…Palladium has surged a massive 17% in just nine trading days on concerns about supply from Russia which is the world’s largest producer of palladium accounting for 40% to 50% of total global palladium.

The original article has been edited here for length (…) and clarity ([ ])

…Global palladium demand outstripped supply by 23 tonnes (25.4 tons) in 2017, so depleted stocks of this very rare and finite metal were already running low. Palladium is a key component in the global car industry and this will cause difficulties for international car manufacturers.

Palladium in USD 20 Years – Macrotrends.net

Were Russia to restrict the supply of palladium due to the bombing of Syria against its will or, indeed, due to the latest round of sanctions, palladium prices will see even greater gains.

Stocks have remained buoyant so far but the U.S. dollar and U.S. bonds have seen selling pressure. The long term fiscal outlook for Trump’s America is increasingly precarious with $1 trillion plus budget deficits being projected for the foreseeable future. This makes the dollar vulnerable in the medium and long term and underlines the case for owning the precious metals of gold, silver, platinum and palladium.

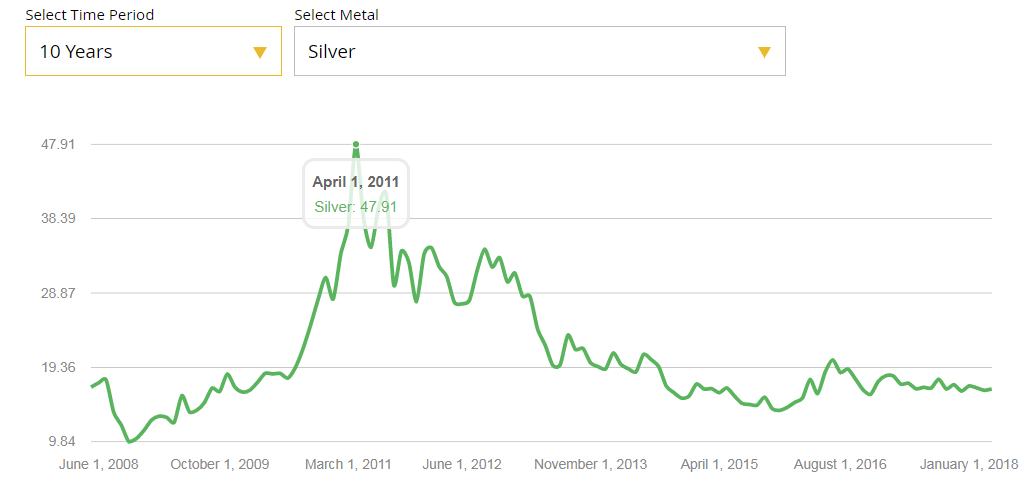

The fundamentals of very depressed silver are arguably even better than palladium. Palladium is not far from all time record nominal highs (see chart above) while silver at just over $17/oz languishes some 65% below its record highs of near $50/ozt in April 2011.

Silver is arguably the cheapest and best value asset in the ‘inflated assets’ world of today. Due to the very positive supply demand fundamentals for silver, including increasing investment demand from the “prudent smart money”, expect silver to see similar sharp gains once it has a weekly close and breaks out above $18.50/oz.

Larger allocations to gold are merited, then silver and investors should consider very small allocations to platinum and palladium.

Related Articles From the munKNEE Vault:

1. Silver Prices: How High Will They Go? $100? $300? $500?

Silver prices have risen exponentially for the past 90 years as the dollar has been consistently devalued. Expect continued silver price rises.

2. Silver Is In A Massive Bull Market – Here’s Why

It’s Economics 101. Price works to balance supply and demand. Limited supply causes higher prices; higher prices help curb demand…[and] that equation is playing out right now in the silver market. Mined silver supplies have been drying up over the past few years, while silver prices have climbed 20% in the same time frame…

3. Silver Is A “Must Own” – Here’s Why

Silver has often rebounded nearly 100% within 12-15 months after bad and long bear markets. History says Silver is ripe for a similar move over the next 12 to 18 months.

4. Silver is Now Even More Precious Than Gold! Do You Own Any?

Silver is now rarer than gold and will be for all of eternity. From this point forth we work from current silver production alone and, from this point forth, demand will outstrip production without exception. Can you imagine what that means for the future price of this, indeed, precious metal? Forget about the popular expression: ‘Got gold?’ The much more important – and potentially more profitable – question to ask these days is, ‘Got silver?’

5. Silver Is THE Antidote to Bubble Craziness – Here’s Why

Silver in early 2018 is inexpensive compared to M3, National Debt, government expenditures, the Dow and gold.

6. In Coming Upsurge Silver Will Move Up Almost 4x As Fast As Gold! Here’s Why

The moves in gold and silver will be explosive. The time to own physical gold and silver is today and not when they move to new highs. Both metals are at inflation adjusted historical lows and the downside risk is minimal. Also, they probably are the most undervalued of all assets currently.

7. A Breakout In the Silver-Gold Ratio Could Spring Silver Much Higher & Carry Gold With It

A breakout here would “spring” silver much higher, and likely carry gold with it. Precious metals investors need to be watching this ratio here!

8. Silver Could Hit $150 A Troy Ounce – Here’s Why

…A collapse of the U.S. dollar is inevitable. The U.S. Dollar Index has been bouncing off of four-year lows for the past several weeks but this cannot last much longer with a global trade war and U.S. equity correction looming….The U.S. dollar and fiat currencies are in trouble, hinting that gold and silver prices could again go screaming higher…[as] the two still generally trade inverse to each other and, while gold is perhaps the safest way to hedge against a falling dollar, the most profitable option is silver.

9. The Silver Setup Is Stunning – Absolutely Stunning!

A major new silver bull market looks imminent and is expected to kick off with a dramatic spike.

10. The Case For $2,450/ozt. Platinum!

The Platinum:Palladium and Gold:Platinum Ratios, plus the decline in supply growth, suggest that we could see much higher platinum prices in the years to come – perhaps by as much as 160.6% were its pricing to revert back to the historical mean.

11. Supply & Prices of Platinum Could Radically Change Soon – Here’s Why

It’s crunch time for global platinum. With events kicking off this week that could radically change the outlook for supply — and prices — over the coming weeks and months.

12. All the Facts About Physical Platinum & Palladium and How to Easily Invest in Them

With demand rising and supply under pressure, the outlook for investment in physical platinum and palladium is compelling. What are they used for? Where are they produced? What is the global supply/demand for each? Learn the full story from the infographic below.

13. Platinum is Downright “Cheap” Relative to ALL Other Precious Metals! Have You Any in Your Portfolio?

If this precious metals bull market continues over the next couple of years, I think one would [be well served to] diversify some assets in gold/silver into platinum. [Let me explain the present relationship between platinum, gold, silver and palladium and why I make the aforementioned recommendation.]

14. Platinum:Gold Ratio Suggests Platinum Will Do Even Better Than Gold in the Future

These days there’s so much interest in gold and silver it can be easy to forget that there are a number of other precious metals out there that investors should be considering for their portfolios. While gold and silver should form the core of any metals portfolio, there’s at least one other metal that merits serious attention and that is platinum. [Let me explain why.]

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money