With interest rates getting pushed lower year after year, interest expense as a percent of disposable income – the debt to service ratio – has been declining in Canada and, for the moment, these low interest rates keep the whole thing glued together. The fact of the matter is, however, that the Bank of Canada will have trouble ever raising rates, regardless of the distortion and mayhem near-zero rates are causing. Here’s why.

interest expense as a percent of disposable income – the debt to service ratio – has been declining in Canada and, for the moment, these low interest rates keep the whole thing glued together. The fact of the matter is, however, that the Bank of Canada will have trouble ever raising rates, regardless of the distortion and mayhem near-zero rates are causing. Here’s why.

The edited excerpts above and below are taken from an article* by Wolf Richter (wolfstreet.com) originally entitled Household Debt Soars in Canada, “Stability” at Risk.

Equifax Canada’s Cautionary Tale

Earlier this month, even Equifax Canada, which is in the business of facilitating and increasing this indebtedness, warned about it stating that:

- the total indebtedness of Canadian households, according to its own measure, jumped 7.7% from prior year which had already been at record levels – the biggest culprits being installment and auto loans…

- referring to it as “a cautionary tale” [suggesting that] consumers and business owners needed to be more vigilant given that

- the price of oil was collapsing,

- house prices in certain areas of the country were beginning to stumble and

- unemployment in certain sectors was rising.

Statistics Canada’s Warning

Statistics Canada reported today that:

- household debt set another breath-taking record in the fourth quarter of 2014…jumping by 1.1% (C$22.6 billion) from the third quarter. Credit cards and auto loans accounted “for the majority of the overall increase”…with consumer credit hitting $519 billion and mortgage debt C$1.184 trillion.

- For the third consecutive quarter, disposable income increased at a slower rate than household credit market debt, and as a result, leverage, as measured by household credit market debt to disposable income, reached a new high of 163.3% in the fourth quarter. In other words, households held roughly $1.63 of credit market debt for every dollar of disposable income in the fourth quarter.

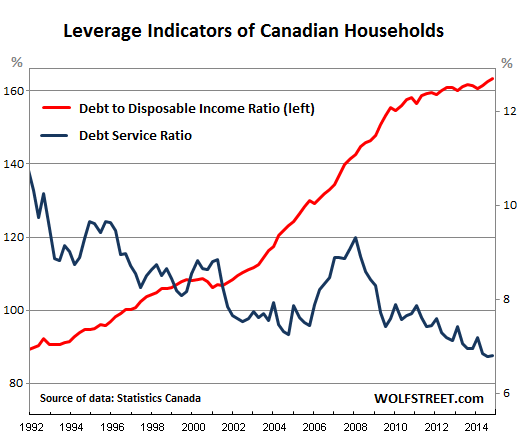

For the moment, there is still one saving grace to this rising mountain of debt: interest rates have been coming down for years so the debt service ratio, which measures household interest expense as a proportion of disable income, has been declining as a function of interest rates, though it inched up in Q4 to 6.8%.

The chart below shows how:

- the ratio of debt to disposable income (red line, left scale) has been rising with a few exceptions, while

- the debt service ratio (blue line, right scale) has followed interest rates up and down:

The ratio of debt to disposable income picked up speed from 2001 on. It blew through the financial crisis even as U.S. households were whittling down their debt by de-leveraging and defaulting. Canadian households didn’t even stop to breathe. They kept spending and piled on debt at an astounding rate. Their incomes rose also, but not nearly enough. It wasn’t until 2011 that the red-hot growth rate started to lose some of its fire, bumping into all sorts of resistance from reality.

What If Interest Expense as a % of Disposable Income Rises?

With interest rates getting pushed lower year after year, interest expense as a percent of disposable income – the debt to service ratio – has been declining. For the moment, these low interest rates keep the whole thing glued together.

If interest rates were ever to rise even by a smidgen, however, the blue line would do what it started doing in 2006 – it would roar higher. With consumer indebtedness at these levels, even a small increase in interest rates would make a big difference in the interest expense consumers would have to fork over.

The Bank of Canada’s Response

The Bank of Canada, kicked into panic mode by:

- the collapse of oil prices,

- the faltering housing market,

- vulnerable banks,

- and other nagging issues, including the indebtedness of the consumer, which it pointed out as a risk factor last year

suddenly cut its benchmark interest rate in January. In the past, it communicated such moves in advance. In January, it was a surprise move that shocked the markets.

Today, Rhys Mendes, Deputy Chief of the Bank of Canada’s Economic Analysis Department, told the House of Commons finance committee that the central bank would “not necessarily” be pressured into following the Fed’s rate increases this year. “The bank targets inflation in Canada, and decisions regarding monetary policy in Canada would be based on the outlook for inflation,” he said, presenting the central-bank smokescreen for keeping rates at near zero for other reasons.

The Bank of Canada will have trouble ever raising rates, regardless of the distortion and mayhem near-zero rates are causing:

- Households can no longer afford higher rates. They have too much debt and not enough income.

- Higher interest payments would eat into spending on other things.

- Higher mortgage rates would crash the still magnificent home prices.

- Consumers would buckle under their burden and default not to mention the already struggling oil companies…

Years of low interest rates encouraged this dreadful level of leverage. Now, and for decades to come, it will an albatross around the neck of the Bank of Canada and, for the economy, it’s a high-risk burden that could quickly, as Equifax suggested, blow up.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and has been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

*Original Source: http://wolfstreet.com/2015/03/12/household-debt-soars-in-canada-stability-at-risk/ (Copyright © 2011 – 2015 Wolf Street Corp. All Rights Reserved.)

Related Articles from the munKNEE Vault:

1. Implosion In Canada’s Housing Market Is Inevitable! Here’s Why

The Canadian housing market is deep into bubble territory. We all know that bubbles can go on for longer than most people think but with the crash in oil prices and people fully believing their own hype, the market is set up for a big fall from grace. Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable. Read More »

2. Continued Low Oil Prices Could Seriously Damage Canada’s Economy – Here Why & How

If oil prices remain anywhere near the current levels for a prolonged period – something the Saudis are aiming for – Canada’s economy is in serious trouble. Here’s why. Read More »

3. Housing Bubble Threatens Financial Stability of Canada – Here’s Why

Over the last 14 years, house prices in Canada have increased by 150%, twice as fast as in the U.S…[and] far outpacing household incomes. Any increase in interest rates would prick the bubble, and its implosion would trigger all sorts of mayhem to the point that the Canadian government has expressed concerned that such an event would be a significant risk to the “stability of the financial system”. Read More »

4. That Canada Is A Financial Safe-haven Is A Myth – Here’s Why

Canada is seen as the new banking safe haven and an “island of safety and stability” because of its perceived sound fiscal position, commodity wealth and solid economic performance – but it’s a myth! Plain & simple. Here are the facts. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money