The markets have heard Powell’s message of higher interest rates, and the damage they could cause the greater economy, loud and clear. The S&P 500 has slid 8.4% over the past month (as of the close of trading Wednesday), and the 2-year Treasury yield recently hit its highest level since 2007…How bad could it get? Ho can an investor survive the coming storm? [Read on!]

At the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, Chairman Jerome Powell delivered unusually blunt remarks saying that the Fed would accept a recession as the price of fighting inflation…to “go hostile” to fight the 8.3% level of inflation that has permeated the economy…by raising rates until they force unemployment higher and slow wage growth…[even if that meant “crashing the markets”…[just like] Paul Volcker’s Fed did in the early 1980s…

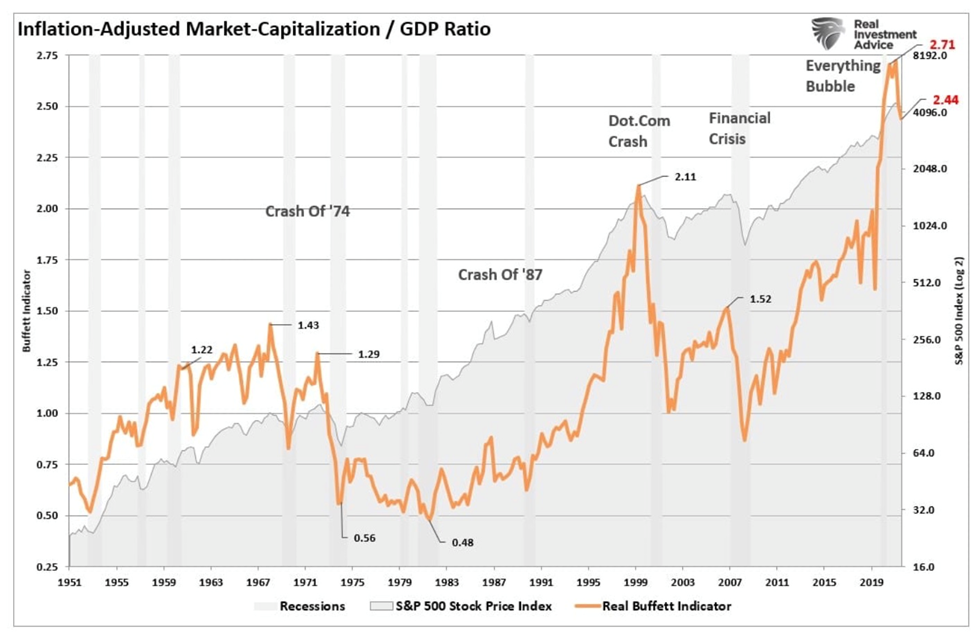

The “Buffett Indicator” Suggests Negative S&P Returns for the Next 10 years

When markets swoon, many stockholders turn to Warren Buffett for investment advice. The “Buffett Indicator” is a valuation measure that compares the stock market’s capitalization to the Gross Domestic Product where any number above 1.0 is overvalued, and below 1.0 is undervalued. .. Investors currently are paying almost 2.44X what the economy can generate in revenue and earnings [and shows] that overvaluation is unsustainable when the market capitalization of stocks grows faster than what economic growth can support.

The chart below…plots the business cycle going back to 1951, with recessions marked as vertical grey lines…Notice that, just before a market crash, the Buffett Indicator, shown as an orange line, spikes. We see this:

- in 1973 (1.29), just before the crash of 1974;

- in 1999 (2.11), the year prior to the dot-com crash;

- in 2007 (1.52), leading up to the financial crisis,

- and 2.71 in 2019, just prior to the coronavirus crisis that began in early 2020.

[This all suggests that] return expectations for the next ten years are as likely to be negative as they were for the ten years following the late ’90s.

Source: Real Investment Advice

Source: Real Investment Advice

Nouriel Roubini Sees A Recession This Fall & A Possible 40% Drop in the S&P 500

The S&P 500 has slid 8.4% over the past month (as of the close of trading Wednesday), and the 2-year Treasury yield recently hit its highest level since 2007. How bad could it get? [Well, according to Nouriel Roubini, in an interview with Bloomberg, we are about to experience]…

- a “long and ugly” recession happening at the end of this year,

- including a sharp correction in the S&P 500, that could last all of 2023, saying “Even in a plain vanilla recession, the S&P 500 can fall by 30%, and in “a real hard landing,” which he expects, it could fall 40%…

His advice to investors is “to be light on equities and have more cash.”

Stagflation and Debt Distress Is Coming

While some market observers believe the Fed will pivot to lowering interest rates, and restarting quantitative easing (QE), once the world is in recession, Roubini…doesn’t expect fiscal stimulus remedies because governments are “running out of fiscal bullets,” and high inflation means that “if you do fiscal stimulus, you’re overheating the aggregate demand.” Roubini, therefore, sees

- stagflation like in the 1970s,

- and debt distress like in the global financial crisis…

The World Bank Concurs That the Risk of Stagflation is Heightening

The World Bank admits that the risk of stagflation is heightening, stating in its latest report, ‘Global Economic Prospects’, that “stagflation risks are rising amid a sharp slowdown in growth.”

- The institution reduced its global growth forecast from 5.7% in 2021 to 2.9% in 2022, significantly lower than the 4.1 % predicted in January.

- Furthermore, the World Bank projects world GDP will slow by 2.7 percentage points between 2021 and 2024 — more than twice the deceleration between 1976 and ’79.

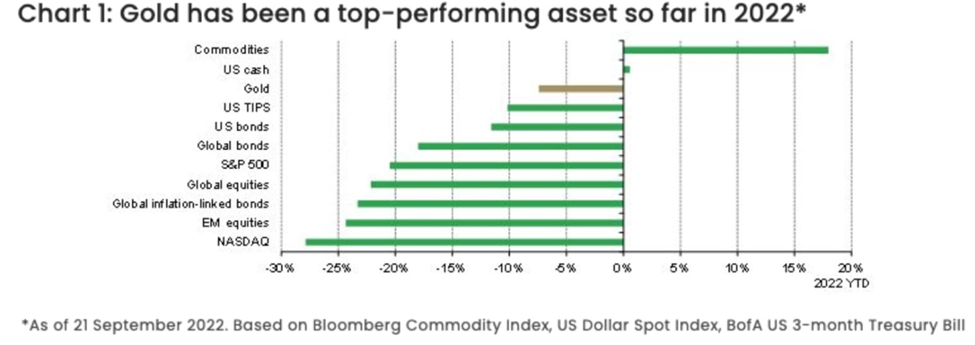

Survive the Coming Storm With Commodities

With the Buffett Indicator pointing to a “lost decade” of negative returns, and Nouriel Roubini predicting the recession will be “severe, long and ugly,” the obvious question is how to batten down the hatches and survive the coming storm. The answer, commodities, may surprise you. It certainly surprised me.

Commodities protect investments from rising prices and currency debasement, making them a good place to park your hard-earned cash. [That being said,] however, both the energy and materials sectors are considered very economically sensitive, exemplified by oil and copper pulling back from their (respective) June and March highs, [so]…when investing in natural resource equities, the commodity capital cycle is more important than the business cycle.

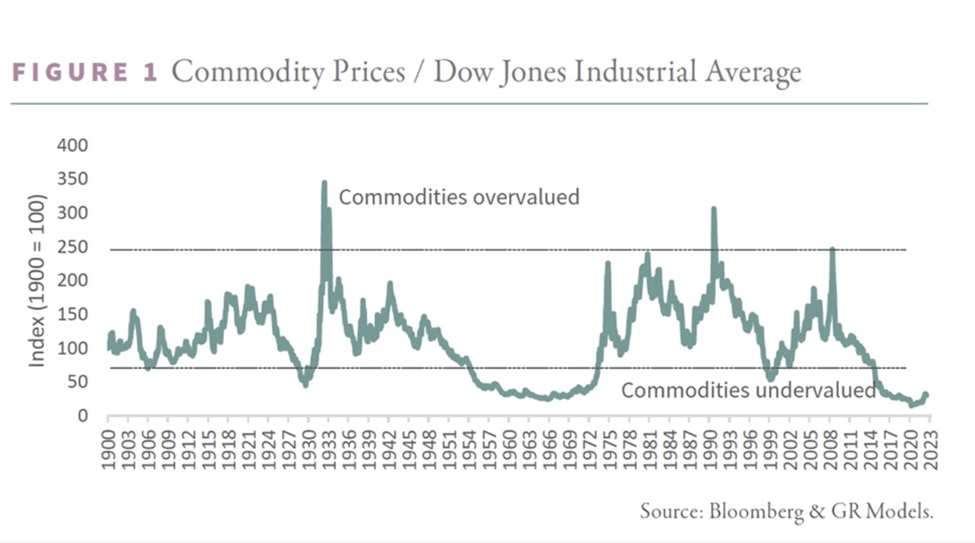

The chart below from Goehring & Rozencwajg, the Wall Street natural resource investment firm, shows the relationship between the Dow Jones Industrial Average and a commodity index going back several decades. It indicates periods when commodities are undervalued or overvalued — compared to the Dow. Where the green line dips below 75, commodities are cheap relative to financial assets. These periods typically represent bear markets for commodities. The chart shows the most undervalued years for commodities were 1929, 1969, 1999 and 2020.

…G&R maintain that:

- the radical undervaluation of commodities and commodity related equities is greater now than it was back in 1929, and the level of capital starvation is just as great…[and] that

- commodities could again be an excellent place to seek high returns, even if the 2020s experience a period of economic turmoil as severe as the Great Depression — a scenario they consider unlikely.

G&R’s Commodity Prices/ Dow Jones Industrial Average chart above shows there hasn’t been a better setup for commodities than now, over a time frame spanning 120 years…

The Bottom Line

Even if the recession is long, commodities should be practically bullet-proof.

The above article is an edited ([ ]), abridged […], retitled, restructured, reformatted, highlighted and grammatically corrected version by Lorimer Wilson, Managing Editor of munKNEE.com, of an article by Richard Mills for the sake of brevity and clarity to ensure a fast and easy read.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money