If oil prices remain anywhere near the current levels for a prolonged period –  something the Saudis are aiming for – Canada’s economy is in serious trouble. Here’s why.

something the Saudis are aiming for – Canada’s economy is in serious trouble. Here’s why.

Collapsing crude prices are starting to make their way through the North American energy sector with the most unprofitable oil & gas rigs being mothballed [recently according to the Baker Hughes Oil & Gas Rig Count (see chart below)]. The closures have been particularly acute in Canada where some 40 oil & gas rigs have been taken out of operation recently.

| Source: Baker Hughes |

The decline in rig count is just the beginning.

Canadian Oil Sands Crude Oil Production Winding Down

Even if prices recover somewhat, Canadian oil sands production – one of the more expensive sources of crude oil – will be winding down as nobody wants to operate money-losing businesses for a prolonged period and those who believe crude will be back above $80/bl any time soon is deluding themselves.

| Source: FT |

Canada’s Non-Energy Trade Balance Declining

There is also the argument that Canada’s economy is “diversified”. Perhaps, but just to put the situation in perspective, take a look at the breakdown of the nation’s trade balances.

| Source: @Earthed , Maclean’s |

Alberta Housing Starts & Prices Declining

Up until now, production from oil sands has fueled growth in other sectors, including for example transportation and housing in Alberta. This is about [to] come to a screeching halt.

| Alberta housing situation (source: Alberta Treasury Board and Finance) |

The national situation is not significantly better. Housing markets across the country have continued to rally, even as homes south of the border had undergone an unprecedented price adjustment. While many point out that the reason for avoiding a US-style housing crash has been a stronger mortgage market, that’s only part of it. The global commodity boom in which Canada successfully participated is the main reason.

| Source: Multiple Listing Service |

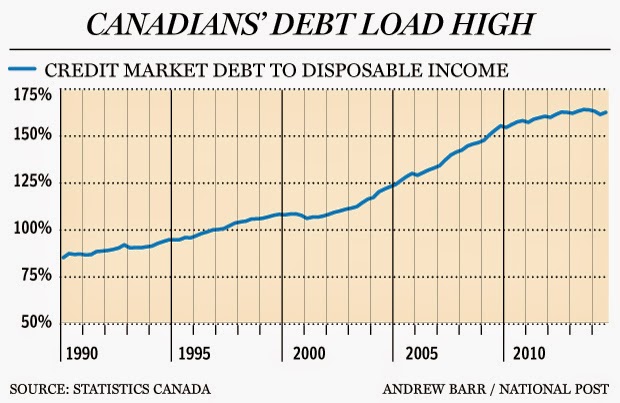

Canadian Households At Near-Record Levels of Leverage

Now as the commodity super-cycle has ended and energy prices collapsed, Canadian households are caught with near-record levels of leverage.

|

| Source: National Post |

Some have been pointing out that Canadian mortgage debt service ratio has continued to improve. However that measure is misleading, as it excludes principal payments. In reality the situation is much worse (see chart, h/t @ac_eco).

Home Renovation Manufacturing to Suffer

…[Canada’s] exposure to energy is going to damage the labor markets, squeezing the nation’s overextended households and the knock-on effect won’t be limited to a severe slowdown in residential construction growth…The expenditures on renovations – something that’s been supporting parts of manufacturing and other sectors – is not going to end well.

| Source: Scotiabank |

Canadian Property REITs Down Drastically

The markets are already sensing the contagion effect from energy on the housing market, as Canadian property REITs take a hit.

_________________________________________________________________________

*http://soberlook.com/2014/12/if-energy-prices-remain-near-current.html (Content copyright 2009-2015. SoberLook.com. All rights reserved.)

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Related Articles:

1. Housing Bubble Threatens Financial Stability of Canada – Here’s Why

Over the last 14 years, house prices in Canada have increased by 150%, twice as fast as in the U.S…[and] far outpacing household incomes. Any increase in interest rates would prick the bubble, and its implosion would trigger all sorts of mayhem to the point that the Canadian government has expressed concerned that such an event would be a significant risk to the “stability of the financial system”. Read

2. That Canada Is A Financial Safe-haven Is A Myth – Here’s Why

Canada is seen as the new banking safe haven and an “island of safety and stability” because of its perceived sound fiscal position, commodity wealth and solid economic performance – but it’s a myth! Plain & simple. Here are the facts. Read More »

3. Next Crisis Will Start In Either Canada, Australia, the U.K or ?? – Here’s Why

The plunge in emerging markets that started this year has given us the Fragile Five (Indonesia, South Africa, Brazil, Turkey and India), courtesy of Morgan Stanley, because their big current-account deficits mean they are acutely vulnerable to a sudden exit of foreign capital. The trouble is, it isn’t true. The next crisis will start, as did the last one, in one of the developed economies [and this time round] it is likely to come from one of these 5 countries:… Read More »

4. Satire At Its Best: America vs. Canada on Greed & Their Respective Banking Systems

In this irreverent clip – satire at its best – Jason Jones from Daily Show teaches regulation-loving Canadian bankers the advantages of harmless American free-market fun or, more accurately, highlights the differences between the American and Canadian banking systems and their respective perceptions on the meaning of the word “greed”. Enjoy! Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money