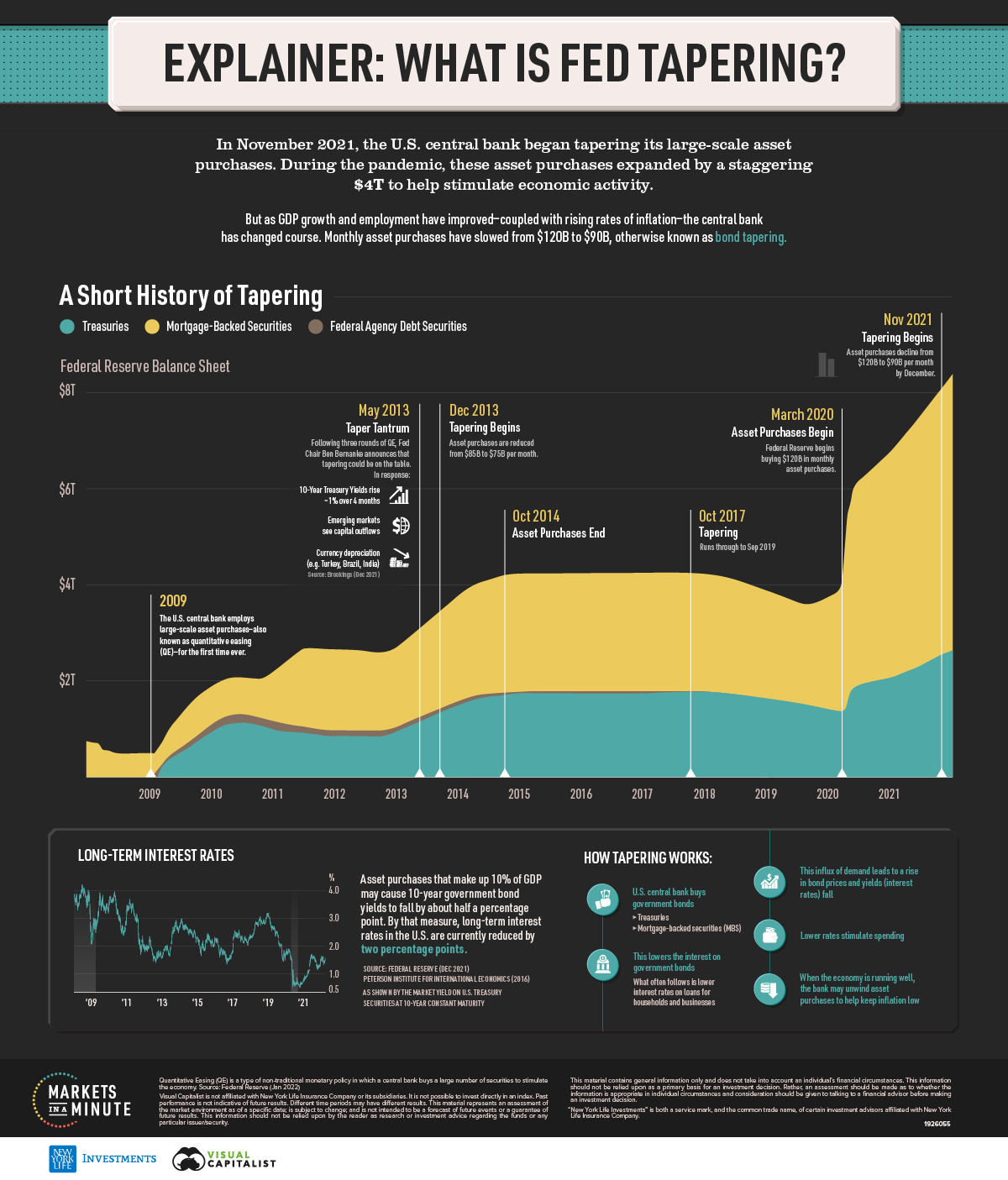

This infographic from New York Life Investments shows how Fed tapering works, and its impact on the economy.

What is Fed Tapering?

Fed tapering is the unwinding of the Federal Reserve’s large-scale asset purchases.

How Does Fed Tapering Work?

Here’s how it works:

- The U.S. central bank buys government bonds typically in the form of Treasuries and mortgage-backed securities (MBS).

- This influx of demand leads to a rise in these bond prices and their yields (interest rates) fall.

- As this lowers the interest rate on the government bonds, what often follows is lower interest rates on loans for households and businesses.

- Lower rates stimulate spending.

- When the economy is running well, the bank may unwind asset purchases to help keep inflation low, otherwise known as Fed tapering.

How Does Fed Tapering Impact Inflation?

By tapering asset purchases, the amount of money circulating in the economy that can be used to borrow to buy a house or car is reduced. According to this theory, when there is less spending, inflation will gradually cool down.

As CPI and financial markets have soared over the pandemic, investors will be watching closely to see how Fed tapering impacts future monetary policy.

Editor’s Note:

The above version of the original article by Dorothy Neufeld (visualcapitalist.com) was edited for a fast and easy read.

Please donate what you can towards the costs involved in providing this article and those to come. Contribute by Paypal or credit card.

Thank you Dom for your recent $50 donation!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money