History, as well as recent action, suggests that weakness in the stock market is more crucial to gold’s future than weakness in the US Dollar.

more crucial to gold’s future than weakness in the US Dollar.

The original article has been edited here for length (…) and clarity ([ ]). For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE tri-weekly Market Intelligence Report newsletter (see sample here)

We do not want to diminish the impact of the US Dollar with respect to gold but its weakness from early 2017 into Q1 2018 failed to impact the precious metals sector in a meaningful way…Moreover, during the recent decline in the US Dollar index from nearly 104 to 88, the stock market outperformed gold, gold stocks, and silver. Clearly, gold needs something else to happen to trigger its bull market.

Gold has continued to underperform the stock market and, from an intermarket perspective, this has prevented it from starting a real bull market. History argues that gold cannot be in a real and significant bull market unless it is outperforming the stock market.

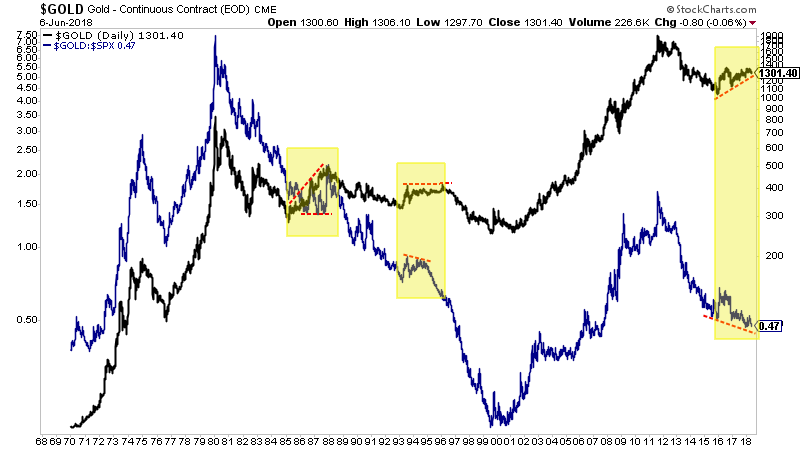

In the chart below we plot gold (blue) along with the gold to S&P 500 ratio (black).

In the 1970s and 2000s, the two plots are trending in the same direction [but] note what happened during the 1993 to 1996 period, the 1985-1987 period as well as during the past few years. These were gold “bull markets” but they were quite weak as gold did not consistently outperform the stock market during these periods. (As an aside, gold only outperformed the stock market in late 1987 after the stock market crashed and the precious metals bull ended. Despite a massive dollar decline in the mid-1980s, gold only enjoyed a merely decent run).

The reality is, real interest rates tend to follow the stock market and If the stock market continues to rise, then the economy is performing well and that means the Fed will continue to hike rates. That means real rates (at least on the short end and that is what impacts gold) will remain stable or even rise.

…Note the similarities between today and the 1999-2001 cycle. Interestingly, the stock market peaked in March 2000, which was 16 months before the US Dollar peaked.

- If the current rebound in the US Dollar is the start of a much bigger move, then I would expect the stock market to peak before the US Dollar.

- The other bullish catalyst for gold (an acceleration in inflation) is also bearish for the stock market as rising inflation leads to falling margins (for corporations) and falling multiples for stocks.

Conclusion

In any case, it’s quite clear that a big bull market in gold will not begin or take place without first a bear market in stocks. A bear market in stocks would trigger or coincide with positive fundamental developments for gold. Sure, a decline in the US Dollar can certainly stabilize gold or support rallies in the interim. However, Gold’s outperformance of the stock market is more important (than a falling dollar) for it to begin a big bull market…

Support our work: like us on Facebook, follow us on Twitter, or share this article with a friend. munKNEE.com – Voted the internet’s “most unique” financial site! (Here’s why)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money