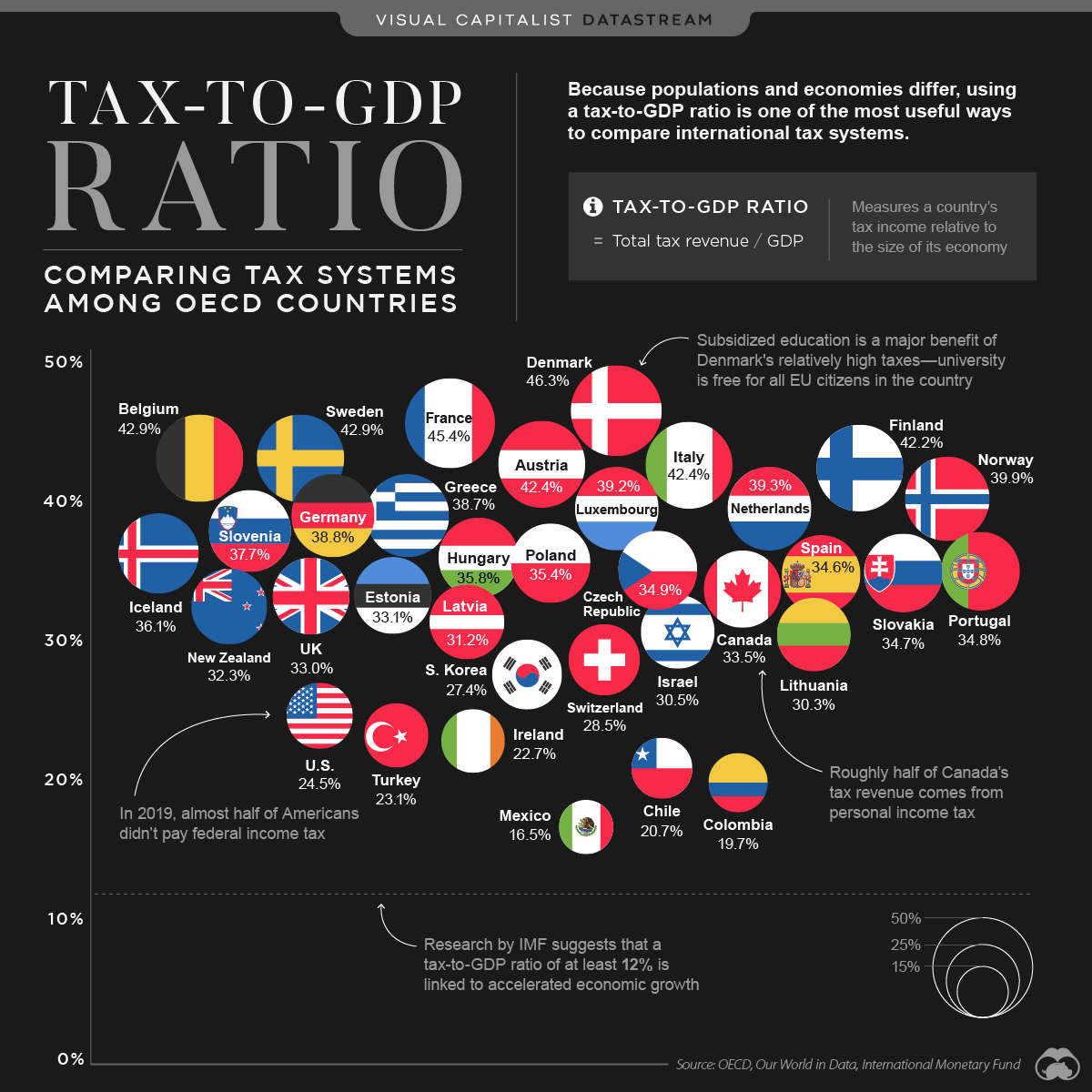

Taxes…provide 50% or more of government funds in almost every country in the world…[and] using a tax-to-GDP ratio is one of the more useful ways to compare tax systems around the world…[and this article does just that].

What is the Tax-to-GDP Ratio?

The tax-to-GDP ratio compares a country’s tax revenue to the size of its economy, which in this case is measured by its GDP. The higher the ratio, the higher the proportion of money that goes to government coffers. If managed effectively, this can support the long-term health and prosperity of an economy. According to research conducted by the International Monetary Fund, countries should have a tax-to-GDP ratio of at least 12% in order to experience accelerated economic growth.

The Tax-to-GDP Ratios of OECD countries

The countries that are part of the Organization for Economic Co-operation and Development (OECD) all meet that threshold, with an average tax-to-GDP ratio of 33.8%. The…[ranking below] looks at 35 of the 37 OECD countries, since recent data for Australia and Japan was not available.

| Rank | Country | Tax Revenue as % of GDP |

|---|---|---|

| 1 |  Denmark Denmark |

46.3% |

| 2 |  France France |

45.4% |

| 3 |  Belgium Belgium |

42.9% |

| 4 |  Sweden Sweden |

42.9% |

| 5 |  Austria Austria |

42.4% |

| 6 |  Italy Italy |

42.4% |

| 7 |  Finland Finland |

42.2% |

| 8 |  Norway Norway |

39.9% |

| 9 |  Netherlands Netherlands |

39.3% |

| 10 |  Luxembourg Luxembourg |

39.2% |

| OECD Average | 33.8% |

| Rank | Country | Tax Revenue as % of GDP |

|---|---|---|

| 11 |  Germany Germany |

38.8% |

| 12 |  Greece Greece |

38.7% |

| 13 |  Slovenia Slovenia |

37.7% |

| 14 |  Iceland Iceland |

36.1% |

| 15 |  Hungary Hungary |

35.8% |

| 16 |  Poland Poland |

35.4% |

| 17 |  Czech Republic Czech Republic |

34.9% |

| 18 |  Portugal Portugal |

34.8% |

| 19 |  Slovak Republic Slovak Republic |

34.7% |

| 20 |  Spain Spain |

34.6% |

| OECD Average |

| Rank | Country | Tax Revenue as % of GDP |

|---|---|---|

| 21 |  Canada Canada |

33.5% |

| 22 |  Estonia Estonia |

33.1% |

| 23 |  United Kingdom United Kingdom |

33.0% |

| 24 |  New Zealand New Zealand |

32.3% |

| 25 |  Latvia Latvia |

31.2% |

| 26 |  Israel Israel |

30.5% |

| 27 |  Lithuania Lithuania |

30.3% |

| 28 |  Switzerland Switzerland |

28.5% |

| 29 |  South Korea South Korea |

27.4% |

| 30 |  United States United States |

24.5% |

| OECD Average |

| Rank | Country | Tax Revenue as % of GDP |

|---|---|---|

| 31 |  Turkey Turkey |

23.1% |

| 32 |  Ireland Ireland |

22.7% |

| 33 |  Chile Chile |

20.7% |

| 34 |  Colombia Colombia |

19.7% |

| 35 |  Mexico Mexico |

16.5% |

| OECD Average |

At 46.3%, Denmark has the highest ratio on the list. The country puts its relatively high tax revenue to use, particularly when it comes to subsidizing post-secondary education—in Denmark, university is free for all EU citizens.

On the less-taxed end of the spectrum, the U.S. ranks 30 out of 35, with a ratio of 24.5%—that’s notably lower than the OECD average of 33.8%…

Where does America’s tax revenue come from? It gains most of its revenue from the personal income tax. In fact, 41% of the country’s total tax revenue comes from taxes on personal income, as well as individual profits and gains—for context, the OECD average is 24%. With President Biden’s recent announcement to increase corporate taxes and personal investment gains, America’s ratio could look a lot different in the near future.

Editor’s Note: The original article by Carmen Ang has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

It would be interesting to know if Denmark’s high taxation rate to fund free college, for students coming from all over the EU, pays off. Do college graduates stay in Denmark? Does their presence raise the national income level? And do the high taxes they pay then become their way of compensating the state for their free education?