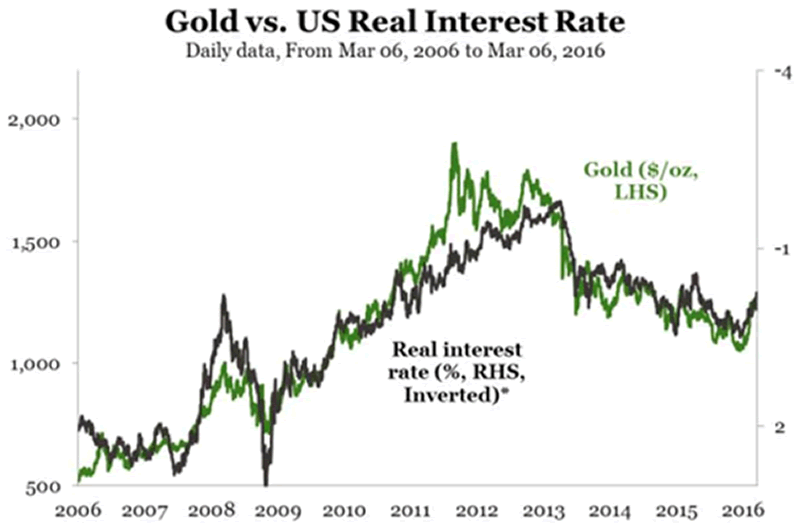

#1: Real Interest Rates Are Still Negative

Even with the Fed raising nominal interest rates, real rates—that is, the nominal interest rate minus inflation—are still in negative territory, and real rates are what really matters to your portfolio.

In the first quarter of 2017, inflation averaged 2.57%. Today, a one-year bank CD pays about 1.4%. Therefore, to keep all of your money in a bank account means to watch your purchasing power erode.

Of course, there are other options. You can put your money in US Treasuries or dividend-paying stocks. However, with the 10-year Treasury yield hovering around 2.25% and the average dividend yield for a company on the S&P 500 at 2.33%, you would still be in negative territory.

Gold is known as the yellow metal with no yield, but simple math tells us no yield is better than a negative one. In fact, real interest rates are a major determinate of which direction the price of gold moves in so gold will protect your capital from the eroding forces of negative rates and help it grow at the same time.

Source: ETF Securities

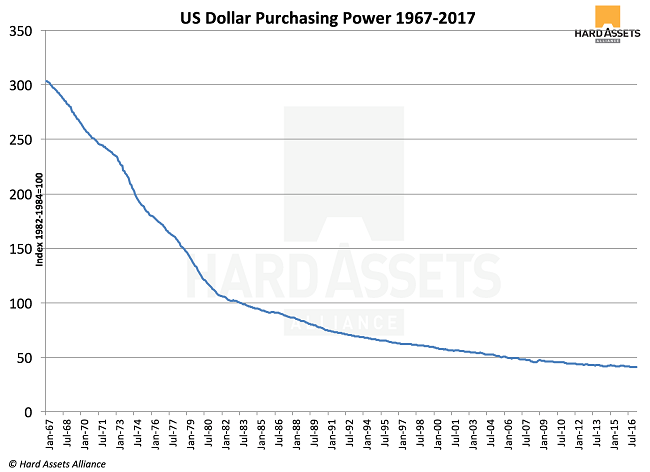

#2: The Dollar’s Value Has Collapsed

The U.S. dollar may be rising against other currencies like the euro and yen [but,]nonetheless, in the last 50 years, its purchasing power has fallen by 86%.

Source: St. Louis Fed

As the chart above shows, keeping your savings in cash is a poor wealth-building strategy. On the other hand, gold has more than kept up with inflation. Since 1972—the first year private ownership of gold became legal again—the price of gold has increased by 2,400%.

#3: Gold Is Money

Why has gold retained its value while fiat currencies have fallen? It’s because gold is money.

2,000 years ago, Greek philosopher Aristotle theorized that any sound form of money must be: durable, portable, divisible, and have intrinsic value and gold has all 4 of those characteristics—[and] that’s why it has proven to be a long-term store of value. Fiat currencies like the dollar cannot be considered money as they don’t have intrinsic value.

In other words, gold is payment in and of itself, but the dollar is only a promise to pay.

#4: Negative Correlation to Stocks and Bonds

The world’s largest asset manager, BlackRock, pointed out recently that in the last decade, the correlation between stocks and bonds has been at almost double its long-term average [and that,] therefore, a portfolio comprised of 60% stocks/40% bonds no longer offers investors adequate diversification. Sure, it’s great when markets are rising—but when the tide turns, that’s going to be a problem.

To keep all your eggs “out of one basket”—buy gold. Recently, the correlation between gold and the S&P 500 stood at its second-lowest level in over 30 years. That’s also the case with gold and bonds.

#5: No Counterparty Risk

Gold is one of the few assets that has no counterparty risk…meaning that once you have physical gold in your possession, you don’t depend on someone else to fulfill a contract or keep a promise for it to retain its value.

Stocks, bonds, ETFs—essentially all paper assets require another party to make good on their end of the deal. Physical gold’s value does not hinge on someone else’s obligation to pay.

Aside from being a long-term store of value and diversification tool, there’s another reason you should buy gold.

Bonus Round: A Profitable Portfolio

Since the beginning of 2017, gold is up over 10%, making it one of the best-performing assets of the year – and this is no anomaly.

- Since late 2015, gold has outperformed the S&P 500 by 30%. In fact, gold has been the best-performing asset class since the turn of the millennium.

Not only will gold preserve your wealth and insulate your portfolio from market sell-offs, it can earn you a profit at the same time.

Given the negative real rates, a falling dollar, and heightened correlation between stock and bonds, gold should be an essential part of every investor’s portfolio today.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money