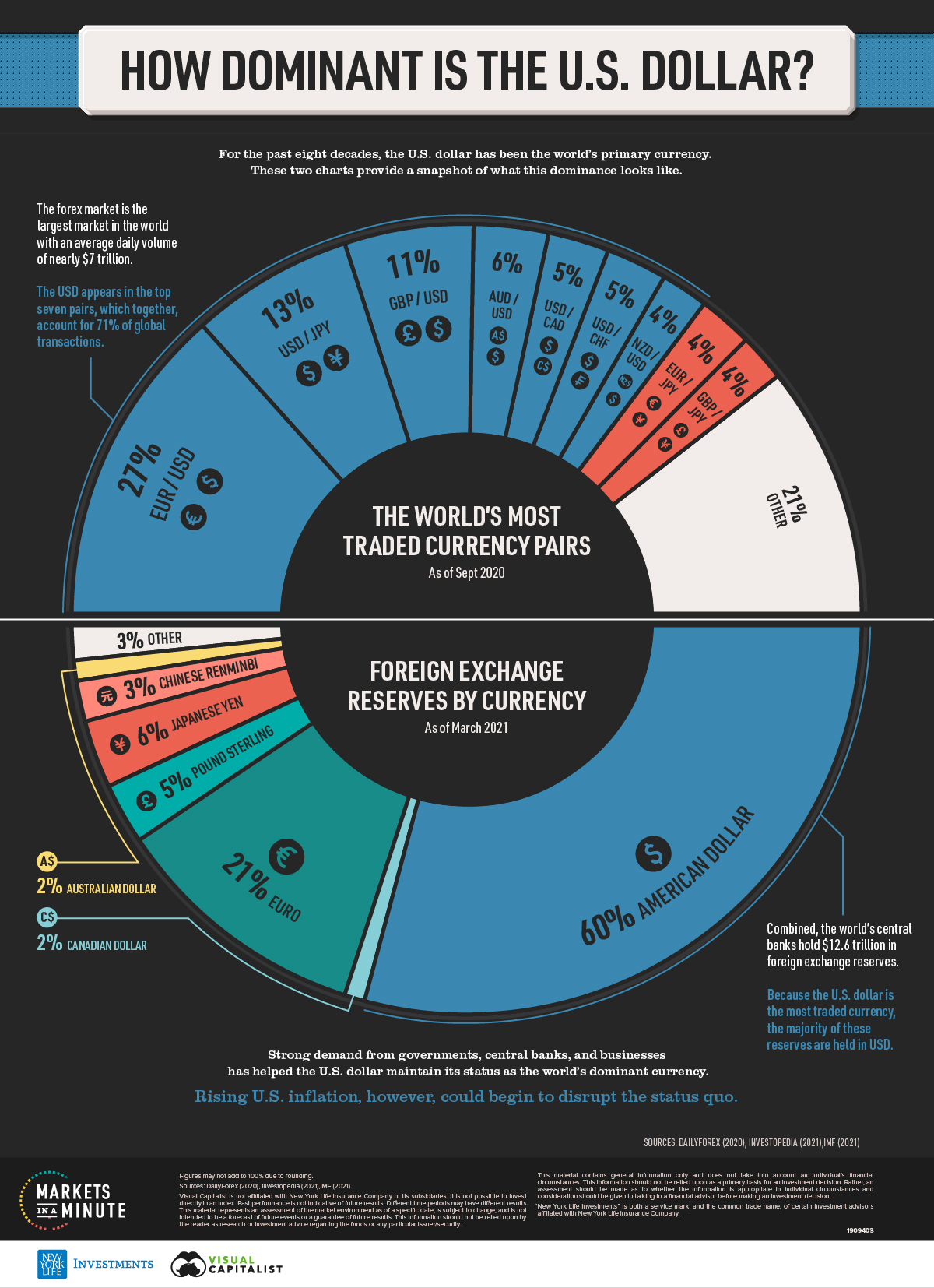

The U.S. dollar has been the world’s dominant currency since the end of World War II…[with] roughly half of international trade, international loans, and global debt securities being denominated in USD as illustrated in the graphic below.

How Dominant Is the U.S. Dollar?

How Long Will The U.S. Dollar Reign?

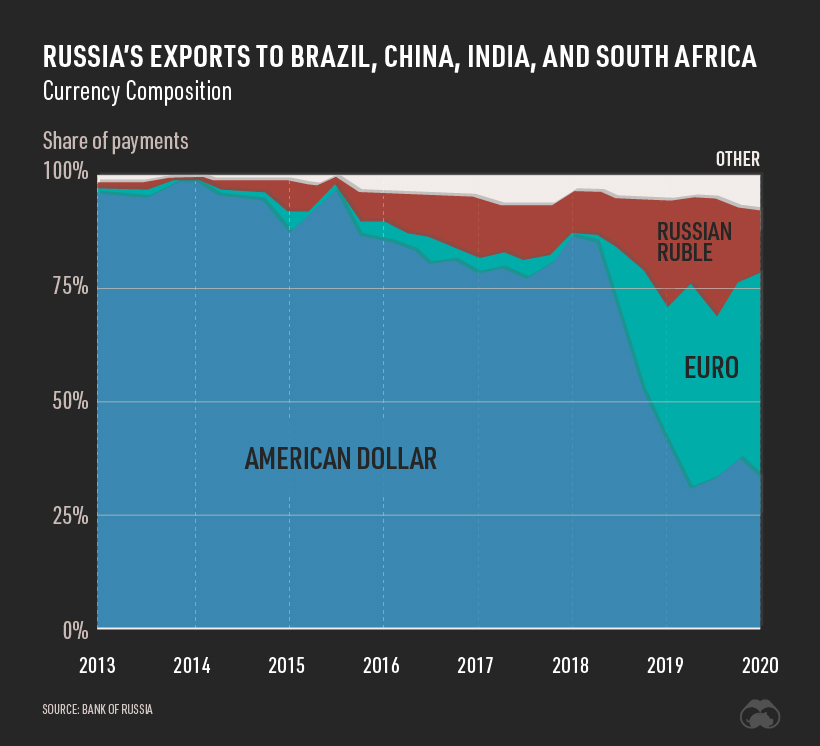

@$Today’s shifting geopolitical and economic landscape presents challenges to the U.S. dollar’s global status. Russia and China have been working towards a closer financial alliance. As of Q1 2020, just 45% of trade between the two nations was denominated in USD, down from 90% in late 2015. @HELP

Another threat to the USD’s dominance is the use of financial sanctions, which limit foreign access to the U.S. financial system. While these sanctions may be effective from a foreign policy perspective, they can also undermine the global role of the USD. The following chart illustrates how Russia has circumvented the U.S. dollar in the face of American sanctions.

What About Inflation?

…In some respects, higher inflation can be a positive. The U.S. debt to GDP ratio is currently over 100%, and by 2050, it’s expected to reach 195%. With so much debt being issued, sustained inflation can gradually undermine the real value of these liabilities. The tradeoff, of course, is a further weakening of the U.S. dollar.

Editor’s Note:

The above version of the original article by (visualcapitalist.com) was slightly edited for a faster and easier read.

Please donate what you can towards the costs involved in providing this article and those to come. Contribute by Paypal or credit card.

Thank you Dom for your recent $50 donation!

1. What Would USD Collapse Mean for the World? (+25K Views)

I came to the conclusion several years ago that it was just a matter of time before the world realized that the relative functionality of the U.S. dollar was about to go belly up – to collapse. Below is an explanation as to why I have come to that conclusion and what I think it would mean for the well-being of the world.

2. U.S. Dollar Will Collapse When This Upcoming Event Happens (+110K Views)

If we want to better understand the answer to the elusive question of “When will the fiat US dollar collapse?”, we have to watch the petrodollar system and the factors affecting it.

Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583

4. The Developing Disaster Facing the U.S. Dollar & the World (+13K Views)

When the supply of something is increased sharply relative to demand, the value of that commodity will decline. If the supply continues to increase rapidly and indefinitely, then that item will become worth less and less, with the potential to finally become nearly worthless. This is the Developing Disaster facing the US Dollar and the world. This is the factor that could become the single most important criterion in investment allocation decisions and possibly even for individual financial survival.

5. Coming Currency Superstorm Will Be Absolutely Catastrophic for U.S. Economy (+4K Views)

What would happen if someday the rest of the world decides to reject the U.S. dollar and that process suddenly reversed and a tsunami of U.S. dollars come flooding back to this country? It is frightening to think about. Just take a moment and think of the worst superstorm that you can possibly imagine, and then replace every drop of rain with a dollar bill. The giant currency superstorm that will eventually hit this nation will be far worse than that.

6. The Collapse of the U.S. Dollar is Unavoidable! Here’s Why (+5K Views)

The mother of all collapses is still in front of us. Below are my reasons why that is the case and how to protect yourself financially from such an eventuality.

7. Massive Debt = Dollar Collapse = High Inflation = Likely Depression (+4K Views)

The value of a currency is determined by a number of variables. In this article, I will focus on the dynamics of demand, supply, current account deficits, and aggregate government debt.

Recent trading patterns suggest that if King Dollar doesn’t reverse higher soon, it may be an indication that investors are losing faith in it.

9. The U.S. Dollar Index: A Deceptive Indicator of USD Strength (+3K Views)

Most of the major financial news outlets and many investors have come to rely on the movements of the U.S. Dollar Index as a daily barometer of the U.S. dollar’s relative strength and weakness taking it on faith that the Dollar Index is the dollar – pure and simple. In reality, the Index offers a very distortive view of the movement of the dollar against the currencies that matter most. If anything, recent movements of the Index are a reflection of euro weakness rather than dollar strength. Words: 1019

10. What’s Happened – and Will Continue to Happen – to the Value of the U.S. Dollar (+7K Views)

Technically the U.S. left the gold standard in 1971 but, in reality, we abandoned it in 1913 with the creation of the Fed…setting the stage for the collapse of the dollar. [Given that this is] the 100th anniversary of the creation of the Federal Reserve, it seems only fitting that we should present a brief history of the U.S. dollar debasement since then. Words: 1144

With less countries and organizations using the dollar to settle international transactions, it slowly chips away at its hegemony of the U.S. dollar as the world’s reserve currency. China is at the epicenter of this transition and is making continued progress in cutting deals outside of the U.S. dollar framework. Deals shown in the infographic are currency flows between countries that have abandoned the dollar in bilateral trade, as well as countries that are considering such measures.

12. The U.S. Should Relinquish Reserve Status for its Dollar – Here’s Why (+5K Views)

Conspiracy theory notwithstanding, claims that the reserve status of the U.S. dollar unfairly benefits the U.S. are no longer true. On the contrary, it has become a burden, both for America and the world. [Let me explain.] Words: 825

13. Here’s How (and Why) the Collapse of the U.S. Dollar Could Unfold (+4K Views)

Imagine if the Fed and the Big Banks are actually planning on the US Dollar to tank! If that is, indeed, the case, here is how I imagine such a coup would unfold.

Our monetary system is guaranteed to collapse. The central banks prints money like there is no tomorrow. The governments spends like a drunken sailor and yet inflation is benign and interest rates sit at generational lows. Banks are gaining in profitability while their bad debts are being erased by rising asset prices. What’s not to like? Plenty! This article goes into the details of the money creation process to understand how and why this is happening, what the future implications will be and how to best invest to protect oneself from these eventualities.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

About the US Dollar. That’s not true. Have you seen the US Dollar chart. It is in breakout mode and is at 97 on the Dollar Index. It’s heading to 150. The Euro is collapsing and money is flowing into the dollar from around the world.

Sure Uncle Sam, you can print trillions of Dollars to infinity, run a yearly massive budget deficits and your currency will become stronger. Tell that to Germany of the 1920’s, Venezuela or Zimbabwe. The house that I bought 30 years ago for $54,500 sells at today’s fiat dollars for $600,000, the house that I bought for $411,000 20 years ago, just sold for $1,360,000. What is going to be the value of these properties in US fiat paper money in 10 years?