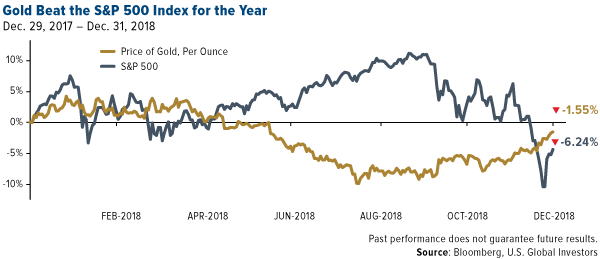

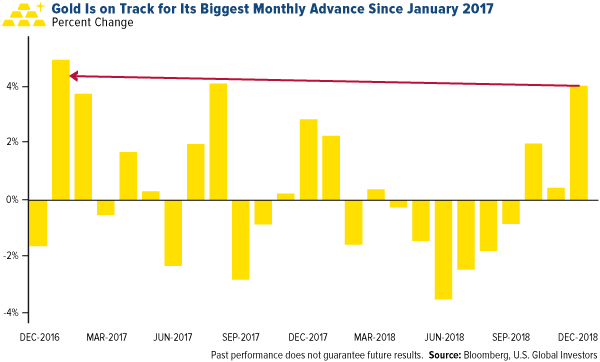

“…U.S. stocks just logged their worst year since 2008—their worst December since 1931—as fears over global trade, ballooning debt, the end of accommodative central bank policy and a U.S. government shutdown unsettled investors. Against this backdrop, the price of gold rallied late in 2018, reversing a trend of negative returns and weak investor demand that prevailed for most of the year.”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[Editor’s Note: This version* of the original article by Frank Holmes has been edited ([ ]), restructured and abridged (…) by 49% for a FASTER – and easier – read. Please note: This complete paragraph must be included in any re-posting to avoid copyright infringement.]

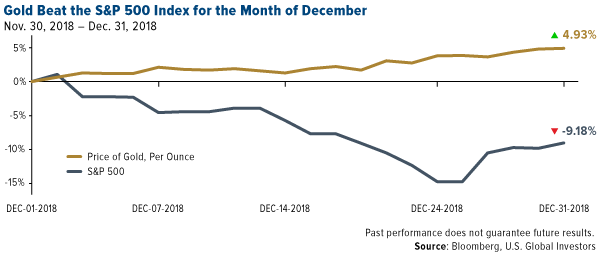

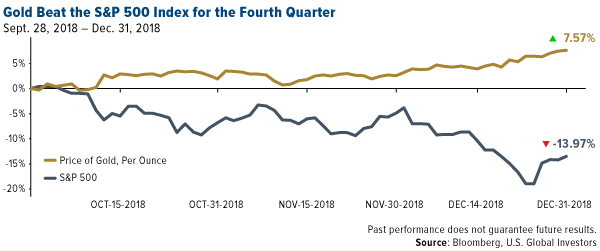

“The yellow metal…has historically had a strong negative correlation with the market…[and] this inverse relationship held firm in 2018, proving again that investors continue to see gold as a valuable asset in times of financial instability. As you can see in the charts below:

1. Gold beat the S&P 500 Index for the month of December, 2018

2. Gold beat the S&P 500 Index for the 4th quarter of 2018

3. Gold beat the S&P 500 Index in 2018

4. Gold is on track in January 2019 to have its biggest advance since January 2017

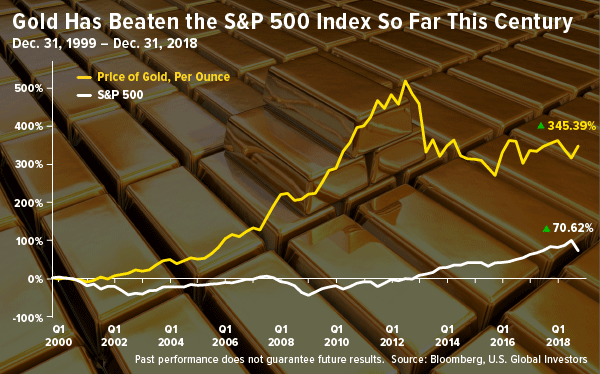

5. Gold Has Consistently Outperformed During Last 19 years

Conclusion

Conclusion

…[The above charts] tell me that, even though gold is still down from its 2011 peak, investors continue to value it as an attractive store of value.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money