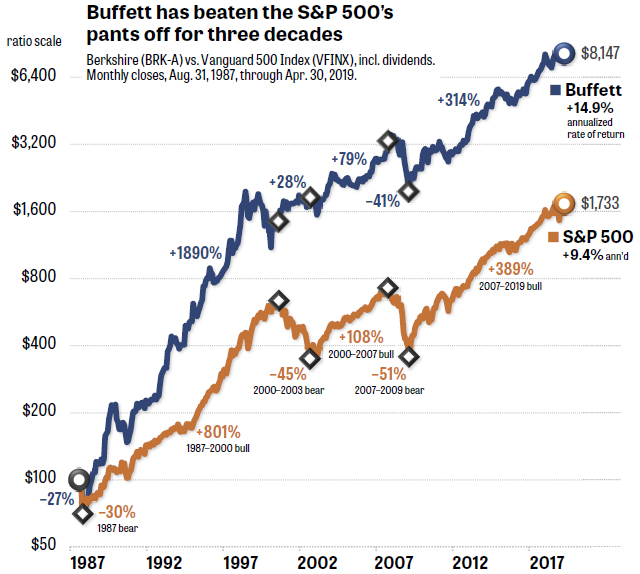

Beating the S&P 500 is so difficult that the index outperforms most active money managers but Warren Buffett has consistently done so. Over the last 30 years BRK.A has had an average annualized total return of 14.9%, while the S&P 500 has returned 9.4%.

…The following chart compares the total return of BRK.A against the total return of the S&P 500 over the past 30 years:

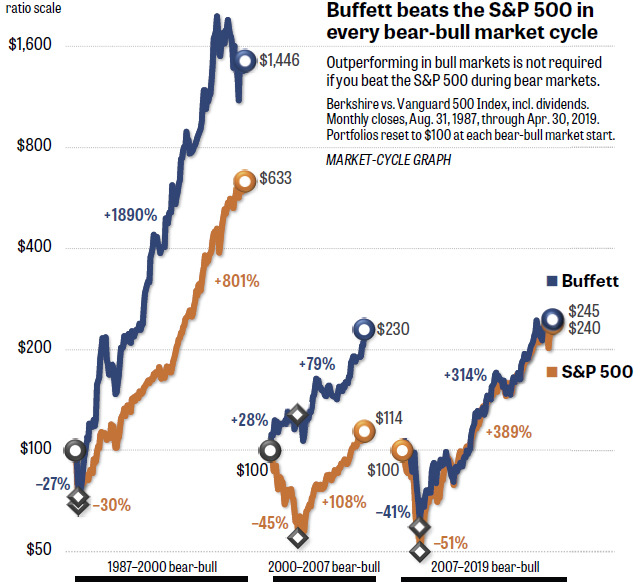

…The chart below shows that Buffett bested the S&P 500 in every bear-bull market cycle during that period but the margin between the two has narrowed as the years have passed to the point where, from 2007 to the present, Buffett’s investing prowess has been consistent with the S&P 500’s return…

Given the above, it’s no wonder then why the aging billionaire is leaving instructions for his estate to invest in the S&P 500 for the benefit of his survivors after he passes away.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

No disptute about the performance of the Buffett partnerhip from 1956 to 1969 when it ceased. But that was 50 years ago.

In the “here and now”. during the last 10 years, Berkshire Class A had a CAGR of 12.8% (no dividend) whereas the S&P 500 returned just under 14% (including dividends).

That’s a DECADE of slight under-performance. In other words, in the last 10 years, my 93 year old grandmother, blind in one eye and walks with a cane could have PASSIVELY invested in a S&P ETF such as SPY and out-peformed Warren baby.

We’ll save recent investments in DaVita and Teva Pharmaceuticals for another day. Ditto for Paul Bunyan and Casey Jones.

Dear Lorimer,

If Buffet thinks the S&P is second best–and best for his heirs–why don’t all investors simply invest in it, and come closest to Buffet’s returns with little risk?

My weekly thanks to you,

Bernard