…When growth becomes exponential and relates to a bigger sample like the world or a major continent, the likelihood is that it won’t last and that there will a substantial move in the opposite direction…This article looks at the unsustainable trends in most asset classes, population numbers, inflation and credit growth [and discusses the dire consequences that are most likely to unfold in the years to come as a result.]

world or a major continent, the likelihood is that it won’t last and that there will a substantial move in the opposite direction…This article looks at the unsustainable trends in most asset classes, population numbers, inflation and credit growth [and discusses the dire consequences that are most likely to unfold in the years to come as a result.]

The following are excerpts from the original article by Egon von Greyerz (goldswitzerland.com) which has been edited ([ ]) and abridged (…) to provide a fast and easy read.

The Population Bubble

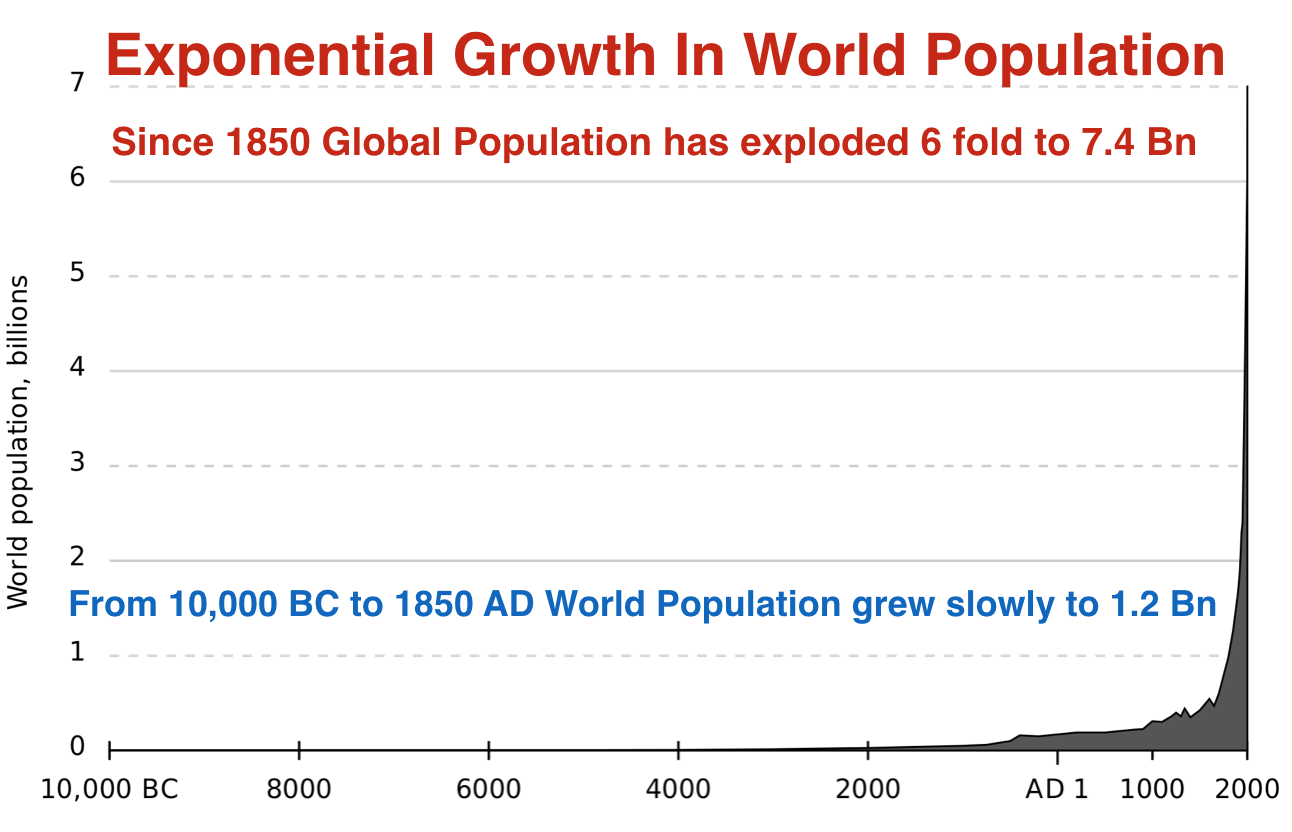

…For almost 12,000 years, global population grew gradually to reach 1.2 billion people in 1850. It then reached 1.4 billion at the turn of the 1900s but, since then, as shown in the graph below, there has been an absolute explosion to 7.4 billion currently.

Experts are now forecasting that global population will double to 15 billion by 2100. This is in my view very unlikely. If we look at the 100-year spike on the graph, that is likely to end abruptly at some point. Yes, population can continue to grow for a number of years but spikes or exponential growth never continues straight up and doesn’t just pause with a sideways move. Instead a spike move will eventually result in a spike in the other direction so, at some point, world population will come down by say 30-50%. This sounds implausible today, but remember that throughout history there have been events that have resulted in a major reduction of humans on earth.

Experts are now forecasting that global population will double to 15 billion by 2100. This is in my view very unlikely. If we look at the 100-year spike on the graph, that is likely to end abruptly at some point. Yes, population can continue to grow for a number of years but spikes or exponential growth never continues straight up and doesn’t just pause with a sideways move. Instead a spike move will eventually result in a spike in the other direction so, at some point, world population will come down by say 30-50%. This sounds implausible today, but remember that throughout history there have been events that have resulted in a major reduction of humans on earth.

- Take the Black Death in the mid-1300s. It is estimated that up to 40-60% of Europe’s population were killed and maybe as many as 200 million worldwide…

- War and economic depression could also have serious implications on the size of the population. A nuclear war could be totally devastating and collapse of the financial system would lead to famine.

I am not forecasting these events, but the probability is major that one or several of these disasters will happen at some point in the future.

Inflation/Hyperinflation

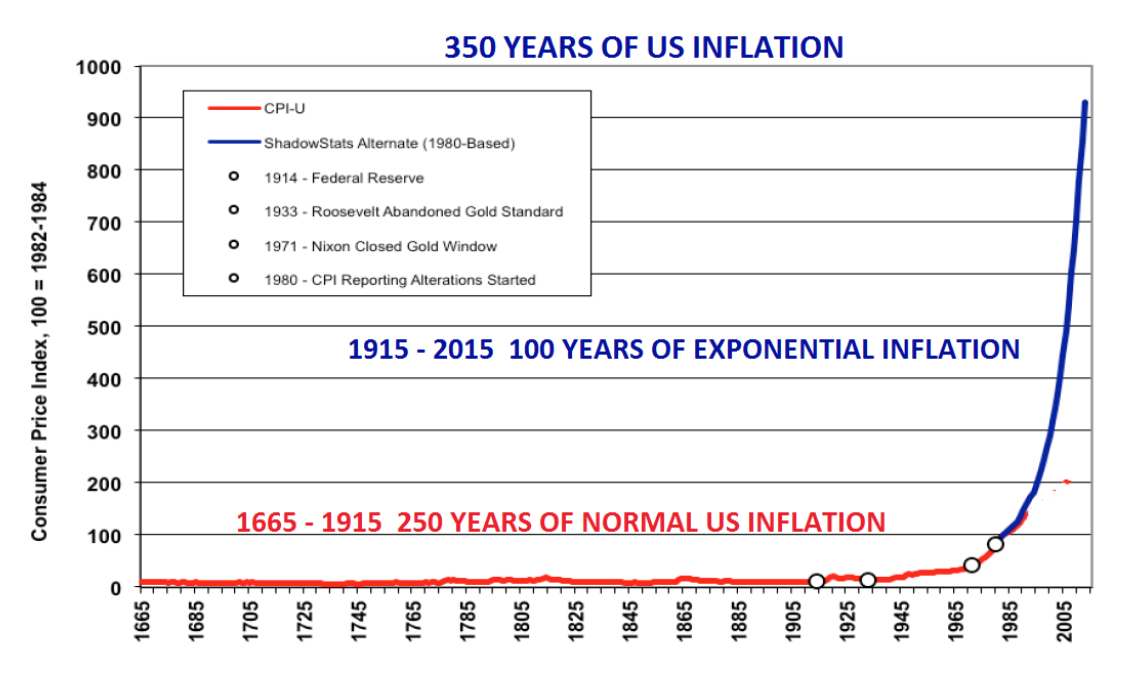

Another unsustainable trend is the explosion in US inflation. Between 1665 and early 1900, US inflation was on average maximum 1-2% p.a. Then from 1913 with the creation of Fed, the credit explosion and money printing started. Initially it was gradual but from 1971, when Nixon abolished the gold backing of the dollar, inflation has gone exponential and so has credit growth.

I know that many people will argue that we are not seeing any inflation in the U.S. or the world economy and that we currently have deflationary pressures. There are a few reasons for this.

- Governments deliberately skew the inflation figures so that they are totally misleading.

- The credit created and the money printed does not go to the ordinary consumer. Instead it goes to the banks and major investors. This has led to the most massive asset inflation that the world has ever experienced with the explosion of stock, property and bond prices.

Just like the population bubble, the exponential growth in inflation will not last but before the bubble bursts we are likely to see one final and futile attempt by governments and central banks to try to save the world economy and financial system by unlimited money printing in the trillions or even quadrillions of dollars. Conclusion: another spike in inflation is coming, leading to temporary hyperinflation is likely before it all implodes in a deflationary swoon.

Global Debt

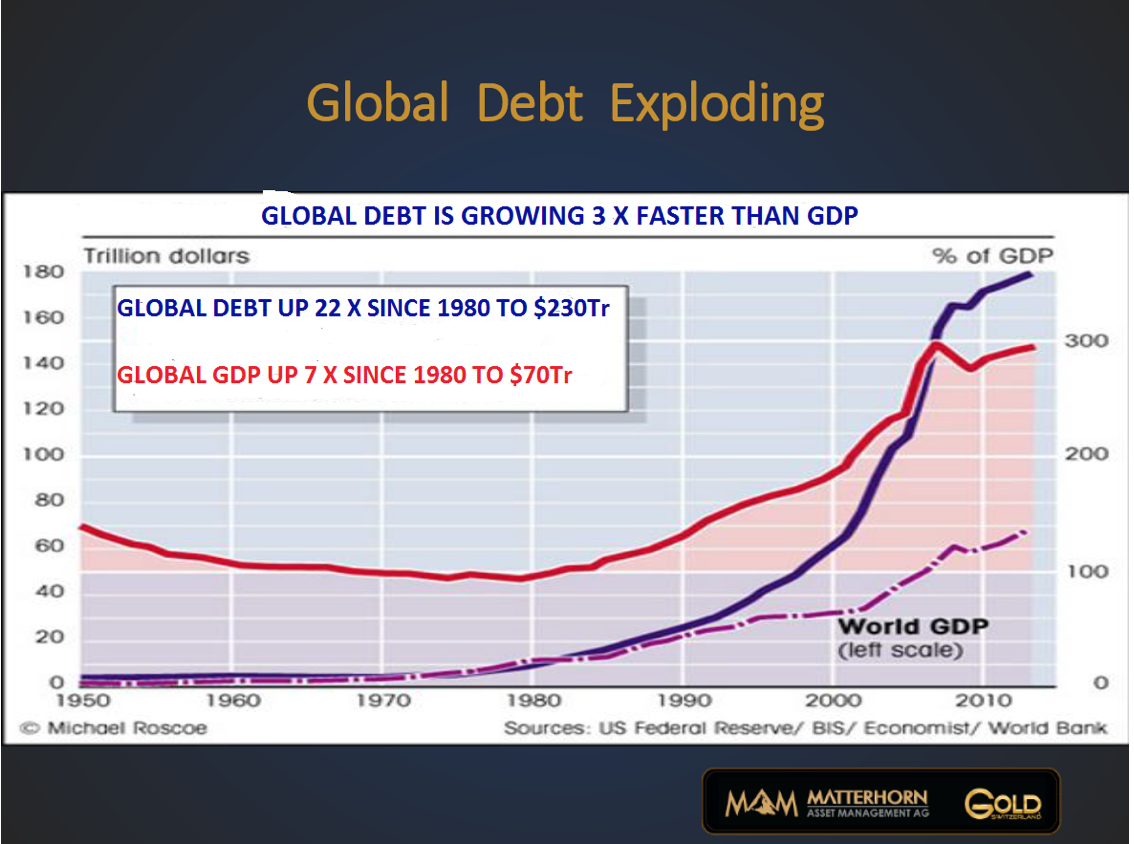

The third spike is the explosive growth in global debt. This is what has created the mess the world is currently in. Central bankers took Amshel Rothschild’s words to heart but then they turned too greedy until they totally lost control of the monetary system. That’s where we are now.

Together with governments, the bankers have now created [a] disastrous vicious circle that is spiralling down at ever increasing speed. Exploding government deficits and debts and the insolvency of the banking system combined with zero or negative interest rates have produced a situation which central bankers have not got a clue how to deal with or solve. The only solution they know is to apply the same method that created the problem in the first place, namely to print more money and issue more debt.

Just look at how global debt has exploded 22 times in the last 35 years from $10 trillion to $230 trillion today. At the same time global GDP has gone up 7 times only. We could call it the law of diminishing returns if we want to be kind. More and more credit is needed to create an increase in GDP but if we want to be truthful we should call it the biggest disaster that man created throughout history.

The world cannot continue to grow naturally before the current debt of $230 trillion together with the $1.5 quadrillion of derivatives have all disappeared. This must and will happen at some point in the not too distant future. The result will be an implosive depression that will make most debt disappear and cause assets such as stocks, property and bonds to decline by 90% or more.

[To recap, as I see it:]- at some point, world population will come down by say 30-50%,

- another spike in inflation is coming, leading to temporary hyperinflation is likely before it all implodes in a deflationary swoon, and,

- at some point in the not too distant future there will be an implosive depression that will make most debt disappear and cause assets such as stocks, property and bonds to decline by 90% or more.

Of course the above seems impossible today but the spikes in the charts above all indicate that this is likely and, based on logic, this has to happen. It is only a question of when. The consequences will be totally devastating for the world economy and for almost all human beings…

What’s a Person To Do?

It is clearly impossible to protect yourself against all these risks…[but] for the privileged few who can afford to acquire some physical gold and silver, this has throughout history been the best financial insurance to own…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money