Regular home buyers are wondering why they are unable to partake in the American Dream of owning a home now that they actually have to document their income and put some skin in the game. The reason is that the current median selling price of $201,000 puts real estate out of reach for most Americans earning the typical $50,000 a year unless they go into massive levels of debt. They are too broke to own a home!

The above are edited excerpts from an article by mybudget.com originally entitled You are too broke to own a home in America! The typical American household making $50,000 a year cannot afford to purchase the typical $200,000 median priced home without straining their budget.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in further edited excerpts:

Housing values far outpacing overall inflation and income gains

The housing market is quickly outpacing any sort of normal inflationary gains. The BLS CPI measure of course is missing the entire jump from last year because it is focused only on what a home would yield in rent. This is a poor measure but then again, this missed the previous housing bust.

Housing will consume the biggest portion of your income regardless of you being a renter or an actual home owner. Owning a primary residence is not an investment! An investment usually kicks money back your way instead of draining it out of your wallet. Of course there is so much propaganda on owning that people continue to buy even if prices are far beyond their reach.

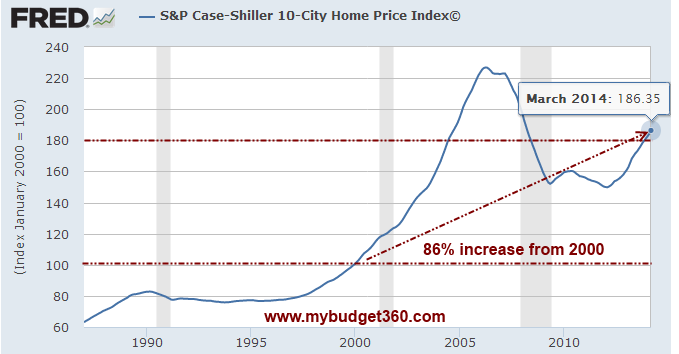

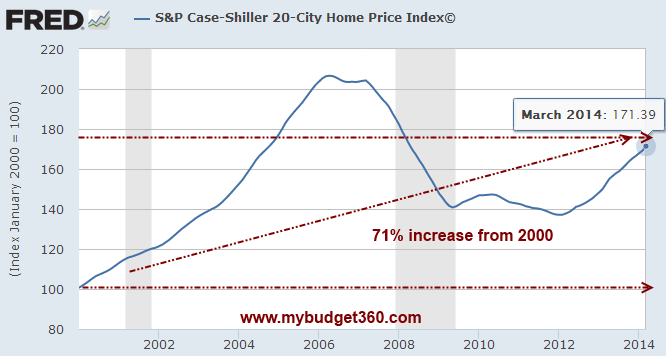

First, it might be useful to take a look at true housing values via the Case Shiller Index and how they have performed since 2000:

The Case Shiller 10 City index has prices up 86% from 2000 and 71% if we look at the newer 20 City Index:

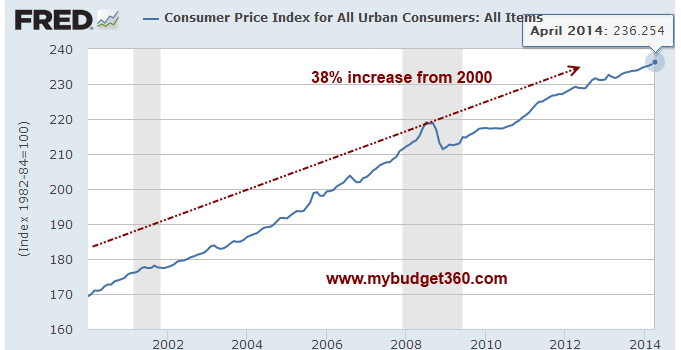

It would then be useful to see how this compares to the overall inflation rate since 2000:

Source: BLS

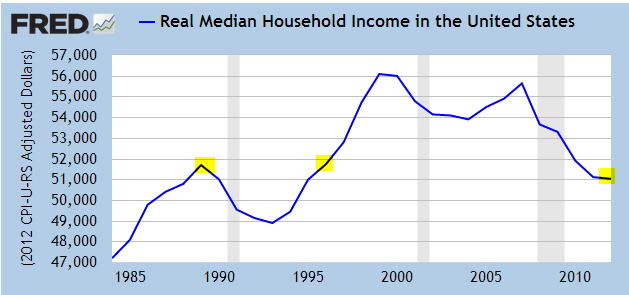

That is interesting. According to the CPI inflation is up 38% since 2000 so why are housing prices going up nearly twice the rate of the CPI? Thanks to our current financial system debt is the currency of choice from banks and the system is flooded with easy money. The only problem of course is that banks and investors are crowding out regular buyers in this new market because U.S. households have seen no inflation adjusted wage growth for nearly a generation:

In other words, households are too broke to purchase in today’s market! Even with low interest rates a regular U.S. household cannot buy the median priced home of $201,000 with the median household income of $50,000 without stretching their budget and foregoing retirement planning.

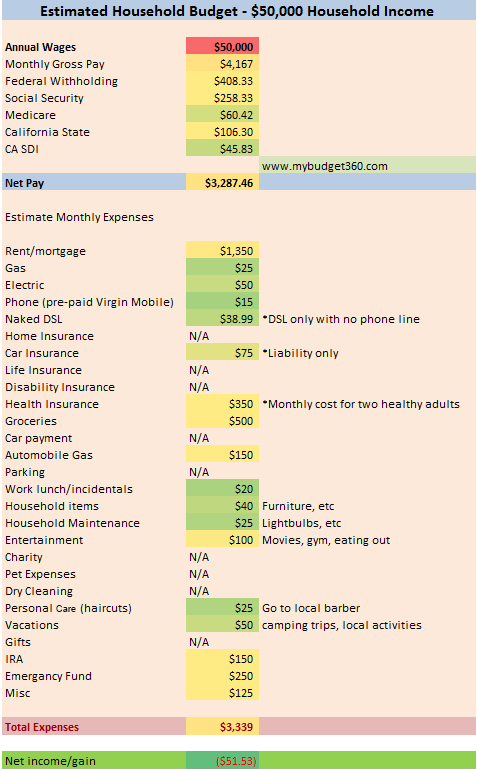

It might help to look at a budget for this household:

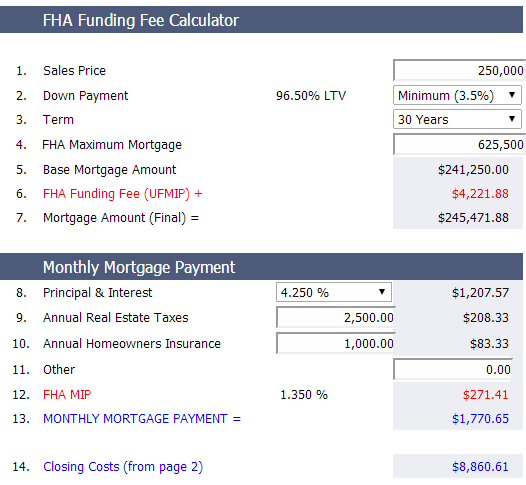

The above budget is examining a household in California. First, good luck finding an affordable house in the state (keep in mind the median income in the state is roughly $60,000 so don’t think it is far off from the above budget). Let’s assume this hypothetical family found a home in a lower priced city of California for $250,000. Can they afford it? No! But of course, we have FHA backed loans that allow people to buy with only 3.5 percent down:

The above household will be dishing out $1,770 a month, or more than 53 percent of their net take home pay on their housing payment. Most buyers are going in with very little down outside of the big investors. The regular household would be hard pressed for a 10 percent down payment ($20,000) let alone a 20 percent down payment ($40,000). You already see in the budget that this will severely cut into their retirement planning.

Most Americans are winging it when it comes to retirement. For those that own, their retirement plan is their home but a home does not throw off income!

I think it is critical to understand what is going on here and that is that housing is becoming unaffordable to many throughout the country.

Many will take on debt and put every extra penny into their property. They forget to plan for retirement or to save for things outside of housing. This is why we now have an impending retirement crisis on hand.

[Even if]…you now pay off your home…you still have insurance, taxes, and maintenance forever! Where is your income going to come from in retirement? Certainly not your home unless you sell but then you still need shelter. Most people don’t think this far out and are betting that Social Security will be there for 10, 20, or 30 years of their retirement and will provide them with enough to comfortably get by. That is not going to be the case.Conclusion

The fact that housing values jumped in 2013 because of investor money, and regular buyers are out of the market, should tell you something – most Americans are too broke to buy. Of course many will go into massive debt trying to cling on to the fading ideals of the American Dream. You need to run the numbers carefully and realize that owning a home is not a clear cut decision.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.mybudget360.com/too-broke-to-own-a-home-income-housing-values-budget-median-home-value-united-states/

Related Articles:

1. Is a House/Condo a Good “Investment”? Hardly! Here’s Why

Most people seem to think owning a house is a great “investment” but, in actual fact, when you look at the numbers closely, such an acquisition is anything but. Let me explain with supporting evidence. Read More »

2. The Average Home “Owner” Is Totally Out of Touch With Reality! Here’s Why

A recent Gallup survey on expected future returns of asset prices shows that most Americans still think that owning a home is the best way to generate a high return in the future. Nothing could be further from the truth! It just shows how totally out of touch with reality the average American is. Read More »

3. Your House: A Home, An Investment or a Ponzi Scheme?

In the past few decades, the concept of home ownership has been completely turned on its head. Previously, homes were considered a very long-term consumption good…[No one] ever considered tripling the value of their homes by retirement time and selling them to move beachside yet, somehow along the way, this became a reasonable investment expectation. Even today, home buyers still make their purchases with the hopes of escalating prices. [It begs answers to these questions: Is a house just a home? Should a house be expected to behave like an investment? Is the housing game nothing more than a Ponzi scheme where the end buyer before the market corrects becomes the “greater fool”? Let’s try and answer those questions.] Words: 935 Read More »

4. How Much Do Americans Earn?

How much does the typical American family make? This question is probably one of the most central in figuring out how we can go about fixing our current economic malaise. In this article we break down the U.S. household income numbers. Words: 464 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money