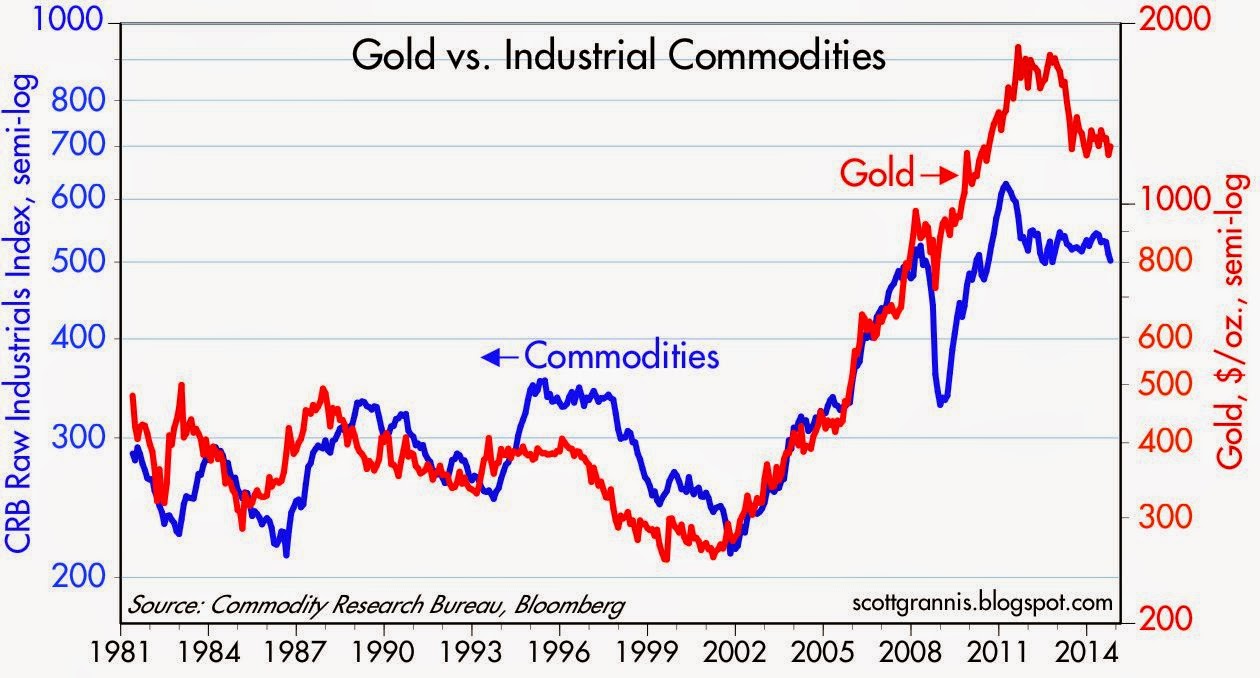

The downside risks to owning gold are much greater than the upside risks. Without the onslaught of newly rich Asian buyers its price is coming back down to more closely track those of other commodity prices and, while I worry that central banks may inadvertently spark a round of higher inflation in the years to come, if I had to reconcile those two views, I would say that today’s elevated real price of gold has effectively priced in a lot of higher inflation in the future. This article presents 6 charts which clearly illustrate just what is currently going on.

onslaught of newly rich Asian buyers its price is coming back down to more closely track those of other commodity prices and, while I worry that central banks may inadvertently spark a round of higher inflation in the years to come, if I had to reconcile those two views, I would say that today’s elevated real price of gold has effectively priced in a lot of higher inflation in the future. This article presents 6 charts which clearly illustrate just what is currently going on.

- speculated that China’s spectacular growth over the previous two decades, which included a monster accumulation of foreign exchange reserves and a significant appreciation of the yuan, could have been the driver for the the incredible rise in gold prices.

- noted the slowing in China’s accumulation of forex reserves,

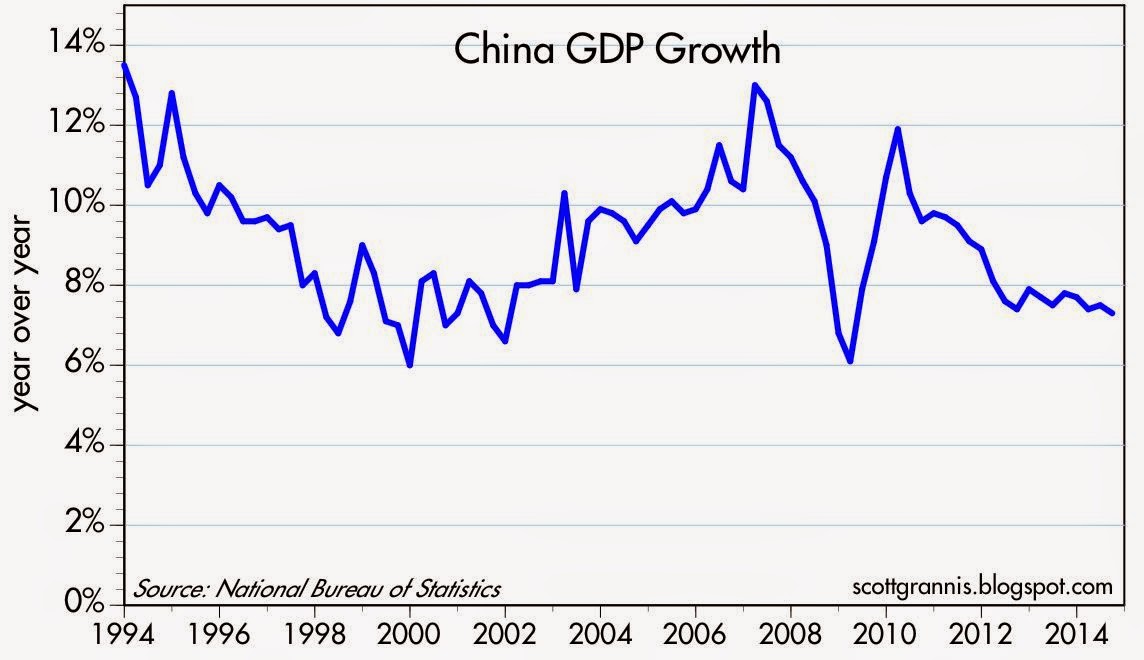

- noted the slowing in Chinese economic growth, and

- noted the beginnings of stabilization of its currency, and

- asserted that “the boom in gold is over.”

Shortly thereafter gold suffered a significant decline.

I followed up the above post with one in April, 2013 entitled “Gold is relinking to commodities” in which I outlined how the link between China and gold works:

- the outstanding stock of gold doesn’t change very fast, growing only about 3% a year

- the spectacular growth of the Chinese economy beginning in the mid-1990s created legions of newly prosperous Chinese whose demand for gold pushed gold prices to stratospheric levels

- China’s economic boom attracted trillions of foreign investment capital, which China’s central bank was forced to purchase in order to avoid a dramatic appreciation of the yuan, and to provide solid collateral backing to the soaring money supply needed to accommodate China’s spectacular growth.

and concluded that:

- China’s explosive growth and new-found riches were what fueled the rise in gold prices but,

- in recent years, the bloom is off the rose.

I think these same dynamics are still in play:

- Chinese economic growth has definitely slowed,

- China’s forex reserves only increased by 6% in the year ending September,

- the yuan is unchanged over the past year, and

- gold prices are down by one-third from their 2011 peak.

Below are some updated charts to illustrate what’s going on:

China’s economy is no longer booming, but 7% growth still ranks as very impressive. China’s economy is not collapsing, it’s maturing. Even 7% growth is unsustainable for long periods. We ought to expect further slowing in the years to come.

The growth in China’s foreign exchange reserves was exponential for many years, but now it has slowed to a trickle. Capital inflows (money wanting to invest in the China boom) have slowed, while outflows (money looking for diversification overseas and money to pay for China’s growing appetite for foreign goods and services) have picked up, and the two are coming into balance. That means the BoC doesn’t have to buy up capital inflows to keep the currency from appreciating. The yuan is likely to be much more stable going forward.

As it is, the real value of the yuan has appreciated by an astounding 83% in the past 20 years, despite the valiant attempts by the BoC to prevent excessive appreciation. Slower growth and more balanced capital flows mean there is no more need for currency appreciation.

A strong currency and a strong economy have enabled China to enjoy a low rate of inflation for the past 15 years or so. Happily, inflation in the U.S. and China has converged. China’s economy has accommodated to its strong currency, and capital flows are coming into balance. On a PPP basis, there is very little pressure for the yuan to keep appreciating.

The spectacular rise in China’s forex reserves paralleled the outsized growth of its economy and mirrored the equally spectacular rise in the price of gold. Lots of newly rich Chinese (and Indians, for that matter) were eager to acquire gold for the first time, but that demand appears now to be largely sated.

Conclusion

Gold is still trading well above its long-term average in real terms (I calculated that the average price of gold over the past century in today’s dollars is about $650/oz.), so without the onslaught of newly rich Asian buyers its price is coming back down to more closely track those of other commodity prices.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://scottgrannis.blogspot.ca/2014/10/how-china-could-explain-decline-in-gold.html

Related Articles:

1. Gold Price Plunge: The Inside Scoop

We will allow all of you here today, in the weeks running up to the seizure of the world’s gold, to put in place your trading strategies in anticipation of the ’Mother of All Insider Trades’. This will allow you and your organizations to profit beyond your wildest dreams when we ‘drop the hammer’ and reduce the price of gold to $20.67 USD. Read More »

We are at an interesting and perhaps critical juncture with respect to the direction of the gold price as it approaches a key support level. There are many mixed signals out there and the market seems to be vacillating, frustrating both bulls and the bears. Let us look at both cases in order to try to understand what the gold market may have in store for us during the coming weeks and months. Read More »

John LaForge, commodities strategist at Ned Davis Research has said that gold should drop about 40% lower than where it is currently trading down to $660 an ounce. I think LaForge is dead wrong and this article argues the reasons why the gold market has not yet peaked and why we are in a counter-trend correction within the long-term bull market. Read More »

If I am right about my views going forward then gold isn’t just risky based on past performance, but it could be even riskier in the future as the “faith put” subsides and the myth that “gold is money” disappears. Read More »

5. Should You Become Bullish – Or Remain Bearish – On Gold? Here’s What the Indicators Say

Gold has been mired in a descending triangle over the past year or so. From a technical perspective, such triangles are likely to be continuation patterns. Gold fundamentals have recently worsened a bit with the most obvious headwind being the continued strength in the U.S. dollar, but this isn’t the only indicator that has turned more bearish lately. This article is an update of the indicators we follow. Read More »

6. The Gold Price Could Go Even Lower – Here Are 5 Reasons Why

I see various signs that indicate that gold bulls may have to endure one more capitulation to the downside before the next leg of the bull market begins. In what follows I identify what could send the gold price lower and suggest some investment strategies to consider. Read More »

7. I Don’t Mean to Rant Against Gold BUT…

I don’t mean to rant against gold. I just think that there are some fundamental reasons to keep gold in the proper perspective when we consider its value as a portion of our asset holdings. In my view, it’s not the type of asset you want to build a portfolio around. Here’s why. Read More »

8. Gold Price Is Falling For This Totally Logical Reason

Despite continuing QE and huge government deficits the price of gold has fallen 35% since its peak in 2011 and is down over 10% from its highs this year. Is there a logical explanation for this?I think there is. Read on. Read More »

9. What Do Current Low Interest Rates Mean For the Future Price of Gold?

Investors commonly assume that rising interest rates adversely impact the gold price, and vise versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income but this intuition is unfounded. Let me explain why that is the case ans why, as such, gold investors shouldn’t fear rising interest rates. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I believe that Gold is now being used to create international financial tensions that could at any time further threaten the value of the US$, so as the Gold prices tend to creep lower ask yourselves who is taking advantage of these lower prices to acquire even more?

I feel the same thing could also be said about the other PM’s, since their prices are also tending to follow what is happening to Gold prices; said another way PM’s are one sure investment that looks even better the farther into the future you consider.