The impending emergence of The Four Horsemen of the Apocalypse (Debt, Derivatives, Deficits & Dollar) may soon sound the death knell of the entire U.S. economic recovery [we have seen] since early 2009 and eventually and sadly morph into mass Unemployment, Home Foreclosures, Stagnant Wages & Shrinking Retirement.

soon sound the death knell of the entire U.S. economic recovery [we have seen] since early 2009 and eventually and sadly morph into mass Unemployment, Home Foreclosures, Stagnant Wages & Shrinking Retirement.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Doolittle goes on to say in further edited excerpts:

[Specifically,] The Four Horsemen of the Apocalypse are:- Debt As A Percent of the GDP

- Derivative Growth (Worldwide)

- Deficits (Federal Budget Deficit)

- Dollar Devaluation

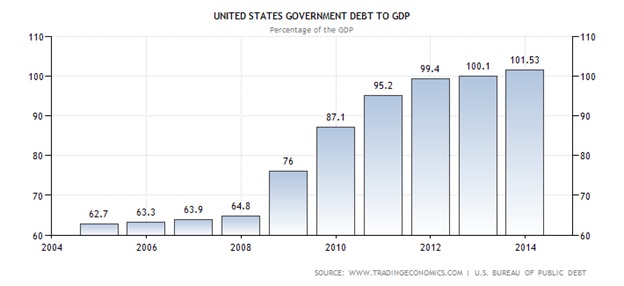

1. Debt As A Percent of the GDP

Since 2003 the U.S. National Debt as a percent of GNP has gone up dramatically with little probability of diminishing. Moreover, the implementation of Obama Care will most likely propel the percentage…[even further]. To date this translates into a Total National Debt of $17 TRILLION…and growing by the second:

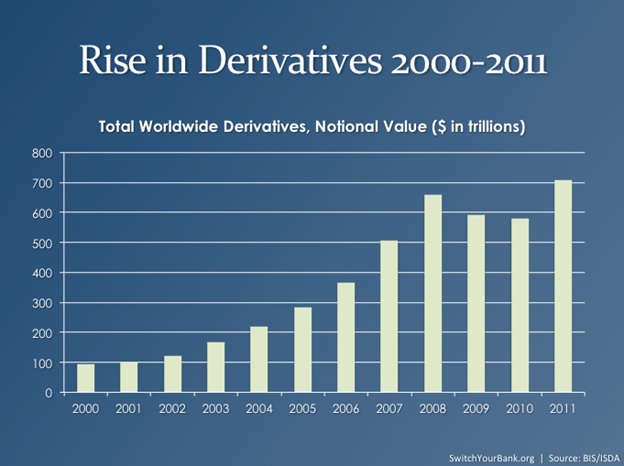

2. Derivative Growth (Worldwide)

Derivatives are financial instruments whose value is derived from an underlying asset (stocks, bonds, commodities, etc.). Traders can swap interest rates, take bets on whether a firm will go bankrupt, safeguard against future asset price increases, etc—all under the ugly umbrella term “derivative”. The concept of a derivative has been around for centuries, but their use has recently exploded from an estimated $100 trillion in 2002 to over $700 trillion in 2011, according to the most recent survey by the Bank of International Settlements…[of which 4] U.S. mega banks—JPMorgan, Bank of America, Citi, and Goldman Sachs—have more than 30% of the worldwide amount ($214 trillion)

….Mega banks trade risk via derivatives contracts to another firm while keeping the underlying asset on their books. This way they can bypass capital requirements and take on more debt which, in turn, allows them to make more trades. [On the other hand, however,] it also means that if a sudden downturn surfaces in the markets, the firm which borrowed way beyond their means may quickly go bankrupt. Lehman Brothers experienced this after they’d borrowed 30 times more money than they had in reserve. In that case a relatively small loss of a mere 3% meant that Lehman no longer had reserves (i.e. capital), and they therefore collapsed…i.e. totally wiped out.

The leverage that derivatives allow is incomprehensible. The 4 mega banks mentioned above are betting 30 TIMES MORE MONEY THAN THEY HAVE. This is financially insane.

Try to comprehend the magnitude of $700 trillion in financial derivatives. To do this one needs a benchmark. We all know the U.S. National Debt today is more than $17 trillion. Well, today’s total worldwide financial derivatives is a number more than 40 TIMES LARGER than today’s Total US National Debt – 40 TIMES LARGER!

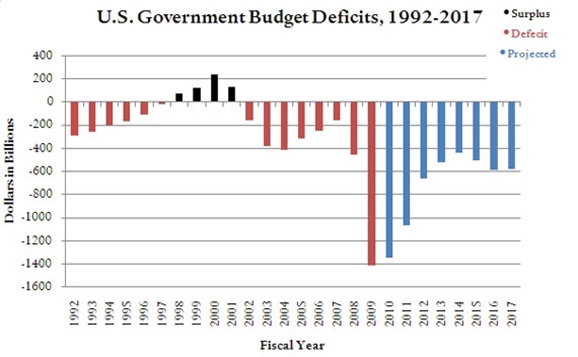

3. Deficits (Federal Budget Deficit)

The Federal Budget Deficit has been exploding since 2002.

The…U.S. Federal deficit has been on a collision crash course since 2002 – and is projected to suffer yearly budget deficits through 2017 – and this inexorable growth of yearly deficits will inevitably tank the U.S. dollar.

4. Dollar Devaluation

The total national debt is expected to exceed $25 Trillion by the time President Obama leaves office. Subsequently, U.S. total indebtedness may become so onerous that the government may not be able to borrow enough (via issuance of Trillions more in US$ T-Bonds) to finance the ever mounting debt. Consequently, the Federal government will be literally forced to print more money (or default on the debt)…which will end in the total collapse of the U.S. greenback and in this event interest rates will be fueled sharply upward, thus tumbling (again) the U.S. real estate market as mortgage rates soar (curtailing housing sales).

Conclusion

The impending emergence of The 4 Horsemen of the Apocalypse (Debt, Derivatives, Deficits & Dollar) may soon sound the death knell of the entire U.S. economic recovery since early 2009….[which] may eventually and sadly morph into mass Unemployment, Home Foreclosures, Stagnant Wages & Shrinking Retirement

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.gold-eagle.com/article/4-horsemen-apocalypse

Related Articles:

1. Take Note: U.S. Gov’t Ready for Dramatic Changes In Country’s Economic Conditions – Here’s How

In the not-too-distant future, sociopolitical and economic conditions in the U.S. will be changing dramatically, affecting tens of millions of Americans and to that end the U.S. government has enacted new legislation that allows it to transform itself into a full-on police state. Read More »

2. 5 Red Flags of Imminent Economic Collapse

These 5 red flags will give you anywhere from a few days to a few months of warning that things are about to change drastically…and well before those around you grasp the full extent of what is going on. This is hopefully a scenario that never happens as this will truly be the end of the world as you knew it. Read More »

The great majority of people, who have already seen the first half of the Great Unravelling come to pass, still somehow cannot imagine the second half—the more disastrous half—as being in any way possible. [Here’s a heads up on] what that collapse will look like as it unfolds – and what the symptoms be. Read More »

4. There Are 11 Stages of Economic Collapse – Where Are We Now?

If we look at the economic collapses of the past, from the fall of the Roman Empire to Weimar Germany to Argentina and Zimbabwe, the pattern is extremely similar. Let’s have a look at that pattern and ask ourselves if the present situation might not play out much the same. Read More »

5. U.S. Dollar Collapse Will Be Cataclysmic Endgame of Current Fiscal Policy

Government fiscal policy – profligate spending, leading to debt crisis, leading to currency crisis, leading to…the fall of the U.S. dollar – is the major cataclysmic endgame that is going to befall the U.S. Read More »

6. What Will Happen In Coming Collapse? How Will Governments Try to Fix Things?

Most people deal in the present, rarely questioning the future beyond what they consider to be the very next event. The great majority of people…cannot imagine…a disastrous collapse as being in any way possible because surely, somehow, the governments of the world will fix things. The number of people whose eyes have been opened seems to be growing, however, and many of them are asking what the collapse will look like as it unfolds. What will the symptoms be? Here is how we see it. Read More »

7. Economic Collapse Is Inevitable – Here’s Why

An inevitable economic collapse has been warned about since this website began over four years ago.based on the following 3 key economic points that have been consistent since its beginning. Here they are: Read More »

8. I Repeat: “Economic disaster of unprecedented scale is coming!” Here’s Why

I get tired of preaching economic disaster and I am sure readers are just as tired of reading about it. Yet, it is coming regardless. The disaster will be of such importance that one cannot overemphasize it or warn too often about it. It will be a disaster of unprecedented scale. Read More »

9. Economic Collapse Is a Distinct Possibility – Are You Prepared (even a little bit)?

Do you share concerns about the world today, and the path we are headed on? Do you believe a total economic collapse is a real risk? Many would say it’s a concern but doubt it’s actually going to happen. It’s always been okay, so it probably always will be, is certainly the view that most of us hold. The thing is, though, that it hasn’t always been ok and it could easily happen again. Are you prepared for such an eventuality? Read More »

Having given a lot of thought to both the differences and the similarities between Russia and the U.S. – the one that has collapsed already, and the one that is collapsing as I write this – I feel ready…to define five stages of collapse to serve as mental milestones as we gauge our own collapse-preparedness and see what can be done to improve it.

11. How the Ongoing U.S. Economic Collapse Compares to the U.S.S.R. Experience (Dmitry Orlov)

Dmitry Orlov’s repeated travels to Russia throughout the early nineties allowed him to observe the aftermath of the Soviet collapse first-hand. Being both a Russian and an American, Dmitry was able to appreciate both the differences and the similarities between the two superpowers. Eventually he came to the conclusion that the United States is going the way of the Soviet Union and has concluded that when the U.S. economy collapses, it is bound to be much worse – and permanent – because the factors that allowed Russia and the other former Soviet republics to recover are not present here. Words: 3730; Slides: 28

12. It’s a Mad, Mad “Madoff Market” World We Live In – Here’s Why

Given the economic outlook, there seems little reason for stock prices to be as high as they are…This market could be called a “Madoff Market” in the sense that it is a Ponzi scheme, not the classic Ponzi scheme where exponential growth of new dupes is necessary to keep the scam going…but, rather, on exponential money creation. Fantasy is fun while it lasts but reality eventually intercedes and…[and it is] those way out in fantasy land [who] are especially vulnerable to disappointment [and] so it is for those betting on the stock market and an economic recovery. Let me discuss this further. Words: 1075

13. 50 Reasons to Seriously Consider Becoming a Prepper – Financially or Otherwise

[While] I am not a prepper in the traditional sense of stockpiling food, guns and the like, I have always considered myself a financial prepper…For anyone not familiar with how dicey matters are becoming, [however,] I suggest they read the 50 questions below. Words: 1323Those dependent on the welfare state are unaware that their benefits are not sustainable. Most believe tomorrow will be like today and the checks will keep coming from Mother Government. Political power was gained based on promising these benefits. No politician will risk his position by trying to reduce them. No democratic society has ever rolled them back via peaceful political means. [At worst,] the economy and society could end up in ashes [and, at best,] the world is in for a long period of stagnation, retrogression and conflict. [Let me explain more fully.] Words: 1115

15. Today’s Investment Approach Must Change to Survive Tomorrow’s Major Economic Changes – Here’s How

The world is hurdling toward what seems to be certain economic collapse so, if your expectations are similar to mine, then you should be exploring ways to prepare for something that eventually will become an economic dark age. Investment performance is always relevant and it has never been more important than in these difficult economic times – nor has it ever been more difficult. Markets have already changed and are getting worse…As the economy worsens, market movements [like the two 50% declines we have seen since 2000] are likely to become more pronounced [and, as such,] it behooves anyone with exposure to the stock market to understand what is happening and [take action to] protect themselves against further 50%, and possibly larger, downsides. [This article outlines how best to do just that.] Words: 1491; Charts: 2; Tables: 1

16. We Are On the Precipice of Enormous Financial & Economic Change

We are on the precipice of enormous financial and economic change. It is not change for the good, especially for the United States. Excesses and mis-allocated resources of several generations are about to be exposed as modern industrial nations sink deeper into the economic hole they have dug for themselves. The purging of these economic mistakes will be painful, could create new wars as politicians attempt to deflect blame and may end up changing the political form of government in some countries. (Words: 364; Charts: 1)

17. The Average U.S. Citizen Is Clueless Regarding the Desperate Shape the Country Is In! Are You?

The corrosive nature of politics and government has destroyed the economy and the moral fiber of citizens. These issues are not insurmountable, but they are very close to being so. Their ramifications are potentially existential in nature: the average length of life, the very time span or cycle of a nation has been proven in history to be approximately 250 years. Since the USA was born in 1776 this says we have about 14 years of life remaining for America. The way things are going we don’t doubt it. [Let me explain.] Words: 768

18. Nothing Can Be Done to Avoid Coming World-wide Depression! Here’s Why

Governments everywhere are becoming more distressed and desperate as economic realities dominate the political doublespeak. The world is at a dangerous point. Much of what we thought we knew and assumed regarding governmental behavior and economics is beginning to be reassessed. Governments of the world are out of money and out of ideas. The ponzi scam that has been perpetrated for over fifty years is collapsing under its own weight. There are not enough suckers and capital left to sustain the fraud. [Let me explain further.] Words: 999

19. What Will the Outcome of All the QE Mean for the U.S. (and the World)?

At the risk of looking/sounding like some crazed religious fanatic usually seen carrying a sign or proclaiming: “Repent, the end is near,” I shall avoid the word “repent”. To me, the rest of that proclamation appears accurate and reasonable, at least with regard to our economic condition. [Let me explain:] Words: 1896

20. Current Distortion of Interest Rates is Unsustainable & Will Have Dire Consequences

Interest rates have been manipulated to keep them extremely low in an attempt to stimulate the economy but…unless deficits are dramatically reduced…. interest rates will eventually rise and government interest expense will double or triple from the amounts being paid today. That potentially triggers a debt death spiral, where government has to borrow more than otherwise expected. It also raises the credit risk and could ratchet interest rates up again. It has happened to Greece, Portugal, Spain and other European countries already this year and could well happen in the U.S. too. Words: 595

21. The U.S. May Engineer A “Soft Default” – Here’s Why and How

When government is wounded, trapped and desperate, it lashes out like a wild animal. Survival in the political class is just as strong a drive as it is in the wilderness. I don’t know how government will lash out, but you are likely to see laws, restrictions and behavior you never imagined….Washington has demonstrated it will “print money” in whatever quantities necessary to stave off a sovereign bankruptcy and a Great Depression but this strategy cannot work forever because existing debt is already too high to be serviced. It is only a matter of time before the U.S. economy succumbs – unless it engineers a ‘soft default’ [which will save it’s ass and get you shafted! Let me explain.] Words: 1394

22. U.S. Financial Crisis Makes Future Rioting In The Streets An Almost Certain Outcome! Here’s Why

The U.S. government has put us between the proverbial ‘rock and a hard place’. Cutting spending to improve our country’s financial situation would surely trigger rioting in the streets by those Americans most adversely affected yet not cutting spending will trigger much higher inflation – even hyperinflation – which will also result in rioting….Government cannot control how this ends. They may be able to tinker with the timing a bit and they still have the choice of poisons with which to destroy the country, [but] that the country is gone, that is no longer alterable. Words: 930

23. George Soros Predicts Economic Chaos/Conflict in Europe and Riots in the U.S.!

George Soros…is more concerned with surviving than staying rich…He doesn’t just mean it’s time to protect your assets. He means it’s time to stave off disaster. As he sees it, the world faces one of the most dangerous periods of modern history—a period of “evil.” Europe is confronting a descent into chaos and conflict. In America he predicts riots on the streets that will lead to a brutal clampdown that will dramatically curtail civil liberties. The global economic system could even collapse altogether. [I our opinion, though,[such comments ar nothing more than] the fear-based promotions of the power elite to frighten the middle classes into giving up power and wealth to globalist institutions. Let us explain.

24. 2014: Is This How U.S. Financial Crisis Will Unfold Later This Year?

As economic and political matters become more desperate in the U.S., so will what the government considers acceptable. If a debt default cannot be engineered via continuous inflation as the Fed’s current money-printing is attempting to do, it will occur via a direct repudiation of obligations or a quasi-surreptitious one such the hypothetical one I present in this article. Here is… a look (not a prediction) at a series of not improbable events that could develop [and which] would change our economic world overnight [ – and your financial well-being too]. Words: 1365

25. Don’t Ignore the Coming Financial Storm – It IS Coming and Here’s How to Get Prepared

Many people refer to me as a “doom and gloomer” because I run a website called “The Economic Collapse”. [Just because] I am constantly pointing out that the entire world is heading for a complete and total financial nightmare, [however,] I don’t think that it does any good to stick your head in the sand. I believe that there is hope in understanding what is happening and I believe that there is hope in getting prepared. [This article does just that.] Words: 2432 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money