If imports and exports are both falling, that means consumption is weak pretty much everywhere, and weak consumption means slow or negative growth which means lower corporate profits, which, if history is still a valid guide, means less valuable equities, so could it be that the markets are simply figuring this out and revaluing assets accordingly?

pretty much everywhere, and weak consumption means slow or negative growth which means lower corporate profits, which, if history is still a valid guide, means less valuable equities, so could it be that the markets are simply figuring this out and revaluing assets accordingly?

By John Rubino (dollarcollapse.com)

Regular contributor Michael Pollaro offers three more charts which tell a story that’s both disturbing and apparently misunderstood by a lot of mainstream analysts.

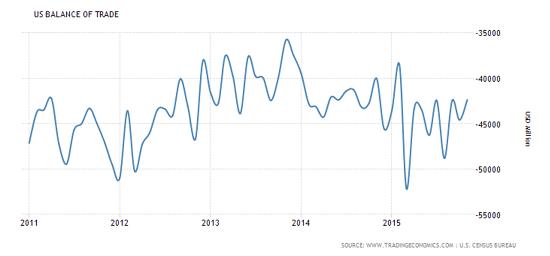

U.S. Trade Deficit Getting Smaller

The U.S. trade deficit (exports minus imports) has been getting smaller. Since a trade deficit subtracts from GDP growth, a shrinking deficit will, other things being equal, produce a bigger, faster-growing economy (that’s the mainstream take) but other things aren’t equal. It turns out that the components of that trade balance figure are both shrinking.

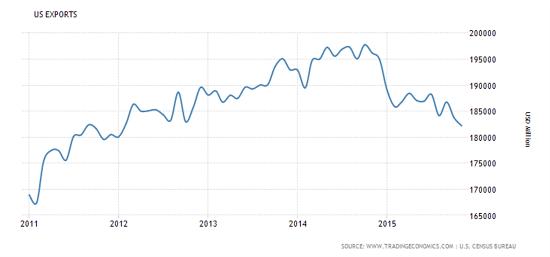

Exports Are Declining

Exports — the stuff we sell to foreigners — have been declining since the dollar spiked in 2014. That’s not a surprise, since a strengthening currency makes exports more expensive and thus harder to sell so other countries are buying less of our stuff, which, though not surprising, is a bad sign.

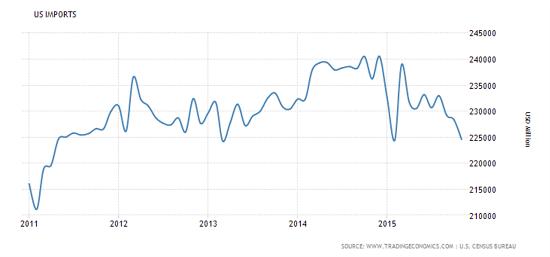

Imports Have Plunged

Meanwhile, imports — stuff we buy from abroad — have also plunged in the past year. This is partly due to cheaper oil lowering the dollar value of energy and other commodity imports but it also means that even though French wine and German cars have become less expensive as the dollar has soared against the euro, we’re not buying more of them so U.S. consumers, even with all the money they’re saving at the gas pump, still can’t (or won’t) take advantage of a sale on imported goods.

Conclusion

If imports and exports are both falling, that means consumption is weak pretty much everywhere – and weak consumption means slow or negative growth, which contradicts the recovery thesis that now dominates policy making and the financial media.

It also makes…[the current] market turmoil easier to understand. Falling trade means lower corporate profits, which, if history is still a valid guide, means less valuable equities, so it could be that the markets are simply figuring this out and revaluing assets accordingly.

[The original post written by John Rubino (dollarcollapse.com) is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – sign up in the top right corner) in a slightly edited ([ ]) and/or abridged (…) format to provide a fast and easy read.] munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money