History is testament that there exists monumental probability (76% to 100%) that 2014-2016 will witness  impressive gains for Gold, Silver and Precious Metal Equities…across the board. Below are 8 charts that show that Golden Crosses are a fait accompli or are about to experience imminent completion thus heralding an immediate new Bull Market and that the forth-coming secular bull markets in all forms of precious metals may well far surpass the forecasts herein stated. The focus of the following analysis is to prove the predictable accuracy and timing of the The Golden Cross.

impressive gains for Gold, Silver and Precious Metal Equities…across the board. Below are 8 charts that show that Golden Crosses are a fait accompli or are about to experience imminent completion thus heralding an immediate new Bull Market and that the forth-coming secular bull markets in all forms of precious metals may well far surpass the forecasts herein stated. The focus of the following analysis is to prove the predictable accuracy and timing of the The Golden Cross.

So says Vronsky (gold-eagle.com) in edited excerpts from his original article* entitled Gold Forecasting Via The Magic Of The Golden Cross (Part 1).

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Vronsky goes on to say in further edited excerpts:

The Golden Cross – A Definition

- When prices begin a move up, the shorter term 50 day moving average (50 dma) will begin below the longer term 200 day moving average (200 dma).

- As the price continues rising, the 50 dma will cross above the 200 dma and continue above it until there is a material change in the price trend.

- Therefore, the point at which the 50 dma moves above the longer term 200 dma is known as The Golden Cross and is considered by competent chart analysts as a reliable A BUY SIGNAL.

Below is shown the 2001-2014 history of the Golden Crosses of eight precious metals related securities – and the profitable results they subsequently produced.

In order to highlight the Golden Cross, the top chart will only show the 50 dma and 200 dma (omitting the actual price of the security for clarity). However, the actual price trend of the underlying security will be seen below moving average chart.

1. GOLD (Bullion) – The Golden Cross is imminent

2. GDX (Market Vectors Gold Miners – NYSE) The Golden Cross is completed

3. GDXJ (Market Vectors Junior Gold Miners – NYSE) The Golden Cross is completed

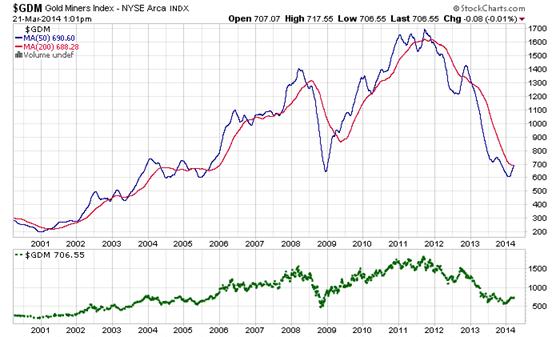

4. GDM (Gold Miners Index – NYSE) The Golden Cross is completed

5. HUI Index (Goldbugs Index) The Golden Cross is completed

6. XAU Index (Gold & Silver Index) The Golden Cross is completed

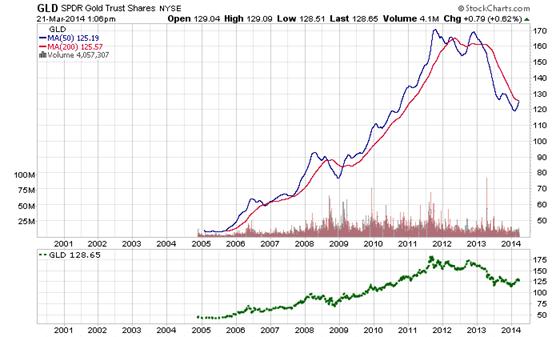

7. GLD (SPDR Gold Trust shares – NYSE) The Golden Cross is completed

8. SILVER (Bullion) The Golden Cross is almost completed

Forecast Price Basis

Market History since 2001 demonstrates the profitability subsequent to flashing of the magical Golden Cross Buy Signal.

The following forecasts are based on the assumption that the predicted future price and date might be equal to the average appreciation of each of The Golden Crosses Buy Signals since 2001.

1. GOLD (Bullion) – The Golden Cross is imminent

Since 2001 GOLD has had four Golden Crosses with an average gain of 67% over a 22-month period. Based on this it is predicted GOLD might reach $2,170 by January 2016.

2. GDX (Market Vectors Gold Miners – NYSE) – The Golden Cross is completed

Since 2001 GDX has had one Golden Crosses with an average gain of 85% over a 27-month period. Based on this it is predicted GDX might reach $46 by June 2016.

3. GDXJ (Market Vectors Junior Gold Miners – NYSE) – The Golden Cross is completed

It is not possible to make a reasonable forecast for GDXJ as it has not had a long enough record. However, as it is more volatile than GDX, one might estimate GDXJ might rise 100% to $80 in the same time period that GDX is predicted to increase 85% by June 2016.

4. GDM Index (Gold Miners Index – NYSE) – The Golden Cross is completed

Since 2001 GOLD has had five Golden Crosses with an average gain of 93% over a 17-month period. Based on this it is predicted GDM might reach 1360 by August 2015.

5. HUI Index (Goldbugs Index) – The Golden Cross is completed

Since 2001 HUI has had five Golden Crosses with an average gain of 96% over a 16-month period. Based on this it is predicted HUI might reach 461 by July 2015.

6. XAU Index (Gold & Silver Index) – The Golden Cross is completed

Since 2001 XAU has had five Golden Crosses with an average gain of 54% over a 15-month period. Based on this it is predicted XAU might reach 152 by June 2015.

7. GLD (SPDR Gold Trust shares – NYSE) – The Golden Cross is completed

Since 2001 GLD has had two Golden Crosses with an average gain of 81% over a 22-month period. Based on this it is predicted GLD might reach $232 by January 2016.

8. SILVER (Bullion) – The Golden Cross is almost completed

Since 2001 SILVER has had three Golden Crosses with an average gain of 157% over a 30-month period. Based on this it is predicted SILVER might reach $52 by September 2016.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.gold-eagle.com/article/gold-forecasting-magic-golden-cross-part-1

Related Articles:

1. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Let me explain. Read More »

People who have trusted the paper market first go to gold when they have their awakening because it is the largest precious metals market in the world but the more I learned about silver, however, the more I realized that silver was the smart decision. Here a a few reasons why that is the case. Read More »

3. Stock Market Will Collapse In May Followed By Major Spike in Gold & Silver Prices! Here’s Why

The unintended consequences of five years of QE are coming home to roost! In May or early June the stock market parabola will collapse…followed by a massive inflationary spike in commodity prices – particularly gold & silver – that will collapse the global economy. Read More »

4. Gold Price Forecasts (Update): $5,000 to $11,000 In 2 to 5 Years

During 2011 into 2013 I kept a record of those individuals who expected gold to rise substantially in the coming years and presented updated summaries in a number of articles (see links below). Below are additional or recently updated forecasts by 11 prognosticators whose projections are surprisingly consistent, on average, with previous such estimates. Read More »

We are now starting the hyperinflationary phase in the USA and many other countries – and this will all start in 2014. What will be the trigger? The answer is simple – the fall of the U.S. dollar. Read More »

100+ accredited manufacturers produce a staggering 400 different gold bars among them. This article outlines five rules to follow before, during and after the purchase process. Read More »

7. Beware The Dangers In Buying Certain Gold Coins – Here’s Why

At first glance, buying gold may seem a simple, straight forward process. However, there are dangers, such as falling for a telemarketer’s line that his coins are “non-confiscatable” and somehow have more value because you bought them from him. Basic bullion is the way to go when investing in gold. Words: 788 Read More »

8. What You Need to Know Before Investing in Silver

I believe there is more opportunity in the silver market over the next two years relative to gold and, as such I’m now advocating accumulating a large overweight position in silver relative to gold because, over the long-term, there is such a great demand vs. supply situation developing….Before investing in silver, however, there are a number very important things that you must understand about the silver market. Let me explain. Words: 899 Read More »

9. Compare & Save When Buying Gold: Check Out These Worldwide Dealers

Compare and save! Who is the most reputable, cheapest and most reliable precious metals dealer to buy your physical gold and silver from? There are hundreds of dealers touting their wares but when it comes to direct comparisons only a few rise to the top of the list. Here they are. Words: 262 Read More »

10. Here’s How to Choose Gold & Silver Stocks With the GREATEST Chance of Major Returns

Which gold/silver mining companies own quality undeveloped gold and silver deposits in safe stable countries – and are extremely well managed? Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment. Below are a number of things to look for when considering an investment in such companies. Read More »

11. Gold: What Do Terms “Karat” & “Troy” Mean? What’s A “Carat”?

What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? What’s the difference between a .75 and 1.0 carat diamond? Let me explain. Read More »

12. Silver On Its Way to $50/ozt. & Then to “Blue Sky Country”

Silver has moved above its 200-day moving average which is a signal for silver prices to challenge the $50 area, overcome it and then traverse ‘blue sky country’ to target the upper trendline shown in the chart shown below. Read More »

13. +100% Gains in GDX & GDXJ Are Distinct Possibilities – Here’s Why

Both the short and intermediate term outlook for gold and silver stocks continues to be very positive. Historical analysis shows that GDX & GDXJ could rebound 100% and over 150% respectively by the end of this year. Both forecasts would be below the average of the one year rebounds following the 2005 and 2008 bottoms. Read More »

14. Silver Has the Potential to Increase 4-Fold From Today’s Price – Here’s Why

The price ratio of gold to silver has fallen precipitously in raging bull markets for the metals, so the silver price could have an upwards move at four times the rate of any gold price increase. I think that the fundamentals look better than ever, and…[that] there is an explosive move coming in 2014. [Indeed,] I think that within a reasonable timeframe silver will probably trade over $100. Read More »

15. Rickards: Gold Going to $7-9,000/ozt. in 3 to 5 Years! Here’s Why

Gold is technically set up for a massive rally to $7,000 to $9,000 per ounce in three to five years based on a collapse of confidence in the dollar and other forms of paper money. Read More »

16. The Pros & Cons of Buying Gold Bars vs. Ingots vs. Coins

It is during difficult times [such as these when] quantitative easing and currency wars have highlighted the volatility and vulnerability of currencies…that the true, safe value of gold really stands out. It is now easier for you to convert your savings into gold than ever before and this article outlines the reason for buying physical gold and the advantages and disadvantages of buying gold bars, ingots and/or coins. Read on! Words: 853 Read More »

17. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher!

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691 Read More »

18. These 10 Charts Suggest the Outlook for Gold Is Good for 2014 and Beyond

Very poor sentiment towards gold and oversold conditions is reminiscent of the conditions seen in late 2008 and January 2009 [as seen in the chart below] when gold prices had fallen by more than 25% in 9 months. Subsequently, gold rose from a low on January 15, 2009 at $802.60/oz to a high less than 12 months later at $1,215/oz for a gain of over 50%. A similar move today would see gold above $1,800/oz by year end. Read More »

19. Nick Barisheff: “Today’s the 2nd-Greatest Opportunity to Buy Gold Since 2002!”

Last year…saw gold’s greatest decline in 32 years…but I’m still confident that gold’s bullish fundamentals are still intact and that what I said in my recently published book, $10,000 Gold, still holds true. Here’s why. Read More »

20. Gold Stocks: What Can We Expect in 2014?

After three years of pain, can gold stocks break their losing streak and see a gain in 2014? History says the chances are good. Here’s why that is the case. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Like ET, Is this a signal that GOLD (and other PM’s) are calling Home…?

If so perhaps the “Mother Of All Reversals ” is on its way!

To be continued…