The first rule of personal finance is never carry a credit card balance. It’s another one of those simple to understand yet difficult to execute money management concepts for a large swath of the population.

balance. It’s another one of those simple to understand yet difficult to execute money management concepts for a large swath of the population.

The original article has been edited for length (…) and clarity ([ ]) by munKNEE.com to provide a fast & easy read. For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

The original article has been edited for length (…) and clarity ([ ]) by munKNEE.com to provide a fast & easy read. For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

…The average credit card APR rose to it’s highest average ever in 2017 at around 16%…This makes sense in that it’s an unsecured line of credit given out to borrowers with very little due diligence performed on their creditworthiness but, [on the other hand,] it’s also kind of crazy that as interest rates in nearly everything else have fallen, credit card rates haven’t budged at all.

According to a recent study from Nerd Wallet…the total outstanding amount of credit card debt was close to $905 billion in 2017, up 8% from the previous year…

The average household carries a credit card balance of $15,654. This number does include people who diligently pay off their balance every month but it’s estimated that only half of credit card holders do so.

Households with revolving credit card debt pay an average of close to $1,000 a year in interest costs (the average balance for those who don’t pay their balance each month is between $6,000-$7,000). While that’s not a ton of money in the grand scheme of things if this is money that this group is not saving elsewhere it becomes a double whammy of negative compounding through an opportunity cost to invest for the future and paying interest to tread water.

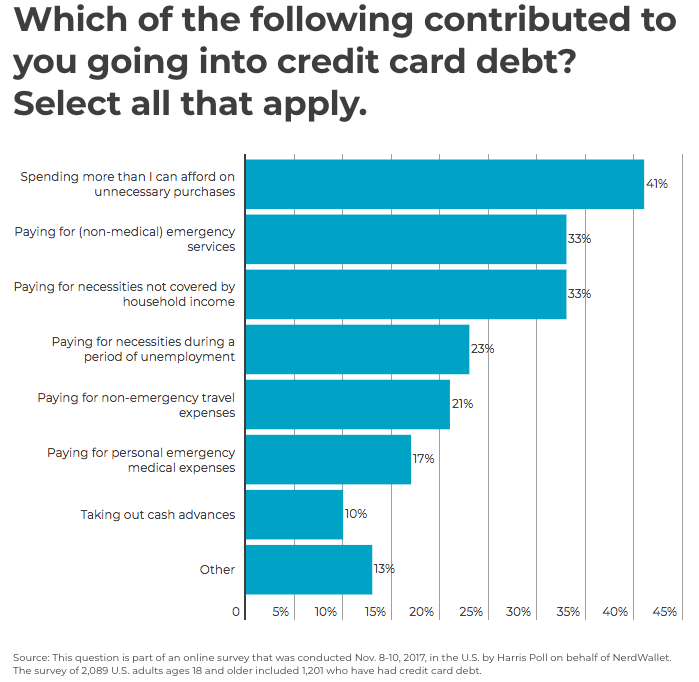

There will always be people who have no choice but to go into credit card debt because of medical expenses or some other type of emergency but it appears most people do so because they spend on things they don’t need:

…At the extremes there are two types of credit card users:

- People who pay off their balance each month and simply use a credit card for convenience and the ability to earn rewards on their purchases. This group doesn’t or shouldn’t care about credit card interest rates because they never have to pay them.

- People who pay the minimum balance, have a hard time paying it down, and accumulate more debt over time. This groups should care about credit card interest rates because they have a negative impact on their wealth.

…There will always be a large group of credit card users who carry balances that end up subsidizing those who don’t. It’s the same thing as investing in the markets where the mistakes of the losing investors lead to the spoils of the winners.

Conclusion

The first rule of personal finance is never carry a credit card balance. It’s another one of those simple to understand yet difficult to execute money management concepts for a large swath of the population.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money