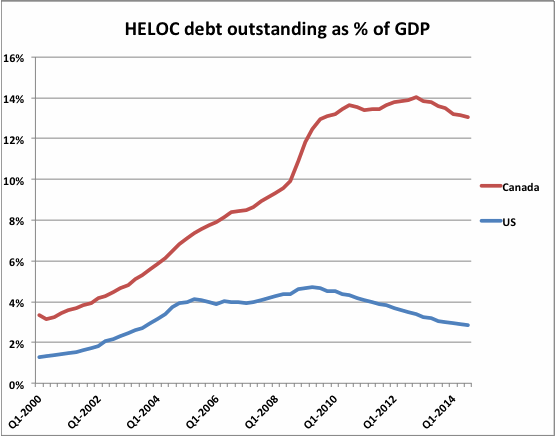

Canadian household debt rose to a fresh all-time high in April above 1.8 trillion. Trustees in bankruptcy are warning that they have never seen so many 2nd mortgages and Home Equity Lines of Credit (HELCO) on Canadian household balance sheets as illustrated in the chart below.

Of course, the Canadian Bankers Association says it’s not worried, insisting that Canadians are responsible borrowers and that banks are prudent lenders. (Sure they are)…

‘Twas always thus:

“-overconfidence seldom does any great harm except, when, as, and if, it beguiles its victims into debt.” -Irving Fisher, Economist, The debt-deflation theory of Great Depressions, 1933

*http://jugglingdynamite.com/2015/06/11/canadas-lust-for-home-equity-lines-of-credit/

Related Articles from the munKNEE Vault:

1. The Canadian Housing Bubble Will NEVER Blow Up – Supposedly! Here’s Why

The Canadian housing bubble will never blow up. There’s simply too much “plankton” in the water. It keeps the “food chain” healthy and offers ample nourishment for the “big wales and sharks” and shorting the Canadian housing bubble is useless. Here’s why.

2. Canadian Households Extremely Vulnerable to Changes in Economy

In 1990, Canadians owed 85 cents for every dollar of annual disposable income. Today that number has grown to a record $1.63. Meanwhile, Canadians are saving just 3.6% of their incomes today – a drop from 12% in 1990. Rising household debt levels have some sounding the alarm.

3. Canada’s Housing Market Most Overvalued In the World – and Could Burst At Any Time!

The real estate sector in Canada is in a bubble that could burst at any time according to the IMF, Deutsch Bank, the Bank of Canada and The Economist.

4. Canada’s Housing Bubble Is A Sight To Behold – A Terrible Sight! Here’s Why

Canada’s housing bubble has been a sight to behold. Home prices only dipped 8% when the US housing market crashed. Then it re-soared. Now, across the country, home prices are 26% higher than they were at the already crazy peak in 2008. In Toronto, they’re 42% higher! There is a major drawback Canada’s housing bubble beyond the fact that it will eventually crash with terrible consequences.

5. Implosion In Canada’s Housing Market Is Inevitable! Here’s Why

The Canadian housing market is deep into bubble territory. We all know that bubbles can go on for longer than most people think but with the crash in oil prices and people fully believing their own hype, the market is set up for a big fall from grace. Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

6. Housing Bubble Threatens Financial Stability of Canada – Here’s Why

Over the last 14 years, house prices in Canada have increased by 150%, twice as fast as in the U.S…[and] far outpacing household incomes. Any increase in interest rates would prick the bubble, and its implosion would trigger all sorts of mayhem to the point that the Canadian government has expressed concerned that such an event would be a significant risk to the “stability of the financial system”.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money