…If some of the world’s largest investment funds decided to make even a small increase in their allocation to physical gold and gold stocks it would be like trying to drain Niagara Falls with a fire hose. Just a small percentage increase in allocation towards gold and gold stocks among global fund managers would make gold stocks double, and then double again – and double again.

in their allocation to physical gold and gold stocks it would be like trying to drain Niagara Falls with a fire hose. Just a small percentage increase in allocation towards gold and gold stocks among global fund managers would make gold stocks double, and then double again – and double again.

This article is an edited ([ ]) and revised (…) version of an article by Marin Katusa to ensure a faster & easier read. It may be re-posted as long as it includes a hyperlink back to this revised version to avoid copyright infringement.

This article is an edited ([ ]) and revised (…) version of an article by Marin Katusa to ensure a faster & easier read. It may be re-posted as long as it includes a hyperlink back to this revised version to avoid copyright infringement.

Extraordinary price moves can happen when money flows into a small sector

[It is important to] realize that the managers of these large investment funds are just regular people. They are as likely to fall victim to groupthink as anyone. They don’t like to stray far from the herd. They tend to make the same decisions at the same time so, when a group of large investment funds decides to buy into a market, they can put well over $100 billion to work.Typically these large investment fund managers stick to very large, very liquid markets like large-cap U.S. stocks and corporate bonds. Some, however, occasionally stray from the herd and buy into less liquid markets. For example, some of them will buy gold stocks and physical gold.

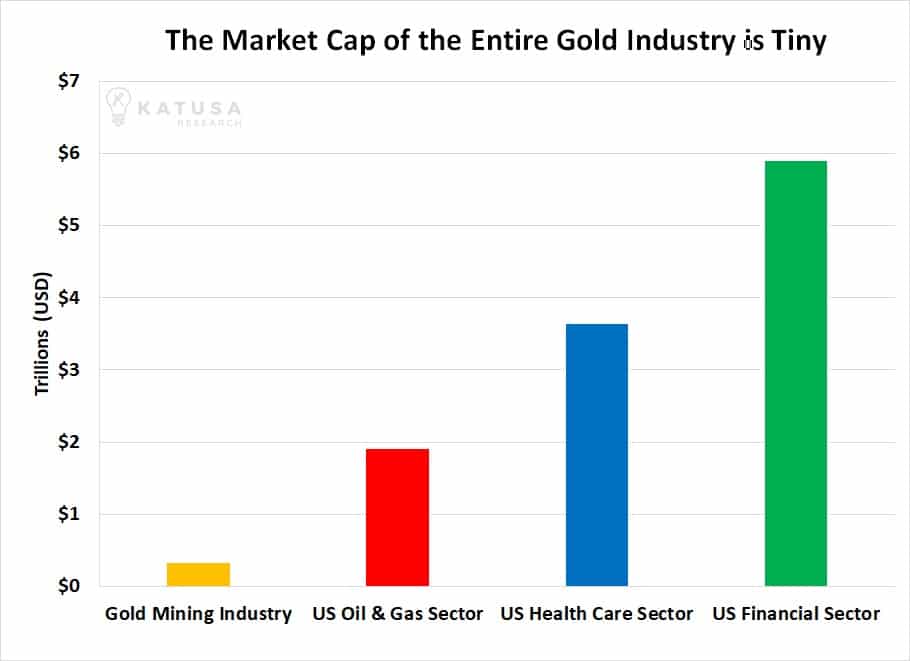

If concerns over the safety of the global monetary system increase (as they did in 2008), more than a few large funds will want to buy gold and gold stocks for both protection and profit potential and all that money will flow into a relatively tiny sector. The current market value of all major publicly-traded gold companies is around $330 billion. This might sound large, but it’s actually tiny in global finance terms.

The entire gold mining industry is smaller than just Facebook ($500 billion market cap) or Google ($650 billion market cap). The chart below shows this comparison, along with Apple and U.S. oil and gas industry for good measure.

To look at it from another angle, consider the $20 billion market cap of the world’s largest gold mining company, Newmont. Newmont is a giant that shapes the industry. It does some of the biggest deals. It has the resources to hire the industry’s best people. It produced over 5 million ounces of gold in 2016. That’s a tremendous amount of gold yet a $20 billion market cap won’t even get you a spot on the top 20 North American oil and gas companies. Newmont is smaller than 266 companies in the benchmark S&P 500.

If just 10 out of the hundreds of money managers around the world with more than $50 billion to invest were to each place just 1% of their portfolios into Newmont, they would buy 25% of Newmont. That very small ripple in the ocean of large fund management would produce a buying tsunami that lands on the shores of the gold mining industry…

There’s an old saying “A rising tide lifts all boats.” Well, when the tide flows into a small market sector such as gold, the boats can rise 10, 50, even 100 times higher. They go from sitting quietly in the harbor to riding tsunamis of investor money.

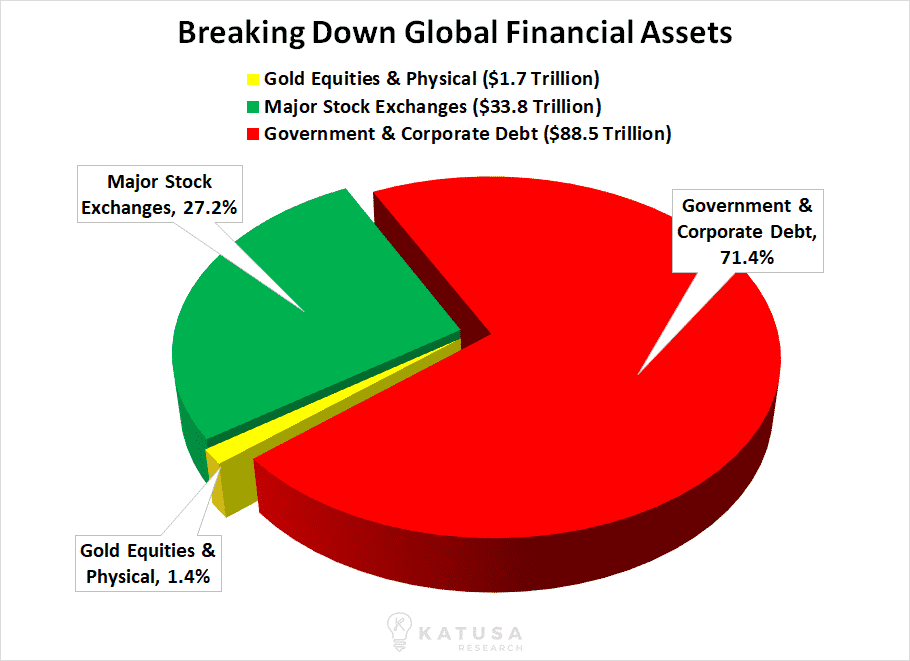

Right now, it’s estimated that 1.4% of the world’s financial assets are allocated to gold and gold stocks. This laughably small percentage shows the world doesn’t care much about gold right now but just a modest increase in this allocation percentage would hugely influence gold stock prices (some money would go into physical gold and gold ETFs, but a lot would flow into gold stocks as well).

To be clear, I’m not saying the world’s biggest money managers will wake up one day, decide to allocate 10% of their portfolios to gold and gold stocks and make gold and gold stocks double in a single trading session. [What I am saying, though, is]…that if gold enters a bull market, it’s going to be front page news. It’s going to come up at investment committee meetings. Big money managers will feel pressure to allocate to gold. People will begin to see buying gold and gold stocks as a prudent way to ensure portfolios against a global monetary accident. Moving substantial amounts of money into gold and gold stocks would be a gradual, multi-year process.

I believe a gold price breakout above $1,400 per ounce is coming soon. This would represent a multi-year high in the gold price. It would be a nice round number the media can quote and hype. It will ignite more and more interest in gold [and all that] investor money investor money will flow into a tiny area.

My advice: get into gold stocks before the large investment funds do.

Related Articles from the munKNEE.com Vault:

1. Most Pension Fund Managers Shy Away From Gold – Guess Why

As the unbacked Federal Reserve Note continues to be abused and devalued, it becomes clearer every day that pension funds should increase their precious metals holdings.

2. Pension Funds: Why $5,000 Gold May Be Too Low!

You already know the basic reasons for owning gold — currency protection, inflation hedge, store of value, calamity insurance — many of which are becoming clichés even in mainstream articles. Throw in the supply and demand imbalance, and you’ve got the basic arguments for why one should hold gold for the foreseeable future. [T]here is another driver of the price, however, that escapes many gold watchers and certainly the mainstream media [a]nd I’m convinced that once this sleeping giant wakes, it could ignite the gold market like nothing we’ve ever seen. [Let me explain.] Words: 788

3. Prepare & Prosper – Gold Equities Could Experience +1000% Returns Once Again!?

We are in the eye of the storm and when the other side of the vortex engulfs us gold and silver will increase considerably, their associated stocks will go up substantially and their warrants, where available, will escalate dramatically. With what has happened in the world of late and what will be unfolding in the next 5 years or so those few investors who fully understand the impact the current economic situation is going to have on future inflation, the USD, interest rates, the stock market, physical gold and silver and gold and silver stocks and warrants in particular are going to be in the unique position of being the benefactors of currently unimaginable returns and wealth. All they need do, as I like to say, is “Just prepare and prosper!” Words: 918

4. Any 1 Of These 20 Stocks Could Be A 10-Bagger At Higher Gold & Silver Prices

The list of stocks provided in this post are what I consider “must own” stocks if you want big returns. Why? Because most of them are potential 10-baggers at higher gold & silver prices. These are the cream of crop when it comes to risk/reward for large returns. They all have solid projects and growth potential. They all have the “goods” and are extremely undervalued. Take a look.

5. If You’re Interested In Gold Stocks This Article is a MUST Read

Historically, junior mining stocks tend to fluctuate between extreme boom and bust cycles and, given that we just completed a major bust cycle, the setup for a major rally in gold stocks is right in front of us. Those with the courage to buy low, and the discipline to sell during a frenzy, could quite possibly realize 10-bagger or even 100-bagger returns that could be worth a million dollars or more. Hold on to your hat!

6. Gold Stocks: Likelihood of Making Breathtaking Returns Has Never Been Greater! Here’s Why

We all think the price of gold, the metal, is depressed and is about equal to the total cost of production but when one compares the price of precious metals mining companies to the price of gold bullion, their prices are at historical lows. It seems that the mining shares can only go in one direction…up…but when and by how much? This article suggests it presents the greatest opportunity in 30 years. Look at the charts! Absolutely unbelievable.

7. Jeff Clark: Are Gold Stocks Still Going to Bring the Anticipated Magic? Yes, Here’s Why

We’re invested in gold stocks not just to make money, but for the chance to change our lifestyles and with their lackadaisical [dare I say dismal] year-to-date performance, one may begin to wonder if they’re still going to bring the magic. [Here are my views on the subject.] Words: 740

8. Gold Producer Stocks Dramatically Undervalued: Don’t Miss This Blood-in-the-Streets Opportunity

While the waterfall decline in gold stocks is painful for those of us already invested, the reality is that this is a setup we get a shot at only a few times in our investing life. It’s a cruel irony that those who are fully invested are now faced with the buying opportunity of a lifetime; however, it would be a shame for anyone to miss this blood-in-the-streets opportunity.

9. Here’s How to Choose Gold & Silver Stocks With the GREATEST Chance of Major Returns

Which gold/silver mining companies own quality undeveloped gold and silver deposits in safe stable countries – and are extremely well managed? Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment. Below are a number of things to look for when considering an investment in such companies.

10. Focus on Quality Junior Gold & Silver Companies to Maximize Returns – Here’s Why & How

The outlook for many junior resource companies in 2013 is grim so investors should focus on those who own quality undeveloped gold and silver deposits in safe stable countries. Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment – and the assets the world’s mining companies desperately need. [Let me explain.] Words: 1328; Charts: 15

The timing of this article may seem incongruous given the current weak performance of gold and gold stocks but that was the identical situation in each of the past manias – both the metal and the equities didn’t excel until the frenzy kicked in. The following documentation (exact returns from specific companies during this era are identified) is actually a fresh reminder of why we think you should hold on to your positions – or start accumulating them, if you haven’t already. (Words: 1987; Tables: 7)

munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com – ” The internet’s most unique site for financial articles! Here’s why“

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money