I believe the signals show that silver is either at, or very close to, a short-term top. Let me explain.

The above comments are edited excerpts from an article* by Ivan Y. as posted on Seeking Alpha.com under the title Silver Appears To Be Topping.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE bi-weekly Market Intelligence Report newsletter (register here; sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Ivan goes on to say in further edited excerpts:

…June has historically been the worst month of the year for silver, declining in price in fourteen of the last twenty years in June…[but] this year has moved against that historical tendency…up over 11% for the month, which is the best performance it has had in at least the last 24 years. I say ‘at least’ because the data I have only goes back…[that] far.

Silver’s positive performance…[in June was] due to…

- The ECB’s announcement of negative interest rates on June 5th.

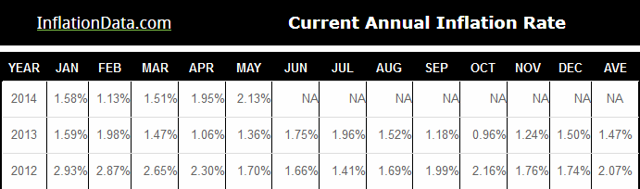

- The U.S. government’s announcement of a 2.13% CPI inflation rate for May 2014. Inflation has not been this high since October 2012. On top of this, after the Fed meeting on June 17-18, the market started to believe that Janet Yellen and the Fed are behind the curve on inflation.

- Throughout June, ISIS militants in Iraq made advances and captured most or all of Mosul, Fallujah, and Tikrit.

- Hedge funds and managed futures funds built up record short positions on COMEX silver futures. The record position occurred on June 3rd and shorts have been covering the last three weeks.

Silver has rallied by over $2 from its bottom in early June, but where is it headed now?

…I believe the signals show that silver is either at, or very close to, a short-term top [because]:

- if you look at a 3-year chart for SLV or spot silver [see below], it’s very clear that every time the RSI goes above 70 – indicating a very overbought condition,, a pull-back in price follows….[and the current] RSI for SLV is at 78 and

- many of the short positions from the June 3rd record high have already been covered. On June 3rd, there was a total of 49,012 contracts (equivalent to 245 million ounces) held short by the so-called Large Speculators (i.e. hedge funds and managed futures funds). On June 24th, those short positions…[had] been cut in half to 24,830 contracts.

A Little Good News

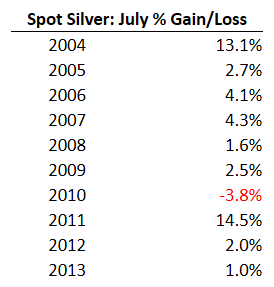

For silver bulls, there is at least one reason to believe that prices have further upside, however, and that is that July is historically a good month for silver.

As you can see [from the above table], silver has gone up in nine of the past ten years…Please note that if I expanded the above table to show the last twenty years, the picture for July would not look as pretty…

Stay connected

- Subscribe to our Newsletter (register here; sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Final Thoughts

If you are a long-term silver bull and already have your positions and plan to hold for several years, then nothing I wrote about in this article really matters. Any price movement in the next week or month is just noise and won’t have any impact on the price in the long-term.

However, if silver does indeed experience a sell-off due to overbought conditions, then another opportunity to accumulate may present itself.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

Silver has now dropped to $19 and is down 3.1% for the year. Unfortunately, the pain is probably not over – yet. Read More »

2. Move Up In Silver To Be Sharper, Greater & Faster Than Gold – Here’s Why

Analysts and investors seem to be very bearish towards silver, but we think that the fundamentals of silver are now becoming extremely attractive in terms of contrarian opportunities. Volatility and risk are not always commensurate, and we believe that silver offers investors fundamentals that can be much stronger than expected and returns that would be magnified by the small size of the silver market (and the bearish positioning by participants). Contrarian investors would be wise to take note. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

The data on charts reflects HISTORY and the trend lines are futuristic guesses at best, therefore what will happen to PM’s will only be revealed by waiting the required amount of time. Once this is accepted, everyone should ask themselves if they possess enough PM’s to protect the rest of their portfolio should stocks and/or flat money value decrease for any reason at all.