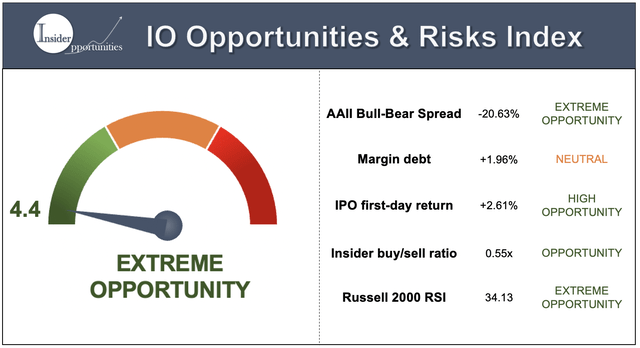

…[My newly developed] Opportunities & Risks Index is a “better version” of the CNN Fear & Greed Index…[in that it] has been an extremely accurate bottom predictor over the past decade…[and] has also been a good predictor for future corrections. [I explain why that is the case below.]

This article is sponsored by David MacOdrum. Go HERE to sponsor your own.

The upcoming monetary tightening cycle caused by record-high inflation and the Russia-Ukraine war has caused the stock market to drop significantly. As such, the O&R Index has come down drastically from its March 2021 highs of 98.8. Currently, the index is trading at 4.4, indicating that the recent fear in the markets has created extreme buying opportunities.

…On Feb. 24, we wrote an article for our members advising them that it was time to buy the dip aggressively. As bad as it is for humanity, the Ukraine situation should not have an impact on the stock market. Our O&R Index reached a low of 4.4, the most fearful level since the 2018 correction. A big buying sign….[and] in the past, such extreme fear has been followed by an average 3-year return of 64.80% for the Russell 2000.

Based on the O&R Index, we’re confident that long-term returns will be very strong from today’s levels. As such, we advise to put cash at work and position your portfolio aggressively. However, it’s very important to pick out the right investments given today’s unique economic environment.

…If you’re targeting strong long-term returns, today is not the day to make your portfolio defensive. Today is the day to become an aggressive buyer… as I expect stocks to rise in the coming months as sentiment turns to normalcy [but] be aware that the coming weeks might remain volatile. Enjoy the gains, but don’t get too greedy during the run-up. When the market becomes greedy again, think back about this article.

(If you are you interested in which stocks the smart money is buying during this correction and think that your portfolio needs better risk management based on a proven method then don’t hesitate to join our investment service Insider Opportunities now. Find out how our insider strategy and IO O&R Index helps hundreds of investors like you improving their long-term returns in the stock market. Don’t hesitate to start a 14-day FREE trial now!)

The above version of the original article by Robbe Delaet was edited [ ] and abridged (…) to provide you with a faster and easier read. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Please Donate Some MONEY to munKNEE.com – Thank You!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money