Like a bad case of hemorrhoids, debt is a topic too often left out of polite conversation. It’s a good thing then that you didn’t come here for polite conversation because, in our quest to clearly understand debt around this ball of dirt we call home, how it impacts us, if it impacts us and what it all means, we’ve had our team put together a comprehensive report on the topic.

conversation. It’s a good thing then that you didn’t come here for polite conversation because, in our quest to clearly understand debt around this ball of dirt we call home, how it impacts us, if it impacts us and what it all means, we’ve had our team put together a comprehensive report on the topic.

The above introductory comments are edited excerpts from an article* by Chris Tell (capitalistexploits.at) entitled Debt Chart Porn.

Tell goes on to say in further edited excerpts:

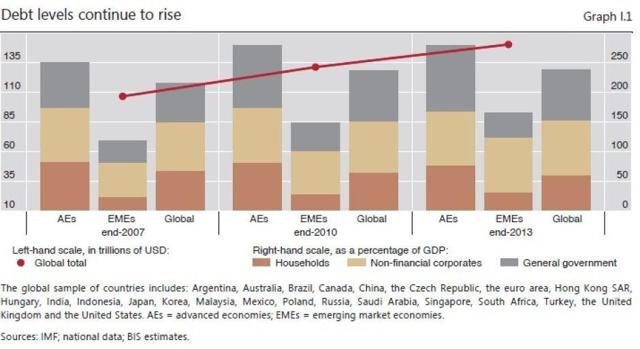

Earlier this year the Bank of International Settlements said in its annual report that debt ratios in the developed economies have grown by 20 percentage points to 275% of GDP since the beginning of the global financial crisis. Albeit not as severe, the trend is similar in the emerging economies where debt ratios have grown with the same pace to 175% of GDP, thanks to the spillover effect of central bankers in the developed world testing their limits with low interest rate policies.

The Bank warned that global debt levels could trigger another Lehman-style crisis, calling continued debt accumulation over successive business and financial cycles as the root (rather than the solution) of the problem.

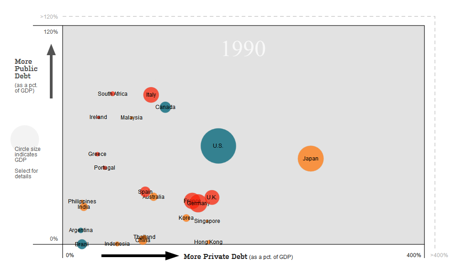

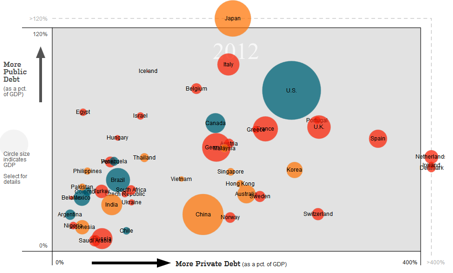

The symptom, however, goes…back [further] than just 2007. As you can see in the charts below (taken from the Wall Street Journal), both public and private debt levels have been expanding since the early 90s.

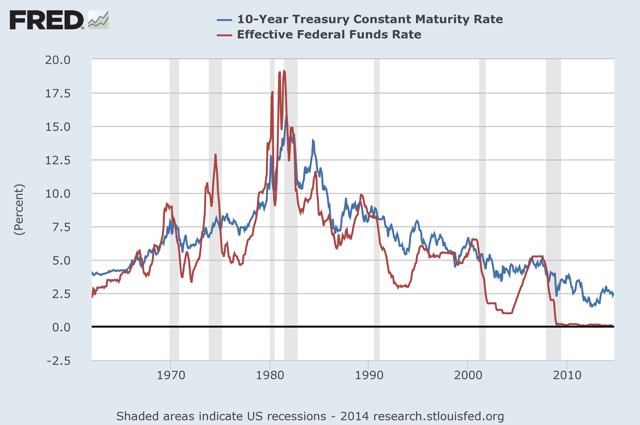

With interest rates trending downwards for the past 30 years and eventually hitting rock bottom in late 2008, it is no wonder that the global debt levels have swollen to 200 year highs. Yep, 200 year highs!

Although the chart above only shows the U.S. rates, the situation is similar all across the globe.

It looks like where low rates essentially validate themselves.

Just a few weeks ago, Spain, one of the Europe’s ailing economies, issued a 50-year bond at a mere 4% rate. This is Spain for God’s sake. They’re broke!

Conclusion

There are some truly crushing debt burdens lurking in full view right here and now. Debts which cannot be repaid and will not be repaid!

Personally I tend to keep on top of this sort of information, but I’ll be honest with you when I say that what our analysts have put together scared even me, and here I was under the illusion that I was adequately informed. We believe it is vital for every investor to keep an eye on those markets.

“Blessed are the young for they shall inherit the national debt.” – Herbert Hoover

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://capitalistexploits.at/2014/09/debt-chart-porn/

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. We’re Doomed! Rising Interest Rates Will Cause Our Financial System To Implode

We’re doomed! Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. As such, any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. Let me explain why that is the case. Read More »

2. There’s debt, Then There’s Debt, Then There’s U.S. DEBT

The next time someone says, “The US is the richest country on Earth” correct them and state that “The U.S. is the most bankrupt and indebted country in the history of the world” because that’s reality. Let me explain. Read More »

3. Monetary System Collapse Guaranteed – Here’s Why & How to Invest & Insure Your Wealth Accordingly

Our monetary system is guaranteed to collapse. The central banks prints money like there is no tomorrow. The governments spends like a drunken sailor and yet inflation is benign and interest rates sit at generational lows. Banks are gaining in profitability while their bad debts are being erased by rising asset prices. What’s not to like? Plenty! This article goes into the details of the money creation process to understand how and why this is happening, what the future implications will be and how to best invest to protect oneself from these eventualities. Read More »

4. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer. Read More »

5. Derivatives Are Nothing More Than A “Game” of Russian Roulette! Here’s Why

Russian Roulette: Put one bullet in the cylinder of a revolver, spin the cylinder, point the gun at YOUR head, and pull the trigger. Most revolvers have 6 chambers, so your odds of surviving are 5 in 6, IF you quit after pulling the trigger once. Press your luck, spin the cylinder, point the gun, and pull the trigger again. It might be okay. Try for a third time? Now let’s play Russian roulette – derivatives style. Read More »

6. Which of These 6 Actions Will U.S. Gov’t Take to Resolve Country’s Debt Problems?

The U.S. is in a financial debt spiral. What’s the Administration to do? This article analyzes 6 alternative courses of action available, presents the consensus view of each, comes to a conclusion as to what will unfold and suggests what the implications are for one’s investment portfolio. Let’s take a look. Read More »

7. $17+ Trillion U.S. National Debt Adversely Affects Every American – Here’s Why & How

For the first time in U.S. history, the national debt has risen past $17 trillion. That number is a bit hard to comprehend and means little to Americans when not applied to their everyday lives. So just how does the national debt affect consumers, and why should the average American care about how much this country owes? Here’s why and how. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money