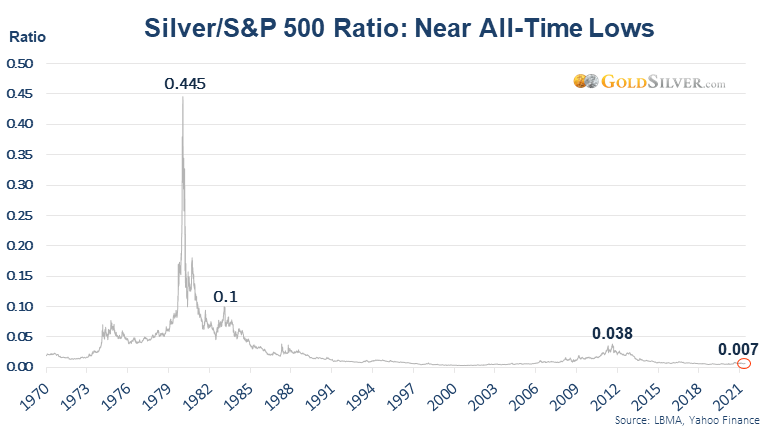

The stock market bubble continues to inflate, while the price of silver remains range-bound but a reversal in those two asset classes is coming, and based on history it could be one for the record books. In fact, you might want to refrain from sipping hot coffee while viewing the tables below.

To the surprise of many mainstream investors, silver outperformed all major stock indexes last year; it’s more than doubled since the selloff in March 2020 and it’s up 6% so far in 2021 yet, compared to the general stock market, silver is still near its all-time low.

The rise in the silver price over the past year, however, has done virtually nothing to improve this ratio. In fact, only at the beginning of the new millennia has this ratio been lower than it is right now…Compared to today, the ratio was:

- 4.4x higher in 2011

- 13.3x higher in 1983

- and a whopping 62.5x higher in 1980!

The point here is obvious. If history were to repeat and the ratio returned to any of these prior levels, it means stocks are headed lower (and probably by a lot), while silver would climb higher (and probably by a lot). Sure, since it’s a ratio only one of those things could happen while the other stays stagnant, but the more likely scenario is they both move.

The following tables show what would happen to the prices of silver and the S&P 500 if the three ratios above were to be hit from current levels. To keep it simple, the tables are calculated from 4,200 for the S&P and $28 for silver.

1. If the ratio returned to its 2011 high of .038, here are various prices for silver and the S&P 500 we could see:

The silver price would have to approach $200 before the S&P 500 would avoid any losses.

- If silver hit $100, it would represent a rise of 257%, while the S&P would lose 40%.

- If silver hit $500 the S&P would nearly triple from current levels, but that would mean silver would rise almost 17 times from its present price.

2. While this scenario is sobering, it only gets worse for stock investors. Here’s what silver and S&P prices would look like if the ratio matched its 1983 high of 0.1:

At this ratio,

- stock investors would only see a gain if silver climbs to $500—in all other scenarios they lose, and in most cases dramatically.

- A $200 silver price would mean the S&P falls by over half. This isn’t farfetched, since again, this ratio has occurred before—and $200 silver wouldn’t even match the 1979/1980 advance of 743%.

3. Now it’s time to set your coffee cup down… a rematch of the 1980 high of .445 represents a complete wipeout of the broad stock market.

…At this ratio the silver price would have to rise to over $2,000 a troy ounce before the S&P registers no loss.

These are not pretend prices, model projections, or wishful thinking on the part of silver bugs. All these ratios have occurred before and, given where the ratio currently sits, the odds of it moving significantly higher are indeed very strong.

Conclusion

When the silver/S&P 500 ratio begins to reverse, stock losses will mount and silver’s gains will grow. Based on history the moves will probably be substantial for both sets of investors…

Given that stocks don’t run up forever, and that silver is deeply undervalued on a relative basis and will almost certainly rise over the next few years, might it not be wise to allocate a portion of your portfolio to silver now? Just don’t wait too long, though, as silver tends to spike suddenly and violently. If you don’t own any silver, I encourage you to buy some now. At the current ratio, your risk is very low.

Editor’s Note: The above version of the original article by Jeff Clark, has been edited ([ ]) and abridged (…) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money