If you had invested in gold in 2004 you would have earned about 10.4%, annualized. I am writing this article, though, to say that you should not consider gold to be a good long-term investment and you should not have a significant proportion of your portfolio in gold. Let me explain.

am writing this article, though, to say that you should not consider gold to be a good long-term investment and you should not have a significant proportion of your portfolio in gold. Let me explain.

The above introductory comments are edited excerpts from an article* by Robert Singarella Jr. (robertsingarellajr.com) as posted on SeekingAlpha.com under the title The Problems With Gold.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Singarella goes on to say in further edited excerpts:

In order to understand why gold is not a good investment, it’s best to cover the topic from several different angles. Loosely speaking, I have organized this article around two major themes that are important to understanding gold: the narrative and the risk profile. I’ll start with the narrative, then cover the risk profile after that.

Gold’s Mythical Properties

When I say “the narrative,” with respect to gold, I mean the many things gold is purported to do. There are some widely held beliefs about gold that are simply false; however, they persist.

1. Gold As An Inflation Hedge

The first, and most common belief, is that gold is a hedge against inflation.

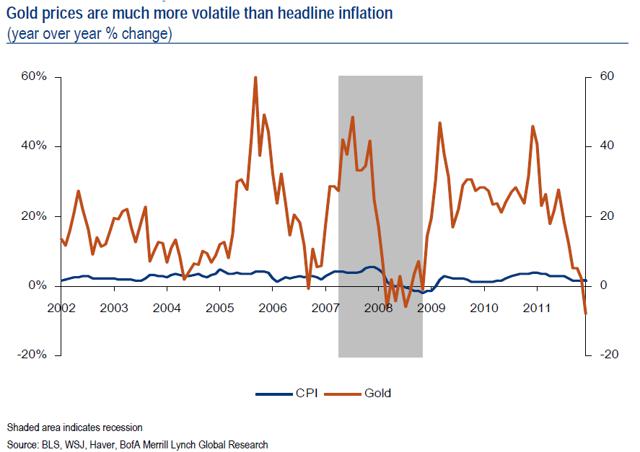

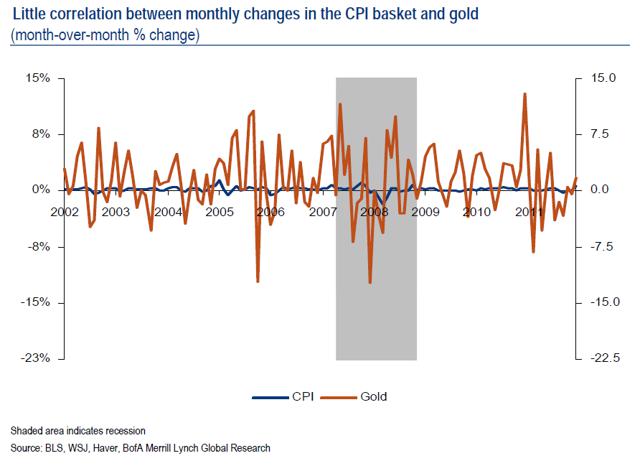

The charts above don’t require a great deal of discussion. It’s clear that gold is far, far more volatile than inflation and the correlation is weak…

2. Gold In An Inflationary Environment

What about hyperinflation? It turns out that gold doesn’t matter much during hyperinflation either. That’s because hyperinflation is not always a monetary phenomenon…Hyperinflation is not caused by money printing, rather, money printing is the response to the events leading to hyperinflation. Hyperinflation is also not the same thing as very high inflation, there are specific social/political/economic conditions required to trigger hyperinflation.

Getting back to gold now. Gold is part of the financial system and therefore, its price and liquidity are fundamentally connected to the rest of the system. Hyperinflation occurs when the economic (therefore financial) system is falling apart. Unlike a currency undergoing hyperinflation, gold would retain some of its value; however, most physical assets would retain at least some value. If only because people outside the country in question still value those assets (in a stable currency). There is no reason to believe that gold would have a significant advantage in such a situation. If you have enough wealth for it to matter, you would likely be on your way out of the country anyway.

Not enough people own gold for it to return to being used as a currency in such a situation. During historical periods of hyperinflation, the barter system returned to prominence, not gold.

3. Gold As A Safe Haven Asset

Moving on from inflation, consider another of gold’s mythical properties; that it’s a safe haven asset.

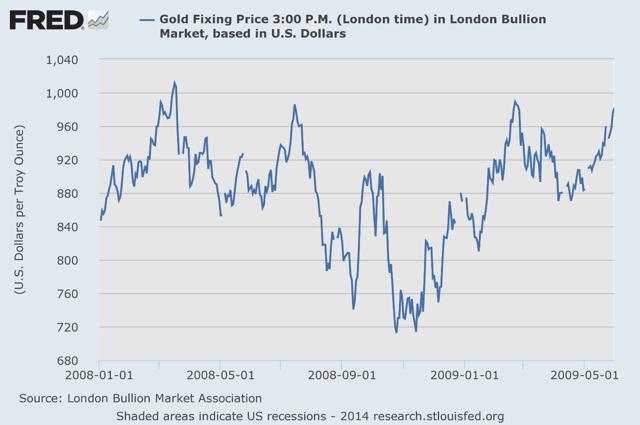

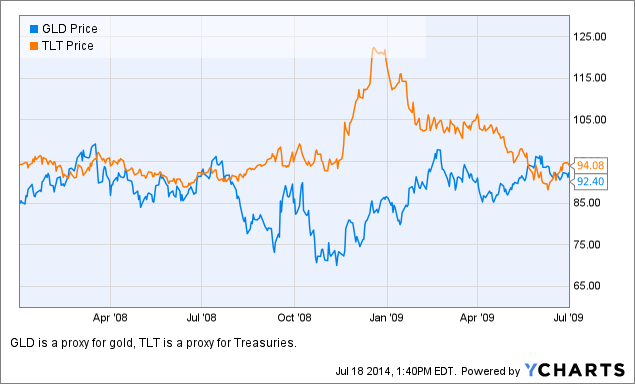

It’s easy to find problems with gold’s so-called safe haven status. The chart above shows the price of gold during the financial crisis. We can’t say it did horribly (compared to stocks, for example), but it was extremely volatile during the crisis.

GLD data by YCharts; TLT data by YCharts

Gold was not totally crushed during the crisis, but it was clearly not as good a safe haven as Treasuries (I’m using TLT as a proxy for Treasuries and GLD as a proxy for gold). TLT increased in value during the course of the crisis and was at no point down more than a few percent. Gold was down more than 10% several times during the crisis even if it did finish with a higher price at the end.

A safe haven is going to face some risk and some potential losses, but it’s problematic to consider something a safe haven if it can fall more than 10% during the time you are relying on it. In a more general sense, gold only benefits from its normal lack of correlation with other asset classes. That’s not the same as being a safe haven.

Gold’s Risk Profile

There are other elements of the gold narrative that can be considered; however, having looked at the two biggest elements of the story I think now is a good time to move onto gold’s risk profile. I organized the risk factors as follows:

- Volatility.

- Risk of price stagnation.

- Black swan.

1. Volatility

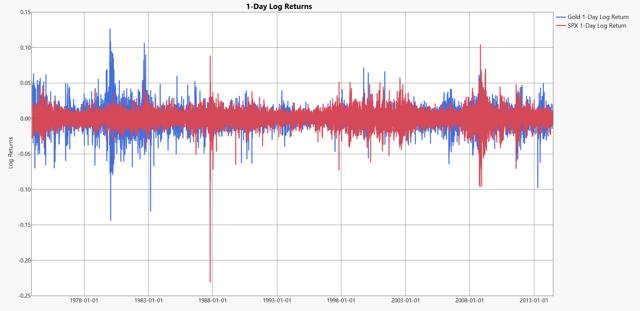

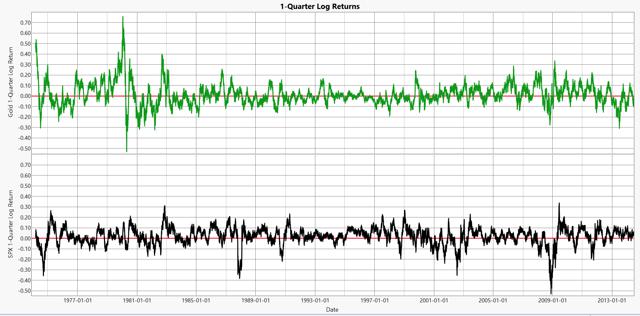

Volatility is the easiest, so let’s start there. It’s not hard to show that gold is more volatile than the S&P 500 index most of the time. The 1-day log return chart shows that very clearly.

Source: Data from Federal Reserve Bank of St. Louis database.

The red line is the S&P 500 (SPX) and the blue is gold. Based on a quick look at the graph, I’d say the volatility for both is of the same order of magnitude, but gold seems to have more high volatility periods (on a side note, both time series exhibit volatility clustering, in other words, conditional heteroskedasticity). The pattern continues for the rolling 1-quarter log returns and 2-year log returns.

Source: Data from Federal Reserve Bank of St. Louis database.

2. Price Stagnation

Now, the 10-year log return chart tells us something different. Specifically, it shows signs of the next risk factor, price stagnation.

Source: Data from Federal Reserve Bank of St. Louis database.

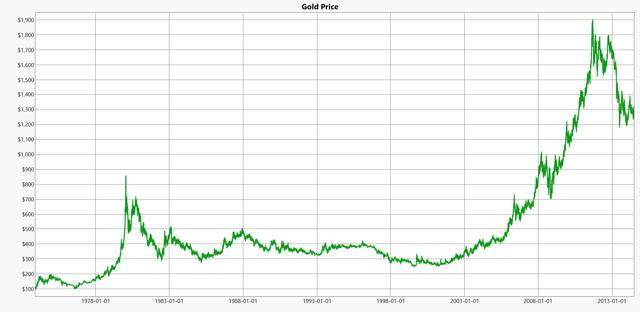

Notice that the red line marks zero. In the late ’80s to early ’90s, gold entered a bear market until about 2004. What’s interesting is that the price didn’t really decline much over that period, rather, it didn’t change very much. When you look at the long-term price chart, it’s apparent that the period of stagnation was longer than the 10-year chart shows.

Source: data from Federal Reserve Bank of St. Louis database.

Starting in the early to mid-’80s, gold entered into a long, very slow decline. I would say stagnation is a better term because the rate of decline was so slow. There has been some speculation that the gold ETF, GLD, helped break the price out of its slump by allowing individual investors greater flexibility. In any case, this has happened before and could happen again. I want to be clear, I don’t see any reason for the price to stagnate in the same manner, and I think the possibility should be considered. There is at least no obvious reason why it will not happen again.

3. A Black Swan Event

The last risk factor is a black swan event. There isn’t much to say about this because it really could be anything. I don’t see any value in trying to guess what sorts of events could be a black swan for gold. The important thing is that it can happen and investors must simply accept that risk. This is no different than for stocks, so I would say the two assets face equal risk from black swans.

After all of that, what’s left is the conclusion that gold…

- has a lower long-term return than equities,

- provides no cash flow,

- often has storage costs associated with it,

- has a poorer return for a longer period of time (as per the 10-year log return chart above) than equities do,

- has a tendency to move somewhat inversely relative to stocks (as per many of the return charts above) which is an example of the non-correlated movement that investors want to take advantage of.

I think I have shown that the risk profile of gold does not make it worthwhile for investors to hold a greater proportion of it in their portfolios.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2324095-the-problems-with-gold (© 2014 Seeking Alpha)

Follow the munKNEE!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Related Articles:

1. Gold Is NOT An Effective Hedge Against A Financial Crisis! Here’s Proof

A short time ago I started looking at the question: “Is gold an effective hedge against a financial crisis?” Having studied the question in more detail, I find the answer is no, gold is not an effective hedge against a financial crisis. Here’s why. Read More »

2. 10 Myths That Suggest Gold Supposedly Has a Bright Future

…Hype, fear and outdated monetary theories simply aren’t enough to support the price of gold. Every finance and economics text book teaches that gold is basically an inflation hedge, and without inflation gold is simply a useless piece of yellow metal. Either the gold bugs are right or the Fed is right, and my money is on the Fed.

3. What Could Possibly Be A Better Safe Haven Than Gold? Read On

Some market commentators are touting gold as a great portfolio diversifier, convincing investors that the precious metal could benefit their portfolio but there may be better alternatives than gold if the motivation is to find a hedge for economic uncertainty or political unrest. Read More »

4. Careful! Gold’s Performance in Times of Crisis Often Not As Expected

We can devise logical scenarios as to what the price of gold should or should not do, but gold doesn’t always follow the plan. To paraphrase an old Jewish saying: “Man plans. Gold laughs.” Read More »

5. Is Gold Ready To Bounce? Not Likely! Here’s Why

Gold and silver have been all over the map in 2014. To figure out what’s next for the metals this article assesses their deep and long term status as speculative assets and the relationship between the two metals and determines what must happen to reverse their continuing decline. Read on! Read More »

6. Gold or Equities: Which Is More Volatile?

With the gold price in dollars breaking decisively the 200 day moving average but with volatility across a broad range of asset classes close to, or at, historic lows…this article looks at what patterns occur in equity and gold prices during both up and down trends and how to adjust your portfolio accordingly. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money